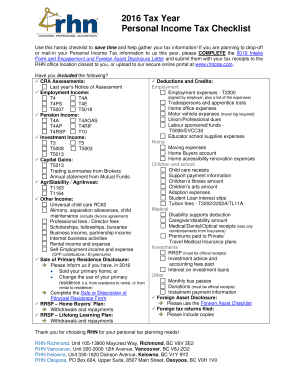

Get the free Financial Hardship Form

Show details

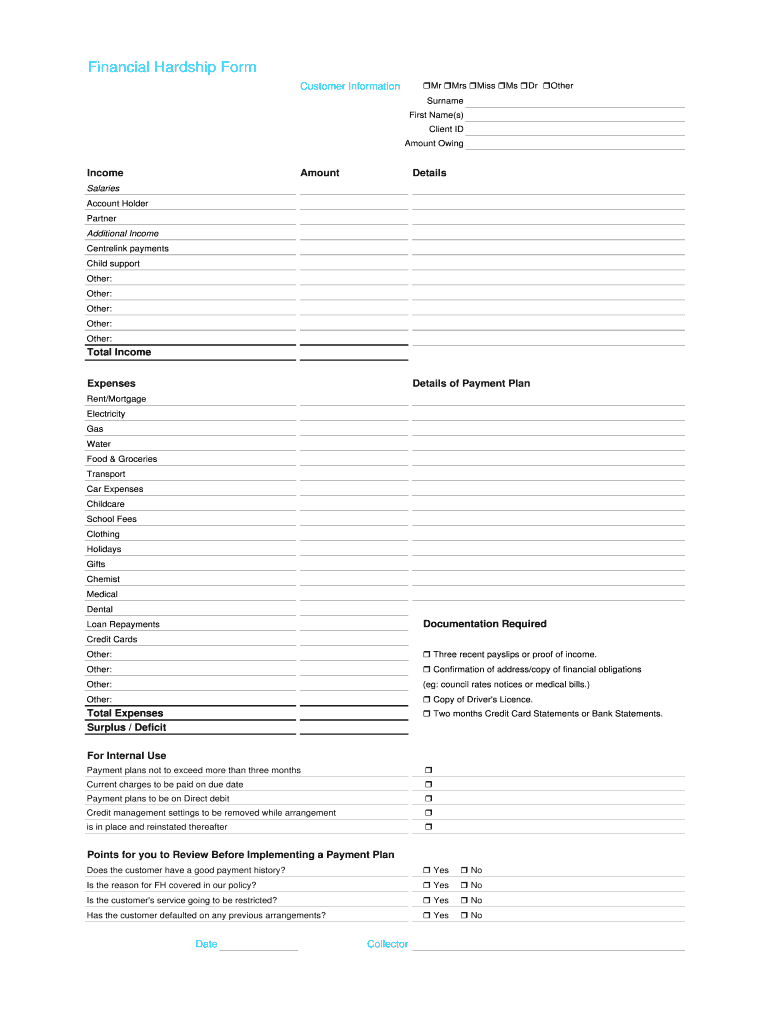

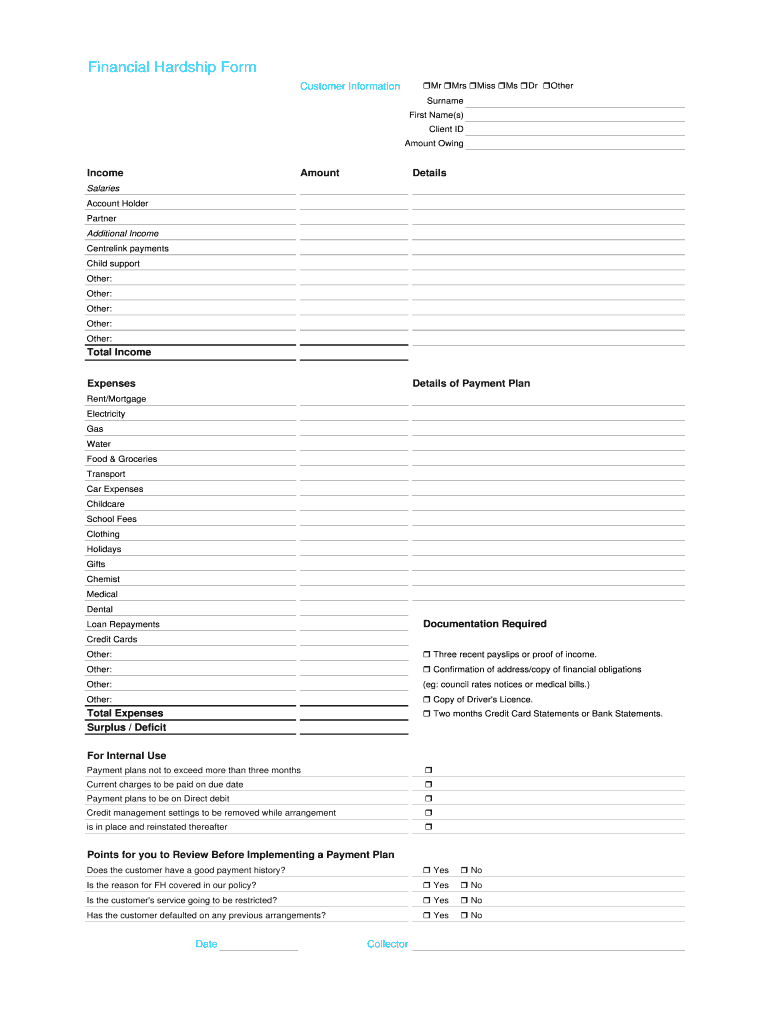

This document is designed for customers to provide information regarding their financial hardship status, including income details, expenses, and required documentation to establish a payment plan.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial hardship form

Edit your financial hardship form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial hardship form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial hardship form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial hardship form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial hardship form

How to fill out Financial Hardship Form

01

Gather necessary documentation such as proof of income, expenses, and any other relevant financial information.

02

Obtain the Financial Hardship Form from the appropriate organization or website.

03

Fill out your personal information including your name, address, and contact details.

04

Provide details about your current financial situation, including income sources and amounts.

05

List your monthly expenses, ensuring to include essential costs such as rent, utilities, and food.

06

Explain your reasons for financial hardship, specifying any recent changes like job loss or medical expenses.

07

Review the form for accuracy and completeness.

08

Submit the form as instructed, either online, by mail, or in person.

Who needs Financial Hardship Form?

01

Individuals or families experiencing financial difficulties due to unexpected circumstances such as job loss, medical expenses, or other significant life events.

Fill

form

: Try Risk Free

People Also Ask about

What proof do you need for financial hardship?

Lenders may ask you for evidence of your hardship, like a doctor's certificate or termination notice. Lenders may also ask for bank statements and evidence of income.

How do I fill out a hardship form?

IRS Hardship Refund Request – Form 8944 The request should include detailed documentation supporting the financial hardship faced by the taxpayer, including proof of income, expenses, debts, and any other relevant financial information.

How do I get proof of financial hardship?

Depending on your situation, you might submit documents such as an unemployment notice, medical bills, military orders or a divorce decree. It's also helpful to provide verification of all sources of income (paystubs, W-2s and 1099s) as well as account statements to show your current financial status.

