Get the free SCHEDULE OF DEBTS (INCLUDING WHOLESALE PLANS ON CARS, MORTGAGES, INSTALLMENT DEBTS &...

Show details

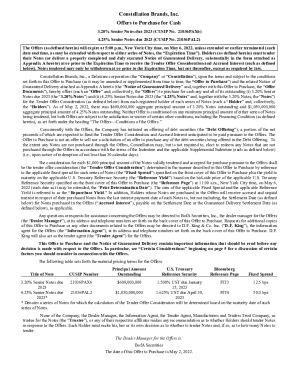

SCHEDULE OF DEBTS (INCLUDING WHOLESALE PLANS ON CARS, MORTGAGES, INSTALLMENT DEBTS & OTHER CONTRACTUAL OBLIGATIONS) PRESENT CREDITORORIGINAL AMOUNTNAME/ADDRESSORIGINAL DATEBALANCEINTEREST PREMATURITY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule of debts including

Edit your schedule of debts including form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule of debts including form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule of debts including online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule of debts including. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule of debts including

How to fill out schedule of debts including:

01

Start by gathering all relevant information about your debts. This includes the names of the creditors, the amounts owed, the interest rates, and the payment due dates.

02

List all your debts in a clear and organized manner. You can create a table or use a spreadsheet to make it easier to fill out the schedule. Make sure to include all the necessary details for each debt.

03

Calculate the total amount of debt you owe by adding up the individual amounts. This will help you have a clear understanding of your overall financial obligations.

04

Prioritize your debts based on their importance. Consider factors such as high-interest rates or those that are in collections. This will help you determine which debts to focus on paying off first.

05

Decide on a repayment plan for each debt. You can choose to pay the minimum monthly payments for some debts while allocating extra funds to pay off others more quickly. Make sure to stick to your plan to effectively manage your debt.

06

Regularly update and review your schedule of debts. As you make payments and pay off debts, make sure to reflect these changes in your schedule. This will ensure that you have an up-to-date and accurate representation of your debt situation.

Who needs schedule of debts including:

01

Individuals struggling with debt: Creating a schedule of debts, including all relevant information, can provide a clear overview of the debt situation. This can help individuals struggling with debt develop a plan for repayment and track their progress.

02

Financial advisors and debt counselors: Professionals who assist individuals in managing their finances can utilize a schedule of debts to assess their clients' situation and provide appropriate guidance. It allows them to analyze the debts, prioritize repayment, and provide personalized advice.

03

Individuals looking to consolidate or negotiate their debts: Having a schedule of debts including all the necessary details is essential when considering debt consolidation or negotiating with creditors. It helps individuals present a comprehensive picture of their debts and aids in negotiating favorable terms.

In summary, filling out a schedule of debts including involves gathering information, organizing it in a structured manner, calculating the total debt amount, prioritizing repayment, and regularly updating the schedule. It is useful for individuals struggling with debt, financial advisors, and individuals seeking to consolidate or negotiate their debts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the schedule of debts including in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit schedule of debts including on an Android device?

You can make any changes to PDF files, like schedule of debts including, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out schedule of debts including on an Android device?

Use the pdfFiller mobile app and complete your schedule of debts including and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is schedule of debts including?

Schedule of debts including is a list of all the debts that an individual or organization owes, including the amount owed, the creditor, and any relevant terms of repayment.

Who is required to file schedule of debts including?

Individuals or organizations who are filing for bankruptcy are typically required to file a schedule of debts including as part of their bankruptcy paperwork.

How to fill out schedule of debts including?

To fill out a schedule of debts including, you will need to list each debt separately, including the creditor's name, amount owed, and any terms of repayment. This information can typically be found on statements or correspondence from the creditor.

What is the purpose of schedule of debts including?

The purpose of a schedule of debts including is to provide a complete and accurate picture of an individual or organization's financial obligations to ensure fair and equitable distribution of assets in the event of bankruptcy.

What information must be reported on schedule of debts including?

On a schedule of debts including, you must report the name of the creditor, the amount owed, any collateral securing the debt, the type of debt (e.g. credit card, mortgage), and any relevant terms of repayment.

Fill out your schedule of debts including online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Of Debts Including is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.