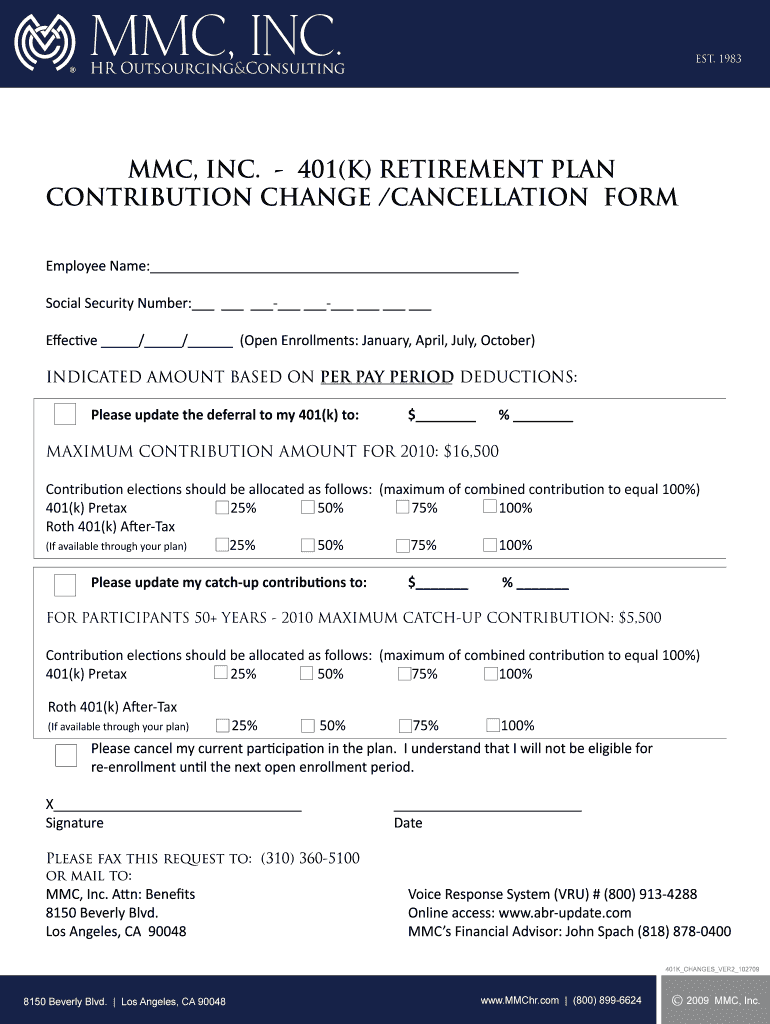

Get the free MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM

Show details

This form is used by employees to change or cancel their contributions to the MMC, Inc. 401(k) retirement plan. It includes sections for updating contribution amounts and percentages, catch-up contributions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mmc inc - 401k

Edit your mmc inc - 401k form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mmc inc - 401k form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mmc inc - 401k online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mmc inc - 401k. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mmc inc - 401k

How to fill out MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM

01

Begin by obtaining the MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM from your HR department or the company's employee portal.

02

Fill in your personal details at the top of the form, including your name, employee ID, and contact information.

03

Indicate whether you are making a contribution change or cancellation by checking the appropriate box.

04

If changing your contribution, specify the new percentage or dollar amount you wish to contribute to your 401(K) plan.

05

If you are canceling your contributions, clearly state your intention to stop contributing.

06

Review the form for any required signatures and dates, ensuring all information is accurate.

07

Submit the completed form to your HR department or the designated person handling 401(k) plans.

08

Keep a copy of the submitted form for your records.

Who needs MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM?

01

Employees of MMC, INC. who wish to change their 401(K) retirement plan contribution rates or cancel their contributions.

Fill

form

: Try Risk Free

People Also Ask about

Can you cancel a 401k and get your money back?

Typically, you can't close an employer-sponsored 401k while you're still working there. You could elect to suspend payroll deductions but would lose the pre-tax benefits and any employer matches. In some cases, if your employer allows, you can make an in-service withdrawal if you've reached the age of 59 ½.

How do I change my 401k contributions?

How to change 401(k) contributions (steps) Contact provider. The first step is to contact the 401(k) plan provider to know when and how you can change the contributions for your plan. Decide how much to contribute. Fill in form. Change validation. Save more. Lower 401(k) contributions. Get full match. Change asset allocation.

What is the penalty for cancelling a 401k?

Key takeaways Your 401(k) is meant for retirement, but it may be possible to access your money sooner. If you make an early 401(k) withdrawal, you'll typically owe income taxes and pay a 10% penalty. There are alternatives to consider before tapping a 401(k), such as a home equity loan or personal loan.

What happens if I cancel my retirement plan?

The IRS levies a 10% penalty on all non-exempt withdrawals before the age of 59 ½. Since pre-taxed money funded your 401k account, your withdrawal is taxed. The money you withdraw stops working for you.

How do I terminate a 401(k) plan?

Generally, the process of terminating a 401(k) plan includes amending the plan document, distributing all assets, notifying employees, filing a final 5500-series form and possibly filing a Form 5310, Application for Determination for Terminating Plan PDF, to ask the IRS to make a determination on the plan's

How do I cancel my 401k contribution?

From the Contributions page, change the contribution rate to 0% or $0 for both Traditional 401(k) and Roth 401(k). Note that once you stop your personal payroll contributions, that you will no longer be eligible to receive any applicable employer match. Click the “Save changes” button.

Can I cancel my 401k and cash out while unemployed?

If you have a 401(k) plan at work, you can withdraw money from it but if you're under age 59½, you'll owe a 10% tax penalty on the distribution as well as income taxes. You may be able to take a hardship withdrawal, which doesn't involve the penalty (but taxes apply).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM?

The MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM is a document used by employees to request changes to their contribution levels or to cancel their contributions to the company's 401(k) retirement plan.

Who is required to file MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM?

Employees of MMC, INC. who wish to alter their contribution amounts or discontinue their contributions to the 401(k) retirement plan are required to file this form.

How to fill out MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM?

To fill out the form, employees should provide their personal information, indicate the desired change or cancellation, and sign the document to authorize the adjustments. Instructions may be provided on the form itself.

What is the purpose of MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM?

The purpose of the form is to formally document an employee's request to change or cancel their contributions to the 401(k) retirement plan, ensuring that the plan administrators can process the request accurately.

What information must be reported on MMC, INC. - 401(K) RETIREMENT PLAN CONTRIBUTION CHANGE /CANCELLATION FORM?

The form typically requires the employee's name, employee ID, the current contribution percentage, the new contribution percentage (if applicable), and the employee's signature along with the date of the request.

Fill out your mmc inc - 401k online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mmc Inc - 401k is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.