Get the free Virtual Bank service

Show details

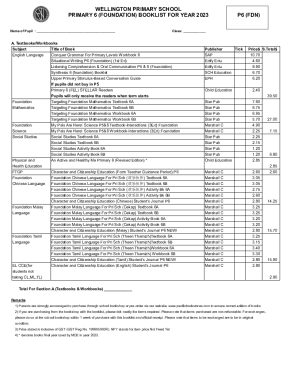

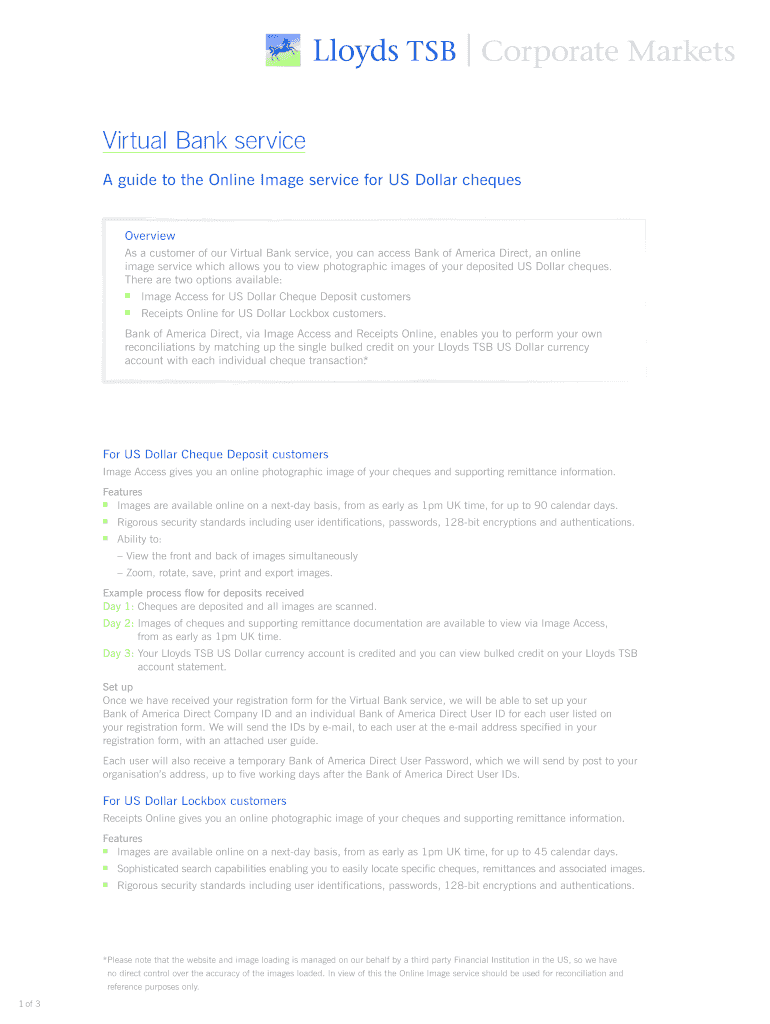

This document serves as a guide for customers of the Virtual Bank service, detailing the Online Image service provided by Bank of America for viewing photographic images of deposited US Dollar cheques,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign virtual bank service

Edit your virtual bank service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your virtual bank service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit virtual bank service online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit virtual bank service. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out virtual bank service

How to fill out Virtual Bank service

01

Visit the Virtual Bank website.

02

Click on the 'Sign Up' or 'Register' button.

03

Fill in the required personal information, such as name, address, and email.

04

Create a secure password for your account.

05

Provide any additional information required, such as Social Security Number or Tax ID.

06

Agree to the terms and conditions.

07

Verify your identity through email or SMS confirmation.

08

Log in to your account and set up your preferences.

Who needs Virtual Bank service?

01

Individuals seeking convenient banking services.

02

Small business owners looking for online banking solutions.

03

People who travel frequently and need access to their accounts remotely.

04

Tech-savvy users who prefer managing finances digitally.

05

Customers interested in lower fees and higher interest rates offered by virtual banks.

Fill

form

: Try Risk Free

People Also Ask about

What is a virtual banking system?

Internet banking, also known as online banking, e-banking or virtual banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website.

What is a digital bank in English?

A digital bank represents a virtual process that includes online banking, mobile banking, and beyond. As an end-to-end platform, digital banking must encompass the front end that consumers see, the back end that bankers see through their servers and admin control panels, and the middleware that connects these nodes.

Is Revolut an English bank?

Revolut Group Holdings Ltd, doing business as Revolut, is a British multinational neobank and fintech company that offers banking services for individuals and businesses. It was founded in July 2015 by British-Russian businessman Nikolay Storonsky and British-Ukrainian software engineer Vlad Yatsenko.

What's the difference between online banking and a virtual bank?

Virtual banks are fully online The key difference to remember between digital and virtual banks is that virtual banks are made up of financial services and processes that exist solely online. By its definition, virtual banks don't rely on branch offices or any other forms of physical presence to resume operations.

What is the difference between mobile banking and virtual banking?

Online banking is accessed through a computer's web browser, while mobile banking is done through an app on a smartphone or tablet. Both offer robust banking services, but mobile banking is optimized for on-the-go transactions with features like remote check deposits and real-time alerts.

Which virtual bank is the best?

Best banking apps Top app-based bank accounts. Starling: Budgeting help + top overseas. Chase: 1% supermaket, transport & fuel cashback. Monzo: Spending notifications + budgeting help. Revolut: Good option for frequent travellers. Top traditional banking apps. NatWest/Lloyds: Highly rated for features & usability.

What is virtual banking with an example?

Virtual bank accounts are bank accounts that are held with an electronic money institution that doesn't have physical branches or automatic teller machines (ATMs). Examples are Wise (formerly Transferwise) in the U.S., Monzo and Revolut in Europe and Starling Bank in the United Kingdom.

How does a virtual bank work?

Because virtual accounts don't have a physical existence, they act as doors into your main or physical bank account, where money can pass through when you pay with a virtual account number or someone sends money to your virtual bank account. The funds, however, are stored in your physical account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Virtual Bank service?

Virtual Bank service refers to an online platform that provides banking services without physical branches. It allows customers to perform banking transactions via the internet, including account management, fund transfers, and loan applications.

Who is required to file Virtual Bank service?

Individuals or businesses that are engaging in banking activities through an online platform without a physical presence may be required to file for Virtual Bank service, depending on regulatory requirements in their jurisdiction.

How to fill out Virtual Bank service?

To fill out the Virtual Bank service application, one typically needs to provide personal or business information, including identification, address, financial information, and details about the intended banking activities. The specific forms and requirements vary by institution.

What is the purpose of Virtual Bank service?

The purpose of Virtual Bank service is to provide convenient and efficient banking solutions to customers by enabling them to manage their finances online without the need for visiting a physical bank branch.

What information must be reported on Virtual Bank service?

Information that must be reported on Virtual Bank service includes customer identification (such as name and address), transaction details, account balances, and any applicable financial disclosures required by banking regulations.

Fill out your virtual bank service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Virtual Bank Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.