How to write a financial hardship statement?

What to include in a hardship letter The date, your name, address and phone number. The lender/servicer and loan number. The date or approximate time frame when the hardship started. The expected timeframe of hardship — short term (six months or less) or long term. Describe your goal. State the facts, not emotions.

What is an example of a financial hardship statement?

As a Federal Employee my income has been reduced by 20% per pay period. I am now experiencing financial hardship due reduced income. Because my income has dropped considerably I can no longer afford the terms of the original loan.

How to prove you are in financial hardship?

Common documents might include: Bank statements that show income and expenses. Copies of your most recent tax returns. Copies of pay stubs. Copies of other bills (credit cards, utilities, medical bills, etc.). Letters of unemployment or notices of reduction in pay/hours. Eviction notice. Medical bills.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Hardship Form?

A Financial Hardship Form is a document that individuals submit to request assistance or relief based on their financial difficulties.

Who is required to file Financial Hardship Form?

Individuals or families experiencing significant financial difficulties, such as job loss, medical expenses, or other financial crises, are typically required to file a Financial Hardship Form.

How to fill out Financial Hardship Form?

To fill out a Financial Hardship Form, individuals should provide accurate information regarding their financial situation, including income, expenses, and any supporting documentation demonstrating their hardships.

What is the purpose of Financial Hardship Form?

The purpose of the Financial Hardship Form is to evaluate the financial status of the applicant and determine eligibility for support programs, reduced payments, or other forms of assistance.

What information must be reported on Financial Hardship Form?

The form typically requires information such as personal identification details, income sources, monthly expenses, debts, and any relevant documentation that illustrates the individual's financial difficulties.

Fill out your financial hardship form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Hardship Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.