Get the free Automatic Investment Plan

Show details

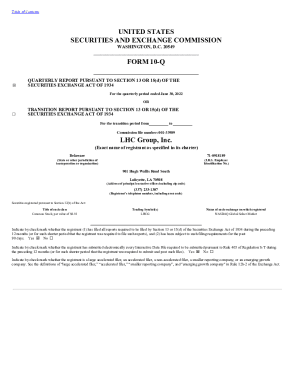

This document is a form to set up an automatic investment plan with Parnassus Funds, allowing contributions from a bank account into various Parnassus funds.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic investment plan

Edit your automatic investment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic investment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing automatic investment plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit automatic investment plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic investment plan

How to fill out Automatic Investment Plan

01

Determine your investment goals and risk tolerance.

02

Choose the investment account where you want to set up the Automatic Investment Plan.

03

Select the investment products (e.g., stocks, mutual funds, ETFs) you wish to invest in.

04

Decide on the amount of money you want to invest periodically (e.g., weekly, monthly).

05

Choose the frequency of the investments (e.g., monthly, quarterly).

06

Provide your financial institution with the necessary information, including banking details and investment choices.

07

Review and confirm the terms of your Automatic Investment Plan before finalizing.

Who needs Automatic Investment Plan?

01

Individuals looking for a systematic approach to investing.

02

Busy professionals who prefer a hands-off investment strategy.

03

People who want to take advantage of dollar-cost averaging.

04

New investors who are unfamiliar with market timing.

05

Those aiming for long-term wealth accumulation without the stress of actively managing investments.

Fill

form

: Try Risk Free

People Also Ask about

How much will I make if I invest $1000 a month?

If you put $1,000 into investments every month for 30 years, you can probably anticipate having more than $1 million by the end, assuming a 6% annual rate of return and few surprises.

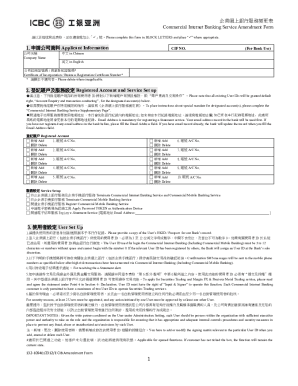

What is AIP in banking?

Automatic Investment Plan (AIP), also known as a fixed-amount periodical investment route offered by mutual funds, refers to an investment arrangement wherein an investor and the bank agree that, based on the investor's specified frequency and timing, a fixed amount will be used to purchase units of a specific open-end

How to set up an automatic investment?

The process of opening a brokerage account and setting up automatic transfers is as simple as opening an IRA. Link your bank account, choose how often you want to contribute money and select your investments. Many investors choose to have a taxable brokerage account as well as an IRA.

What is an AIP plan?

Today, our acronym of choice is AIP. That stands for automatic investment plan, and it's a mechanism investors can set up that automatically contributes to pre-determined investments on a recurring basis.

How to turn $100 into $1000 investing?

High-Yield Savings Accounts. It may seem a bit safe, but a high-yield savings account could turn your $100 into $1,000 just by leaving it alone. Invest in the Stock Market. Start a Blog. Use Robo-Advisors. Invest in Cryptocurrency. Start an E-Commerce Business. Grow a YouTube Audience. Collect Dividends.

Is automatic investing a good idea?

Automatic investments is one of the best tools for investing over a long horizon. It removes decision making and gets your money in the market as soon as it is available. Thus you should get started immediately. So yes, invest the initial 3k to get started then do 10% per paycheck.

What is the 70 20 10 rule for investing?

The 70-20-10 rule is a simple yet powerful budgeting strategy that helps you allocate 70% of your income to spending, 20% to savings and investments, and 10% to debt repayment or donations.

Is automated investing worth it?

Lower fees. Perhaps the greatest appeal of robo-advisors is their substantially lower price tag for advice. Of the 16 providers we reviewed, the median advisory fee was 0.25%. Financial advisors tend to have advisory fees around 4 times that amount — about 1% — which is a greater burden on individuals investing less money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Automatic Investment Plan?

An Automatic Investment Plan (AIP) is a financial arrangement that allows investors to set up a recurring investment in a specific financial product, such as mutual funds or stocks, on a predetermined schedule.

Who is required to file Automatic Investment Plan?

Typically, investors who wish to automate their investment contributions into a specific financial vehicle are advised to file for an Automatic Investment Plan.

How to fill out Automatic Investment Plan?

To fill out an Automatic Investment Plan, an individual needs to provide personal information such as name, address, account number, investment amount, frequency of investment, and financial institution details.

What is the purpose of Automatic Investment Plan?

The purpose of an Automatic Investment Plan is to simplify the investment process by enabling systematic and regular investment contributions, promoting disciplined saving, and potentially dollar-cost averaging.

What information must be reported on Automatic Investment Plan?

Information that must be reported on an Automatic Investment Plan includes the investor's personal details, account information, investment amount, frequency of deposits, and the type of investment vehicle.

Fill out your automatic investment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Investment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.