Get the free Annuity Application

Show details

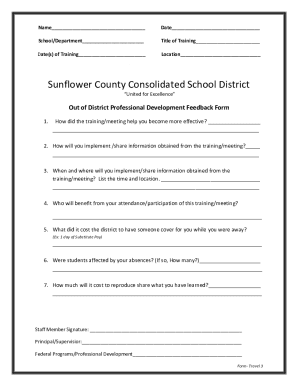

This document serves as an application for an annuity, collecting personal information of the annuitant and owner, as well as other relevant details for processing the application.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annuity application

Edit your annuity application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annuity application online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annuity application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annuity application

How to fill out Annuity Application

01

Begin by gathering necessary personal information, including your name, address, and Social Security number.

02

Identify the type of annuity you wish to apply for (e.g., fixed, variable, indexed).

03

Provide details about your financial status, including income, investments, and existing retirement accounts.

04

Complete the beneficiary section by naming individuals or entities who will receive the benefits upon your passing.

05

Review the terms and conditions, including fees and withdrawal penalties, to ensure you understand your commitments.

06

Sign and date the application, confirming your agreement to the terms provided.

07

Submit the application to your chosen insurance or financial institution, along with any required documentation or initial premium payment.

Who needs Annuity Application?

01

Individuals looking to secure their retirement income.

02

People who want to diversify their investment portfolio.

03

Those seeking tax-deferred growth on their savings.

04

Individuals who want to provide financial support to beneficiaries after their death.

Fill

form

: Try Risk Free

People Also Ask about

Why do financial advisors push annuities?

There are a variety of options that may be better than an annuity for retirement, depending on your financial situation and goals. These include deferred compensation plans, such as a 401(k), IRAs, dividend-paying stocks, variable life insurance, and retirement income funds.

What is the biggest disadvantage of an annuity?

A 65-year-old woman purchasing a $50,000 immediate income annuity for her life only can expect between $284 and $324 per month. But if she waits until age 70 to lock in that same annuity, her monthly income bumps up to as much as $366.

How much does a $100 000 annuity payout per month?

A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select. That income can be a helpful foundation in retirement, especially when combined with Social Security benefits or other investments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annuity Application?

An Annuity Application is a formal document that individuals or entities fill out to request an annuity contract from an insurance company or financial institution.

Who is required to file Annuity Application?

Individuals seeking to purchase annuities, typically retirees or those planning for retirement, are required to file an Annuity Application.

How to fill out Annuity Application?

To fill out an Annuity Application, provide personal information, financial details, and beneficiary information as required by the issuing institution, and ensure all sections are completed accurately.

What is the purpose of Annuity Application?

The purpose of an Annuity Application is to formally apply for an annuity, which can provide regular payments at a future date, often as part of retirement income planning.

What information must be reported on Annuity Application?

Information that must be reported on an Annuity Application typically includes personal identification details, financial situation, investment objectives, and information about beneficiaries.

Fill out your annuity application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annuity Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.