Get the Tax-Free Savings Account TFSA - National Bank Investments

Show details

Transactional Form Three Savings Account (FSA) 7 golden rules for investors 1. Do not buy based on past returns; buy investment products that meet your needs Past performances are not indicative of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax- savings account tfsa

Edit your tax- savings account tfsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax- savings account tfsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax- savings account tfsa online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax- savings account tfsa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

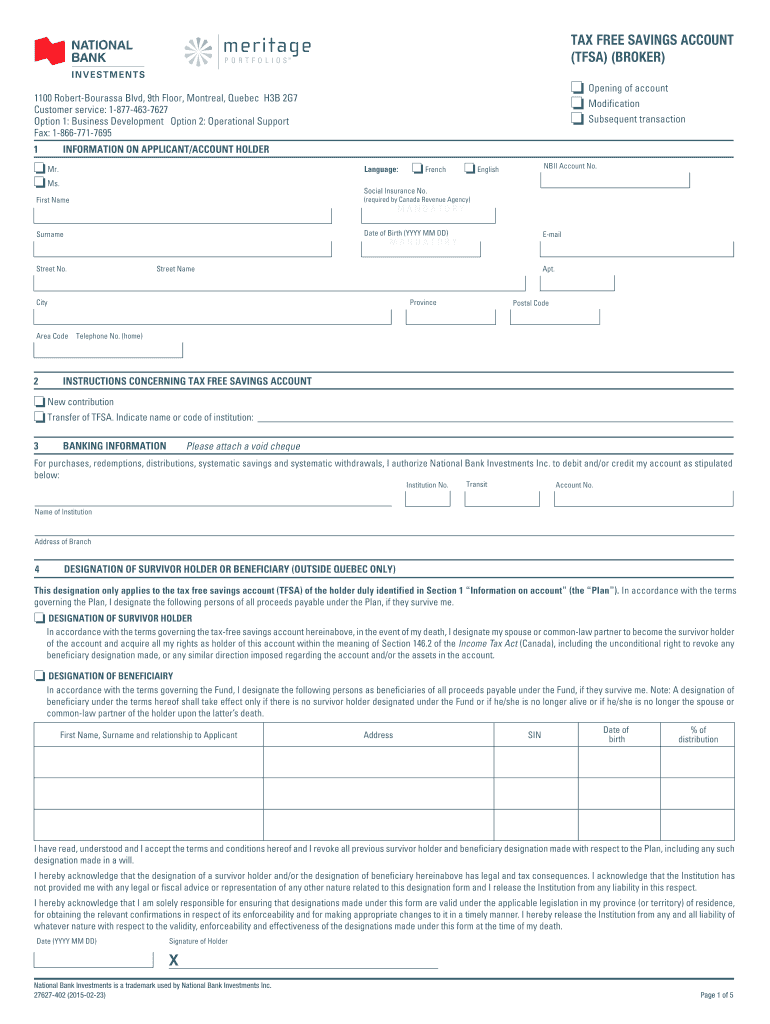

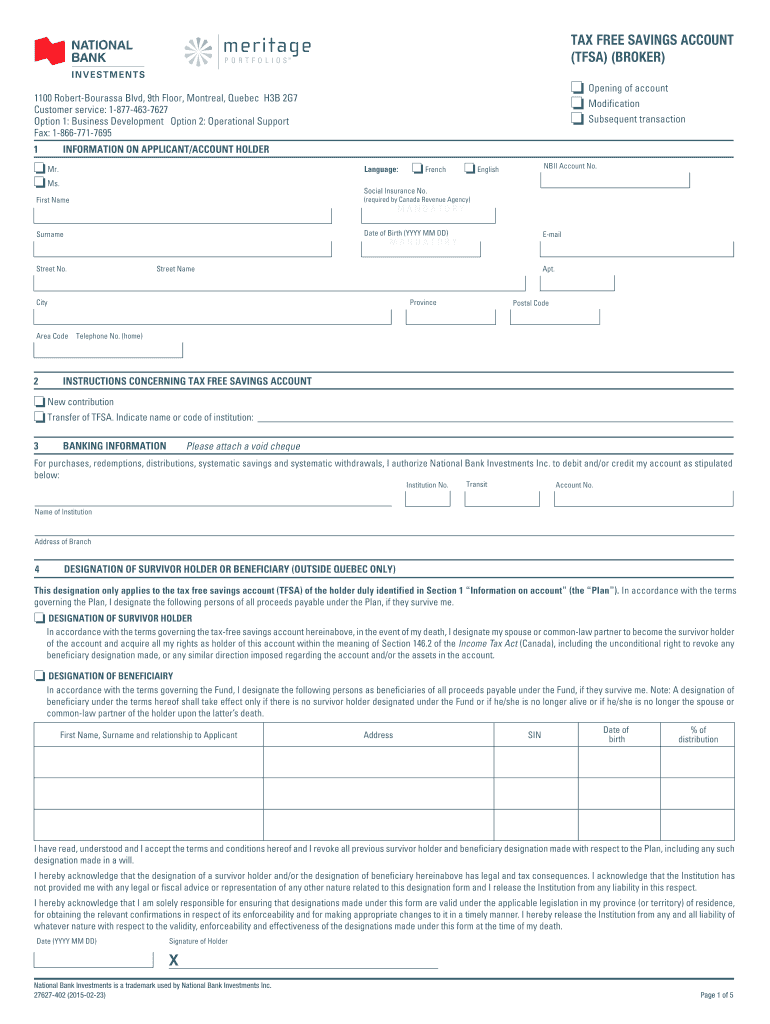

How to fill out tax- savings account tfsa

How to fill out tax-savings account TFSA:

01

Gather all necessary documents: Before filling out a tax-savings account TFSA, gather important documents such as your social insurance number, identification, and proof of residency. These will be required during the application process.

02

Choose the type of TFSA: Determine whether you want a regular TFSA or a self-directed TFSA. A regular TFSA allows you to invest in various savings vehicles offered by financial institutions, while a self-directed TFSA allows you to invest in a wider range of options such as stocks, bonds, and mutual funds.

03

Select a financial institution: Choose a financial institution that offers tax-savings accounts TFSA. Compare different institutions based on their fees, interest rates, and services offered. It is advisable to opt for a reputable institution that suits your investment needs.

04

Complete the application form: Fill out the application form provided by the chosen financial institution. Provide accurate and up-to-date information such as your name, contact details, date of birth, and social insurance number. Follow the instructions carefully and ensure you provide all required information.

05

Decide on contribution amount: Determine how much you want to contribute to your tax-savings account TFSA. Be aware of the annual contribution limit set by the government to avoid over-contributing, as excess contributions may incur penalties.

06

Determine investment options: If you opted for a self-directed TFSA, decide on the investment options you want to pursue. Conduct thorough research or consult with a financial advisor to make informed decisions regarding your investment strategy.

07

Make contributions: Deposit the initial contribution amount to your tax-savings account TFSA. Some financial institutions allow regular contributions, so you can set up automatic transfers to ensure consistent saving and investing.

08

