Get the free REGISTERED EDUCATION SAVINGS PLAN (RESP) TRANSFER

Show details

This form is used to request and record a transfer between Registered Education Savings Plans (RESPs). It includes necessary information for the transfer and guidelines for completion.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registered education savings plan

Edit your registered education savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registered education savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registered education savings plan online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit registered education savings plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registered education savings plan

How to fill out REGISTERED EDUCATION SAVINGS PLAN (RESP) TRANSFER

01

Obtain the RESP transfer form from your current RESP provider or download it from their website.

02

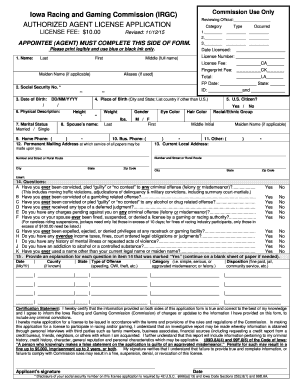

Fill out your personal information, including your name, address, and social insurance number.

03

Provide details of the RESP account you wish to transfer, including the account number and the provider's name.

04

Specify the amount you want to transfer (full or partial transfer).

05

If transferring to a new provider, fill out any additional information required by the new RESP provider.

06

Sign and date the transfer form.

07

Submit the completed form to your current RESP provider, either online or by mail.

Who needs REGISTERED EDUCATION SAVINGS PLAN (RESP) TRANSFER?

01

Individuals who have an existing Registered Education Savings Plan (RESP) and wish to move their savings to a different provider.

02

Parents or guardians looking to consolidate multiple RESPs into a single account for easier management.

03

Those who have found a new RESP provider offering better terms, investment options, or services.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to transfer RESP?

It generally takes 4 – 8 weeks to transfer an RESP account into Wealthsimple. The process is slightly longer for RESPs because we need to work with your current bank to understand the grants and contributions made to the account.

What happens to RESP if you leave Canada?

If you leave, you can keep the RESP open but once your child becomes a non-resident, deposits are no longer allowed. Same thing goes for the TFSA.

Can I use RESP to study in the USA?

If you're wondering, “Can I use RESP to study abroad?” or “Can RESP be used for US schools with different start dates?” — the answer is yes, but with planning. The Canadian RESP provider may require proof of enrollment aligned with specific dates to approve Educational Assistance Payments (EAPs).

Does RESP beneficiary need to live in Canada?

Designating a beneficiary You can designate an individual as a beneficiary under the RESP only if both of the following conditions are met: the individual's SIN is given to the promoter before the designation is made. the individual is a resident of Canada when the designation is made.

Can I use my RESP outside Canada?

The RESP beneficiary can be a non-resident of Canada while studying abroad. Even if the student moves to another country for their education, they can still access their RESP funds. However, it's important to ensure that the educational institution and the program meet the requirements set by the ESDC.

Can I transfer RESP to another account?

You can move your registered retirement savings plans (RRSPs) from one financial institution to another via the RRSP transfer process. This process lets you avoid having to make withdrawals, claim them as income, and pay taxes on that income.

Can I use RESP outside Canada?

The RESP beneficiary can be a non-resident of Canada while studying abroad. Even if the student moves to another country for their education, they can still access their RESP funds. However, it's important to ensure that the educational institution and the program meet the requirements set by the ESDC.

What to do with RESP when leaving Canada?

The plan can remain open even if you are a non-resident of Canada but there can be Canadian tax implications if you decide to close the plan. You can withdraw the capital you contributed to the plan as a tax- free return of capital at any time or you can direct that it is paid to the beneficiary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REGISTERED EDUCATION SAVINGS PLAN (RESP) TRANSFER?

A Registered Education Savings Plan (RESP) transfer involves moving funds from one RESP account to another, allowing the account holder to consolidate savings or change service providers without losing the tax advantages.

Who is required to file REGISTERED EDUCATION SAVINGS PLAN (RESP) TRANSFER?

The account holder or subscriber of the RESP is required to file a transfer, which can include individuals or institutions managing the RESP accounts.

How to fill out REGISTERED EDUCATION SAVINGS PLAN (RESP) TRANSFER?

To fill out an RESP transfer, you need to complete a transfer form provided by the financial institution, ensuring you include information about both the sending and receiving accounts, as well as the beneficiaries.

What is the purpose of REGISTERED EDUCATION SAVINGS PLAN (RESP) TRANSFER?

The purpose of an RESP transfer is to allow individuals to move their education savings between different plans while maintaining the tax-deferred status of the funds.

What information must be reported on REGISTERED EDUCATION SAVINGS PLAN (RESP) TRANSFER?

The information that must be reported includes account details of both the sending and receiving plans, the names of the beneficiaries, the amount being transferred, and any relevant identification numbers.

Fill out your registered education savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registered Education Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.