Get the free Common Ownership

Show details

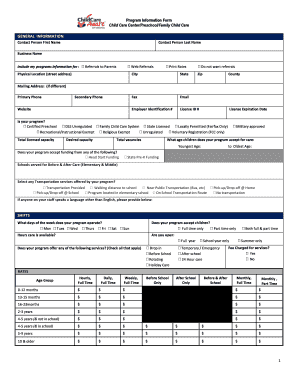

This document is used to collect information regarding companies that qualify as a single employer as per IRS guidelines, specifically for HIPAA compliance.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign common ownership

Edit your common ownership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your common ownership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing common ownership online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit common ownership. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out common ownership

How to fill out Common Ownership

01

Gather all relevant ownership documents related to the entities involved.

02

Identify all shareholders or owners of each entity.

03

List the percentage of ownership each person holds in their respective entities.

04

Determine any overlapping ownership between the entities.

05

Fill out the Common Ownership form by including the identified owners and their respective ownership percentages in a clear manner.

06

Review the completed form for accuracy and completeness.

07

Submit the Common Ownership form to the relevant authority as required.

Who needs Common Ownership?

01

Businesses with multiple entities sharing common ownership.

02

Corporations and LLCs that need to disclose ownership structures.

03

Tax professionals and accountants preparing documentation for clients.

04

Regulatory bodies requiring full disclosure of ownership ties.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of communal ownership?

noun. : the ownership of land or other property by a community so that each member has a right to use the property or a portion of it.

What is the meaning of common owner?

Common owner means an affiliate, immediate family member, manager, parent or subsidiary business entity, investor, person or entity with a commonality of business interests, or other person or entity able to influence the operator or manager of the premises or to prevent the operator or manager from fully pursuing the

What is the meaning of common ownership?

(also ownership in common) a situation in which a home or other property is owned by more than one person or organization. (Definition of common ownership from the Cambridge Business English Dictionary © Cambridge University Press)

What is the theory of common ownership?

The theory of common ownership focuses instead on the role of investors, rather than managers and asks whether such collusive arrangements can be achieved, explicitly or implicitly, by firm managers responding to the incentives or explicit direction of shareholders who own shares in multiple competing firms without any

What counts as common ownership?

Common ownership refers to a situation where competing firms are owned by an overlapping set of investors. The antitrust theory of common ownership posits that firms whose investors own shares in competing firms in the same industry may have less of an incentive to compete with those firms.

What is the definition of common ownership in politics?

Common ownership refers to holding the assets of an organization, enterprise, or community indivisibly rather than in the names of the individual members or groups of members as common property.

What is the concept of common ownership?

In antitrust economics, common ownership describes a situation in which large investors own shares in several firms that compete within the same industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Common Ownership?

Common Ownership refers to a scenario where multiple entities or individuals hold ownership interests in the same asset or business entity. It highlights situations where stakeholders have overlapping ownership stakes, which may impact governance and operational decisions.

Who is required to file Common Ownership?

Entities or individuals that hold ownership interests in a business or asset and are subject to regulatory requirements to disclose their ownership structures are typically required to file Common Ownership. This may include corporations, partnerships, and limited liability companies.

How to fill out Common Ownership?

To fill out Common Ownership forms, one must gather information about the ownership structure, including names of owners, their percentage of ownership, and relevant identification details. Detailed steps vary by jurisdiction but generally require completing a form and providing requisite documentation to support ownership claims.

What is the purpose of Common Ownership?

The purpose of Common Ownership is to promote transparency and accountability in business operations by disclosing ownership structures. This helps regulators and stakeholders assess potential conflicts of interest, financial stability, and governance effectiveness.

What information must be reported on Common Ownership?

Common Ownership reports typically require information such as the names of the owners, percentage of ownership held by each party, types of ownership (e.g., shares, partnerships), and any changes in ownership interests over a specified period.

Fill out your common ownership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Common Ownership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.