Get the free FHA 203-K Streamline FNMA HomeStyle Renovation

Show details

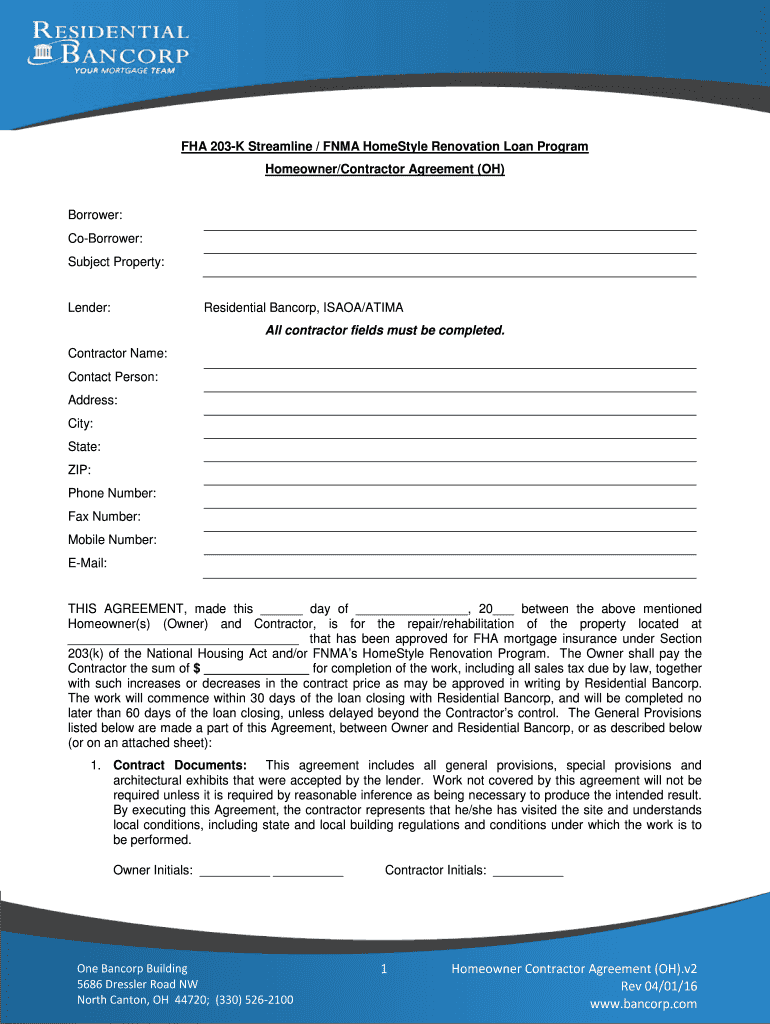

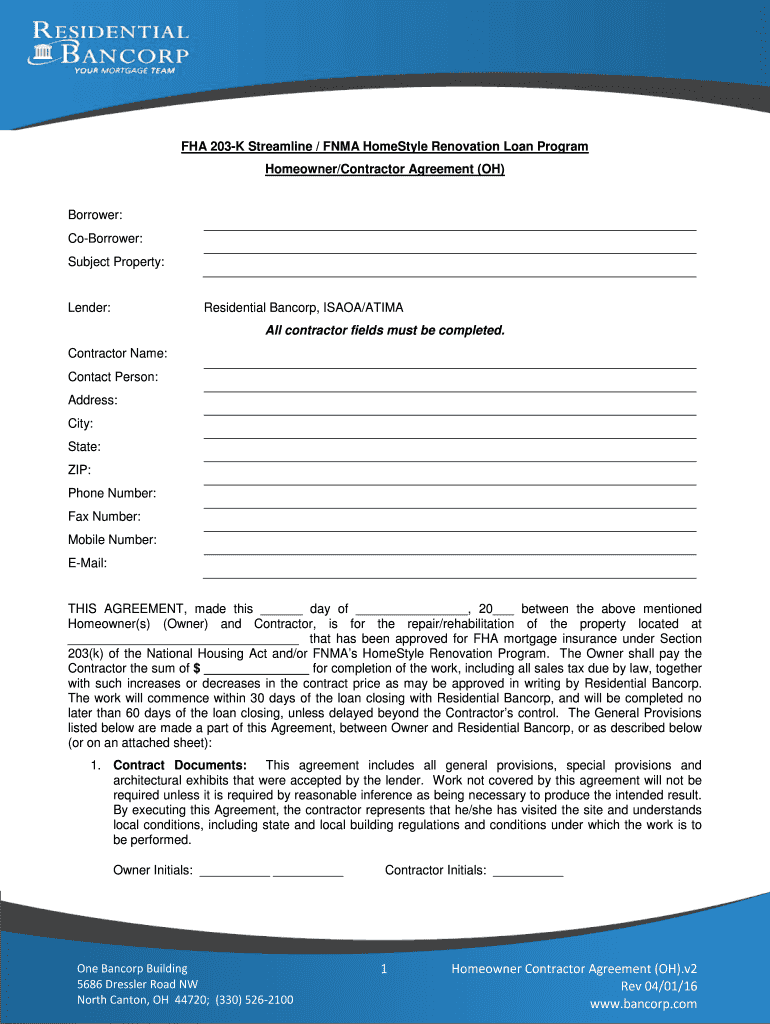

FHA 203-K Streamline / FNMA Hostile Renovation Loan Program Homeowner/Contractor Agreement (OH) Borrower: Co-Borrower: Subject Property: Lender: Residential Ban corp, ISARA/FATIMA All contractor fields

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha 203-k streamline fnma

Edit your fha 203-k streamline fnma form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha 203-k streamline fnma form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fha 203-k streamline fnma online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fha 203-k streamline fnma. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha 203-k streamline fnma

How to fill out FHA 203(k) streamline FNMA:

01

Gather necessary documents: Before starting the application process, make sure you have all the required documents in hand. These typically include income verification, employment history, credit reports, property details, and any other relevant documentation.

02

Obtain an FHA-approved lender: To apply for the FHA 203(k) streamline FNMA program, you need to find an FHA-approved lender. Research and contact different lenders to compare their rates, terms, and requirements. Choose a lender that suits your needs and start the process of filling out the application.

03

Complete the application form: The lender will provide you with an application form specific to the FHA 203(k) streamline FNMA program. Fill out the form thoroughly and accurately, ensuring all the necessary information is provided. Be prepared to input details regarding your personal information, employment history, income, and the property you plan to renovate.

04

Submit required documentation: Along with the application form, you will need to submit various documents to support your application. These may include pay stubs, tax returns, bank statements, contractor estimates or bids for the intended renovation work, and any other relevant documents as required by the lender. Ensure all documentation is complete and organized to expedite the loan approval process.

05

Undergo lender's review and approval: Once your application and supporting documents are submitted, the lender will review them thoroughly. This review process may involve verifying your financial information, ordering property appraisals, and assessing the feasibility of the intended renovation project. If the lender finds everything satisfactory, they will approve your application.

Who needs FHA 203(k) streamline FNMA:

01

Homebuyers planning to purchase a property in need of repair or renovation: The FHA 203(k) streamline FNMA program is designed for individuals who are looking to buy a property that requires improvements. If you are a homebuyer interested in purchasing a fixer-upper or a property in need of significant upgrades, this program can help finance your purchase and renovations simultaneously.

