Get the free RETIREMENT ANNUITY FUND - SAMRO

Show details

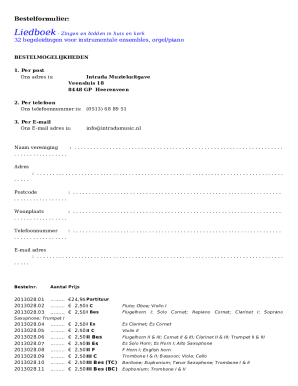

RETIREMENT ANNUITY FUND (Reg. No.: 12/8/7425/2) SA MRO RETIREMENT ANNUITY FUND FORTY THIRD ANNUAL GENERAL MEETING NOMINATION FORM FOR MEMBERS OF THE TRUSTEE BOARD Kindly complete this form if you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement annuity fund

Edit your retirement annuity fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement annuity fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement annuity fund online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit retirement annuity fund. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement annuity fund

How to fill out a retirement annuity fund:

01

Gather all relevant information: Start by collecting all the necessary documents and information such as your identification details, employment history, and financial statements.

02

Determine your retirement goals: Before filling out the retirement annuity fund, it's essential to have a clear understanding of your retirement goals. Consider factors like your desired retirement age, lifestyle expectations, and anticipated expenses.

03

Research and choose a suitable provider: Conduct thorough research to find a reputable retirement annuity fund provider. Consider factors such as fees, investment options, customer reviews, and the provider's track record in managing retirement funds.

04

Fill out the application form: Obtain the application form from the chosen provider and carefully fill it out. Provide accurate information, ensuring that you don't omit any necessary details. Take your time to understand the terms and conditions, making sure you agree with them.

05

Nominate beneficiaries: Most retirement annuity funds allow you to nominate beneficiaries who will receive the benefits in the event of your passing. Consider carefully selecting beneficiaries and ensure their contact details are accurate.

06

Choose investment options: The retirement annuity fund may offer various investment options. Take the time to understand each option and select the one that aligns with your risk tolerance and investment goals.

07

Review and submit the application: Review the completed application form, ensuring all sections are filled in accurately. Double-check the provided information, and if satisfied, submit the form to the retirement annuity fund provider along with any required supporting documents.

Who needs a retirement annuity fund?

01

Individuals planning for retirement: A retirement annuity fund is suitable for individuals who are actively planning for their retirement. It provides a means to save and grow funds, ensuring financial security during retirement.

02

Self-employed individuals: Self-employed individuals often lack the traditional pension plans provided by employers. In such cases, a retirement annuity fund can be an excellent option to create a retirement nest egg.

03

Those seeking tax advantages: Retirement annuity funds often offer tax benefits, making them attractive for individuals looking to optimize their tax planning while saving for retirement.

04

Investors looking for long-term growth: Retirement annuity funds typically offer a wide range of investment options catering to different risk appetites. Individuals seeking long-term growth potential for their retirement savings may find these funds beneficial.

05

Individuals with fluctuating income: Retirement annuity funds provide flexibility for individuals with variable income streams. Contributions can be adjusted based on the individual's income fluctuations, ensuring consistent retirement contributions over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is retirement annuity fund?

Retirement annuity fund is a type of investment fund specifically designed to provide income for individuals during retirement.

Who is required to file retirement annuity fund?

Individuals who have retirement annuity funds are required to file them.

How to fill out retirement annuity fund?

To fill out a retirement annuity fund, individuals must provide information on their contributions, earnings, and withdrawals.

What is the purpose of retirement annuity fund?

The purpose of a retirement annuity fund is to build savings for retirement and provide a source of income during retirement years.

What information must be reported on retirement annuity fund?

Information such as contributions, earnings, withdrawals, and any tax implications must be reported on a retirement annuity fund.

How do I edit retirement annuity fund online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your retirement annuity fund to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out the retirement annuity fund form on my smartphone?

Use the pdfFiller mobile app to fill out and sign retirement annuity fund on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit retirement annuity fund on an Android device?

You can edit, sign, and distribute retirement annuity fund on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your retirement annuity fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Annuity Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.