Get the free Tax Sale Registration

Show details

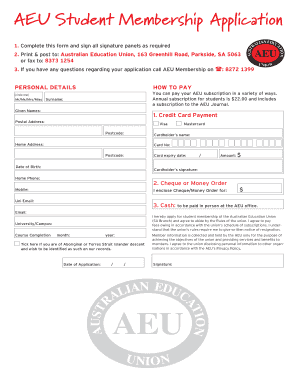

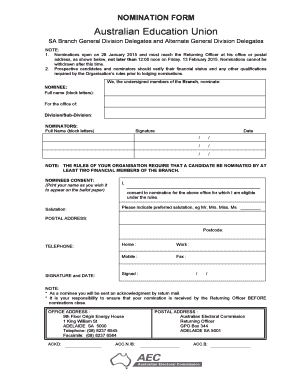

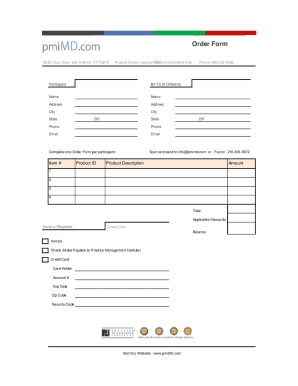

This document serves as a registration form for individuals and corporations wishing to participate in tax sales in St. Mary's County. It collects necessary information from bidders to ensure they

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax sale registration

Edit your tax sale registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax sale registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax sale registration online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax sale registration. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax sale registration

How to fill out Tax Sale Registration

01

Gather necessary documents: Collect identification, proof of residency, and any other required financial documentation.

02

Obtain the Tax Sale Registration form: Visit your local tax office or their website to download the form.

03

Fill out personal information: Enter your name, address, and contact details accurately in the designated fields.

04

Specify the property details: Provide information about the property you intend to register, including its tax parcel number.

05

Review eligibility criteria: Ensure that you meet all requirements for participating in the tax sale.

06

Sign the application: Add your signature to the form to validate the information provided.

07

Submit the form: Return the completed registration form to the appropriate tax authority, either in person or via mail.

08

Pay any required fees: Be prepared to pay any registration fees associated with the submission.

Who needs Tax Sale Registration?

01

Individuals or entities interested in purchasing properties at tax sales.

02

Real estate investors seeking to acquire properties with delinquent taxes.

03

Tax lien investors looking to invest in tax certificates.

04

Homeowners wanting to clear tax delinquency by participating in tax sales.

Fill

form

: Try Risk Free

People Also Ask about

What US tax sale?

A Tax Sale is a public auction of tax deeds and/or tax liens used to recover delinquent real property taxes. Why does a County sell tax-defaulted property? The primary purpose is to collect delinquent taxes.

What does tax sale mean in IL?

What does it mean that my taxes have been sold or that my property has been sold for delinquent taxes? By state statute, any unpaid taxes plus interest and penalties go to a tax sale at the end of November or beginning of December. A registered tax buyer bids their fee for paying those taxes.

What is a tax sale in DC?

Why is the District of Columbia conducting a Tax Sale? The Tax Sale is an annual event held pursuant to DC Official Code § 47-1332(a) in which the District of Columbia sells real property on which the taxes are delinquent.

What is a tax certificate sale in Florida?

A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. The certificate holder is an independent investor who actually pays the taxes for a property owner in exchange for a competitive bid rate of return on the investment.

Does a tax sale wipe out a mortgage in California?

Once a property is confiscated for sale at a California tax auction, the mortgage and deed of trust are wiped out, and there is no longer a loan document on the property. The property is then sold “as is,” with no guarantees about the condition of the property or the title.

What is a tax sale in New Jersey?

What is a tax sale? New Jersey law requires municipalities to hold at least one tax sale per year if properties within the municipality are delinquent in paying their property taxes and/or other municipal charges. At the Tax Sale, the title to the delinquent property is not sold.

What is the most common type of tax sale?

Public Auctions. Public auctions are the most common way of selling tax-defaulted property. The auction is conducted by the county tax collector, and the property is sold to the highest bidder.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Sale Registration?

Tax Sale Registration is a process through which property owners or potential buyers can register their interest in purchasing properties that are up for sale due to unpaid taxes.

Who is required to file Tax Sale Registration?

Typically, property owners who have unpaid taxes and potential buyers interested in purchasing tax-delinquent properties are required to file Tax Sale Registration.

How to fill out Tax Sale Registration?

To fill out Tax Sale Registration, individuals must provide required personal information, property details, and any other specific information requested by the tax authority, then submit the form to the appropriate office.

What is the purpose of Tax Sale Registration?

The purpose of Tax Sale Registration is to manage and facilitate the sale of properties with unpaid taxes, ensuring that all interested parties are recognized and information is accurately collected.

What information must be reported on Tax Sale Registration?

Information that must be reported on Tax Sale Registration typically includes the property address, owner's name, tax identification number, and any other pertinent details required by the local tax authority.

Fill out your tax sale registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Sale Registration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.