02

Homeowners looking to renovate their current property: Existing homeowners who wish to make substantial renovations to their homes can also benefit from the FHA 203(k) streamline FNMA program. Whether it's upgrading your kitchen, adding an extra bedroom, or enhancing the energy efficiency of your property, this program provides a financing solution that combines the costs of purchase or refinance with renovation expenses.

03

Investors interested in purchasing distressed properties: Real estate investors who are keen on purchasing and rehabilitating distressed properties can also take advantage of the FHA 203(k) streamline FNMA program. This program allows investors to finance both the purchase price and the renovation costs, making it an attractive option for those looking to flip or rehabilitate properties for resale or rental purposes.

In summary, to fill out the FHA 203(k) streamline FNMA application, gather necessary documents, find an FHA-approved lender, complete the application form, submit required documentation, and undergo the lender's review and approval process. This program caters to homebuyers, homeowners, and investors interested in purchasing or renovating properties in need of repairs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fha 203-k streamline fnma in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign fha 203-k streamline fnma and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit fha 203-k streamline fnma online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your fha 203-k streamline fnma to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I edit fha 203-k streamline fnma on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing fha 203-k streamline fnma.

What is fha 203-k streamline fnma?

FHA 203(k) streamline FNMA is a program that provides financing for both the purchase and renovation of a home using one loan.

Who is required to file fha 203-k streamline fnma?

Borrowers who are looking to purchase a home that needs renovations are required to file FHA 203(k) streamline FNMA.

How to fill out fha 203-k streamline fnma?

To fill out FHA 203(k) streamline FNMA, borrowers must work with a lender who is approved to offer FHA 203(k) loans and follow the guidelines provided by the program.

What is the purpose of fha 203-k streamline fnma?

The purpose of FHA 203(k) streamline FNMA is to provide an option for borrowers to finance the purchase and renovation of a home in one loan, simplifying the process.

What information must be reported on fha 203-k streamline fnma?

Borrowers must report information such as the cost of the home, estimated renovation costs, contractor information, and project timeline on FHA 203(k) streamline FNMA.

Fill out your fha 203-k streamline fnma online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha 203-K Streamline Fnma is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.