Get the free Declaration of Current/Post-Petition Income and Expenses

Show details

This document is used for debtors to declare their current and post-petition income and expenses as part of bankruptcy proceedings. It includes sections for both income and expenses of the debtor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign declaration of currentpost-petition income

Edit your declaration of currentpost-petition income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration of currentpost-petition income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing declaration of currentpost-petition income online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit declaration of currentpost-petition income. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

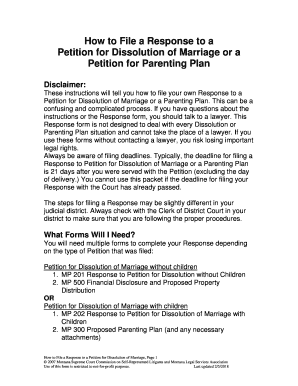

How to fill out declaration of currentpost-petition income

How to fill out Declaration of Current/Post-Petition Income and Expenses

01

Start with your personal information: Enter your name, address, and case number at the top of the form.

02

List all sources of income: Itemize your income from all sources including employment, self-employment, government benefits, and any other forms of income.

03

Include your expenses: Detail your monthly expenses such as rent, utilities, groceries, transportation, and insurance.

04

Obtain necessary documentation: Gather pay stubs, bank statements, and any relevant financial documentation to support your entries.

05

Double-check calculations: Ensure that all numbers add up correctly and reflect your current financial situation.

06

Sign and date the declaration: After reviewing the information, sign and date the form to certify its accuracy before submission.

Who needs Declaration of Current/Post-Petition Income and Expenses?

01

Individuals who have filed for bankruptcy or are undergoing a bankruptcy process need to complete the Declaration of Current/Post-Petition Income and Expenses to disclose their financial situation.

02

Anyone required by the court or a trustee to provide updated financial information during their bankruptcy case.

Fill

form

: Try Risk Free

People Also Ask about

What is FL 141 California?

Declaration Regarding Service of Declaration of Disclosure and Income and Expense Declaration (FL-141) Tell the court that you had the first or final set of financial documents served on your spouse or domestic partner. Get form FL-141.

What is FL150?

Income and Expense Declaration (FL-150) Give your financial information to the court and to your spouse or domestic partner. The court uses the information to make orders for support, attorneys fees, and other costs.

Is FL 150 required in California?

Yes, in a California divorce or family law cases involving financial issues, both the petitioner and the respondent must file form FL-150.

What is the current income and expense declaration in California?

Form FL-150 is an income and expense declaration document that must be completed and submitted to the court in California for divorces and family law cases involving financial orders such as spousal support, child support, or attorney fees.

What is the rule of court Income and expense declaration in California?

General provisions regarding support cases. Except as provided below, for all hearings involving child, spousal, or domestic partner support, both parties must complete, file, and serve a current Income and Expense Declaration (form FL-150) on all parties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Declaration of Current/Post-Petition Income and Expenses?

The Declaration of Current/Post-Petition Income and Expenses is a legal document that outlines an individual's or entity's income and expenses after a bankruptcy petition has been filed. It provides a snapshot of financial status to the court.

Who is required to file Declaration of Current/Post-Petition Income and Expenses?

Individuals or businesses that have filed for bankruptcy protection under Chapter 7 or Chapter 13 are typically required to file the Declaration of Current/Post-Petition Income and Expenses.

How to fill out Declaration of Current/Post-Petition Income and Expenses?

To fill out the Declaration, you need to gather your current income sources and expenses, complete the necessary forms provided by the court, accurately record the amounts, and provide any required documentation to support your claims.

What is the purpose of Declaration of Current/Post-Petition Income and Expenses?

The purpose is to give the court a clear understanding of the debtor's financial situation, help determine repayment plans (in Chapter 13), and assist in assessing the ability to pay debts.

What information must be reported on Declaration of Current/Post-Petition Income and Expenses?

The information reported includes all sources of income (employment, rental income, etc.), monthly expenses (housing, utilities, food, etc.), any additional income or expenses, and any changes expected in the near future.

Fill out your declaration of currentpost-petition income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration Of Currentpost-Petition Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.