Monitor and manage your account: Regularly review your tax-savings account TFSA to assess its performance and make necessary adjustments. Keep track of any changes in contribution limits, withdrawal rules, and investment opportunities offered by your financial institution.

Who needs tax-savings account TFSA:

01

Individuals looking for tax advantages: A tax-savings account TFSA is suitable for individuals seeking tax advantages. Contributions made to a TFSA are not tax-deductible, but any earnings or growth in the account are tax-free. This can be beneficial for those aiming to save and invest while minimizing their tax obligations.

02

Individuals planning for short-term or long-term goals: A tax-savings account TFSA can be utilized by individuals with various financial goals. Whether you want to save for a down payment on a house, an emergency fund, or retirement, a TFSA offers flexibility and tax-free growth potential.

03

Individuals looking for investment options: A TFSA provides an opportunity to invest in a wide range of options such as savings accounts, guaranteed investment certificates (GICs), stocks, bonds, mutual funds, and more. If you want to grow your money through different investment vehicles, a tax-savings account TFSA can be a suitable choice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax- savings account tfsa in Chrome?

tax- savings account tfsa can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the tax- savings account tfsa in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your tax- savings account tfsa directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out tax- savings account tfsa using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign tax- savings account tfsa and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is tax- savings account tfsa?

A Tax-Free Savings Account (TFSA) is a type of account in Canada that allows individuals to earn investment income tax-free.

Who is required to file tax- savings account tfsa?

Individuals who have a TFSA account and have earned investment income within the account are required to report it on their tax return.

How to fill out tax- savings account tfsa?

To fill out a TFSA on your tax return, you will need to report the amount of investment income earned within the account using the appropriate forms provided by the Canada Revenue Agency (CRA).

What is the purpose of tax- savings account tfsa?

The purpose of a TFSA is to allow individuals to save and invest money tax-free, helping them grow their savings faster.

What information must be reported on tax- savings account tfsa?

You must report the amount of investment income earned within the TFSA account, such as interest, dividends, and capital gains.

Fill out your tax- savings account tfsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax- Savings Account Tfsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.