Get the free Request/Authorization Form for Increased local EIT Withholding

Show details

This document serves as a request for taxpayers to authorize their employers to withhold a new local earned income tax rate of 1.65% due to a referendum affecting the Big Spring School District.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign requestauthorization form for increased

Edit your requestauthorization form for increased form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your requestauthorization form for increased form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing requestauthorization form for increased online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit requestauthorization form for increased. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out requestauthorization form for increased

How to fill out Request/Authorization Form for Increased local EIT Withholding

01

Obtain the Request/Authorization Form for Increased Local EIT Withholding from your employer or the relevant tax authority.

02

Fill in your personal information, including your name, address, Social Security number, and any other identification required.

03

Specify the local jurisdiction where you wish to increase withholding.

04

Indicate the amount or percentage by which you would like to increase your EIT withholding.

05

Include any supporting documentation that may be required to validate your request.

06

Review the form for accuracy to ensure all information is correct.

07

Sign and date the form at the designated area to certify your request.

08

Submit the completed form to your employer’s payroll department or the applicable tax authority as instructed.

Who needs Request/Authorization Form for Increased local EIT Withholding?

01

Individuals who reside or work in areas with local Earned Income Tax (EIT) and wish to change their withholding amount.

02

Employees who anticipate owing more in local taxes and want to avoid penalties by increasing their withholding.

03

Taxpayers who have experienced a change in financial circumstances and need to adjust their local EIT withholding accordingly.

Fill

form

: Try Risk Free

People Also Ask about

Is my employer required to withhold local taxes?

Employers must comply with many different types of local payroll taxes. These taxes are based on where your employees work and/or live. Certain types of local taxes are only imposed on employers doing business in a locality.

What is the local EIT tax in PA?

Local Taxes in Pennsylvania Additionally, Pennsylvania has over 3,000 local taxing jurisdictions, including municipal and school district income taxes. Local earned income tax (EIT) rates range from 0.5% to 3.75% (in Philadelphia), which means some taxpayers face a combined state and local tax rate as high as 6.98%.

What is local EIT tax?

Earned Income Tax. The Local Tax Enabling Act authorizes Local Earned Income Taxes (EIT) for municipalities and school districts. This tax is . 5% of your earned income for the municipality and between . 9% and 1.5% for the school district in which you reside.

What does local EIT mean?

EIT – Earned Income Tax: Employees working in Pennsylvania will pay a local Earned Income Tax (EIT). The tax rate is determined by where the employee lives and works. The employee will be taxed by the higher of the two rates.

Who is supposed to pay local service tax?

This is a tax levied on wealth and incomes of all persons in gainful employment, self –employed and practicing professionals, self-employed artisans, business men/women and commercial farmers.

What is EIT tax in PA?

Commonly called a “Wage Tax,” it is usually a tax of one percent (1%) on gross wages and/or net profits from a business or profession. For individuals, this means salaries, wages, commissions, bonuses, incentive payments, fees and tips or any other compensation for services, whether in cash or property.

What does EIT mean in English?

Once an individual has passed the exam the state board awards that person an Engineer-in-Training (EIT) or an Engineer Intern (EI) designation. EIT and EI are equivalent variations in nomenclature that vary from state to state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

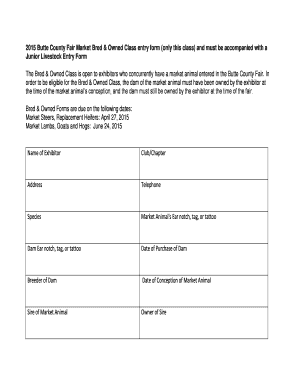

What is Request/Authorization Form for Increased local EIT Withholding?

The Request/Authorization Form for Increased local EIT Withholding is a document used by employers to notify tax authorities of a request to increase the amount of local Earned Income Tax (EIT) withheld from employees' wages.

Who is required to file Request/Authorization Form for Increased local EIT Withholding?

Employers who wish to increase the local EIT withholding for their employees are required to file this form with the relevant tax authority.

How to fill out Request/Authorization Form for Increased local EIT Withholding?

To fill out the form, employers must provide their business information, such as name and tax ID, the current rate of EIT withholding, the requested new rate, and any additional required details as specified by the local tax authority.

What is the purpose of Request/Authorization Form for Increased local EIT Withholding?

The purpose of this form is to formally request the adjustment of EIT withholding rates, ensuring compliance with local tax regulations and facilitating accurate tax collection.

What information must be reported on Request/Authorization Form for Increased local EIT Withholding?

The form must include the employer's details, employee information (if required), current withholding rate, requested withholding rate, and any other pertinent information required by the local tax authority.

Fill out your requestauthorization form for increased online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Requestauthorization Form For Increased is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.