Get the free Annuity Application

Show details

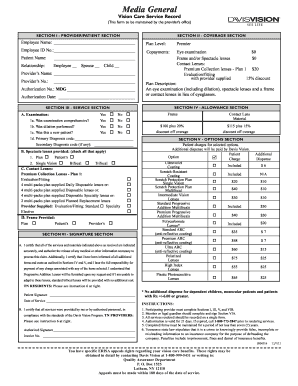

This document is an application form for purchasing an annuity from the Liberty Bankers Life Insurance Company or The Capitol Life Insurance Company. It includes sections for personal information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annuity application

Edit your annuity application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annuity application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit annuity application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annuity application

How to fill out Annuity Application

01

Read the instructions carefully before starting the application.

02

Gather necessary personal information such as identification, Social Security number, and employment details.

03

Complete the applicant information section accurately.

04

Specify the type of annuity you are applying for.

05

Provide beneficiary information, including names and relationships.

06

Fill out any financial information required to assess your eligibility.

07

Review your application for completeness and accuracy.

08

Sign and date the application to certify that all information is correct.

09

Submit the application to the designated address or online portal.

Who needs Annuity Application?

01

Individuals looking for retirement income.

02

Those wanting to secure a long-term investment with guaranteed returns.

03

People who seek to transfer wealth to beneficiaries in a tax-efficient manner.

04

Investors seeking to diversify their financial portfolios.

Fill

form

: Try Risk Free

People Also Ask about

Why do financial advisors push annuities?

There are a variety of options that may be better than an annuity for retirement, depending on your financial situation and goals. These include deferred compensation plans, such as a 401(k), IRAs, dividend-paying stocks, variable life insurance, and retirement income funds.

What is the biggest disadvantage of an annuity?

A 65-year-old woman purchasing a $50,000 immediate income annuity for her life only can expect between $284 and $324 per month. But if she waits until age 70 to lock in that same annuity, her monthly income bumps up to as much as $366.

How much does a $100 000 annuity payout per month?

A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select. That income can be a helpful foundation in retirement, especially when combined with Social Security benefits or other investments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annuity Application?

An Annuity Application is a formal request submitted by an individual to purchase an annuity, which is a financial product designed to provide regular payments over time, often for retirement income.

Who is required to file Annuity Application?

Individuals seeking to purchase an annuity are required to file an Annuity Application. This may include retirees or individuals planning for retirement.

How to fill out Annuity Application?

To fill out an Annuity Application, one typically needs to provide personal information, select the type of annuity desired, specify the payment options, and provide financial information related to the purchase.

What is the purpose of Annuity Application?

The purpose of an Annuity Application is to initiate the process of securing an annuity contract, outlining terms, and enabling the issuing company to assess the applicant's financial situation.

What information must be reported on Annuity Application?

The information that must be reported on an Annuity Application typically includes the applicant's name, contact information, Social Security number, occupation, income details, desired annuity type, and payment preferences.

Fill out your annuity application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annuity Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.