Get the free Loan Agreement with Affordability Covenants and Restrictions

Show details

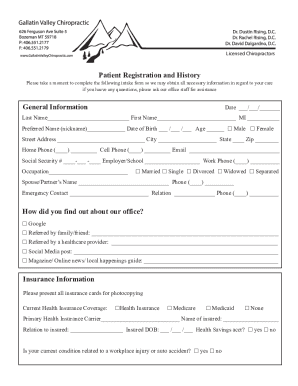

This document outlines the terms of a loan agreement between the Redevelopment Agency of the City of Corona and a qualified homebuyer, establishing affordability covenants and restrictions for a single-family

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan agreement with affordability

Edit your loan agreement with affordability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan agreement with affordability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan agreement with affordability online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan agreement with affordability. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan agreement with affordability

How to fill out Loan Agreement with Affordability Covenants and Restrictions

01

Begin by reading the Loan Agreement carefully to understand its terms and conditions.

02

Gather necessary documentation including income statements, tax returns, and asset information.

03

Identify the affordability covenants relevant to your loan type and ensure you meet the requirements.

04

Fill out personal information accurately, including names, addresses, and contact details.

05

Clearly state the loan amount, purpose, and terms of repayment in the agreement.

06

Review any restrictions related to property use, occupancy, or resale as specified in the agreement.

07

Include details about compliance with local regulations and any affordability guidelines.

08

Seek clarifications on any ambiguous terms from a legal or financial advisor before signing.

09

Sign and date the agreement in the designated areas, and make copies for your records.

10

Submit the completed Loan Agreement to the lending institution as per their instructions.

Who needs Loan Agreement with Affordability Covenants and Restrictions?

01

Homebuyers seeking affordable housing options that require financing.

02

Landlords or developers engaged in projects subject to affordability restrictions.

03

Non-profit organizations working on affordable housing initiatives.

04

Real estate investors looking to comply with local affordability mandates.

05

Individuals or families who want to ensure their borrowings align with budget constraints.

Fill

form

: Try Risk Free

People Also Ask about

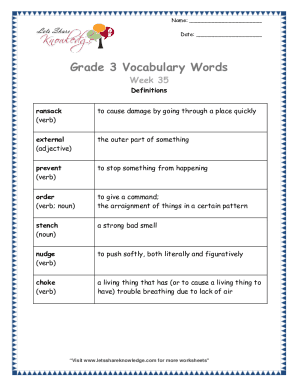

What is an example of a restrictive loan covenant?

These are restrictions placed on the borrower to prevent certain actions that could jeopardise their financial stability or the lender's security. Examples include restrictions on taking additional debt, selling substantial assets, or making large expenditures without the lender's approval.

What are the covenants in a loan agreement?

A loan covenant is a condition in a commercial loan or bond issue that requires the borrower to fulfill certain conditions or which forbids the borrower from undertaking certain actions, or which possibly restricts certain activities to circumstances when other conditions are met.

What is the difference between a covenant and a restriction?

Covenants are either personal, restricting only the party who signs the agreement, or they "run with the land," passing the burden along to subsequent property owners. A restriction is simply a limitation on the use of the land.

What are examples of covenants?

What Are Examples of Covenants? Covenants may be related to finances, property, law, or religion. In business, a loan covenant may disallow a company from acquiring another company or may require a certain amount of cash on hand. A property covenant may require the grass to be cut a specific number of times per year.

Why are covenants included in loan agreements?

Loan covenants ensure that a borrower's financial performance supports the profitability and cash flow needed to repay the loan. They serve as risk management safeguards for the lender, but they also promote a company's overall financial health.

What are common loan covenants?

These are restrictions placed on the borrower to prevent certain actions that could jeopardise their financial stability or the lender's security. Examples include restrictions on taking additional debt, selling substantial assets, or making large expenditures without the lender's approval.

What are the three types of loan covenants?

Affirmative Covenants (or Positive) Restrictive Covenants (or Negative) Financial Covenants: Maintenance vs. Incurrence Covenants.

What are covenants that restrict the borrower's actions called?

Restrictive Covenants → Restrictive, or negative, covenants are intended to prevent borrowers from taking high-risk actions without prior approval. Financial Covenants → Financial covenants refer to pre-specified credit ratios and operating performance metrics that the borrower must not breach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Loan Agreement with Affordability Covenants and Restrictions?

A Loan Agreement with Affordability Covenants and Restrictions is a legal document that outlines the terms of a loan while including specific commitments from the borrower to maintain affordability standards for a specified period. These covenants ensure that the financed property remains accessible and affordable to certain income levels.

Who is required to file Loan Agreement with Affordability Covenants and Restrictions?

Typically, developers or entities seeking financing for affordable housing projects are required to file a Loan Agreement with Affordability Covenants and Restrictions. This can also include nonprofits and other organizations involved in housing development.

How to fill out Loan Agreement with Affordability Covenants and Restrictions?

To fill out a Loan Agreement with Affordability Covenants and Restrictions, the borrower must provide detailed information regarding the project, including the proposed budget, timeline, terms of affordability, and any relevant compliance commitments. It involves completing specific sections of the agreement that pertain to the covenants and restrictions required by the lender.

What is the purpose of Loan Agreement with Affordability Covenants and Restrictions?

The purpose of a Loan Agreement with Affordability Covenants and Restrictions is to ensure that the funded project adheres to affordability criteria over a defined period, thus promoting access to housing. It aims to protect the financial interests of the lenders while supporting community goals related to affordable housing.

What information must be reported on Loan Agreement with Affordability Covenants and Restrictions?

The information that must be reported typically includes the borrower’s identification details, project description, affordability criteria, terms of the loan, compliance mechanisms, reporting timelines, and any potential penalties for non-compliance with the covenants.

Fill out your loan agreement with affordability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Agreement With Affordability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.