Get the free APPLICATION FOR REFUND OF FINNISH WITHHOLDING

Show details

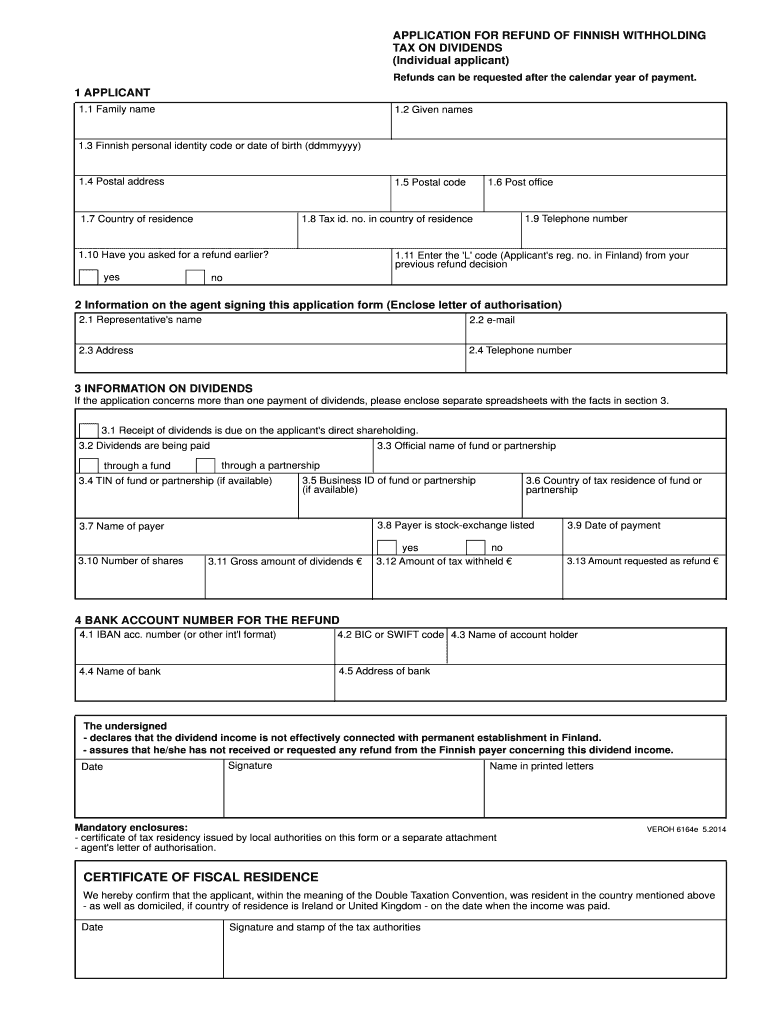

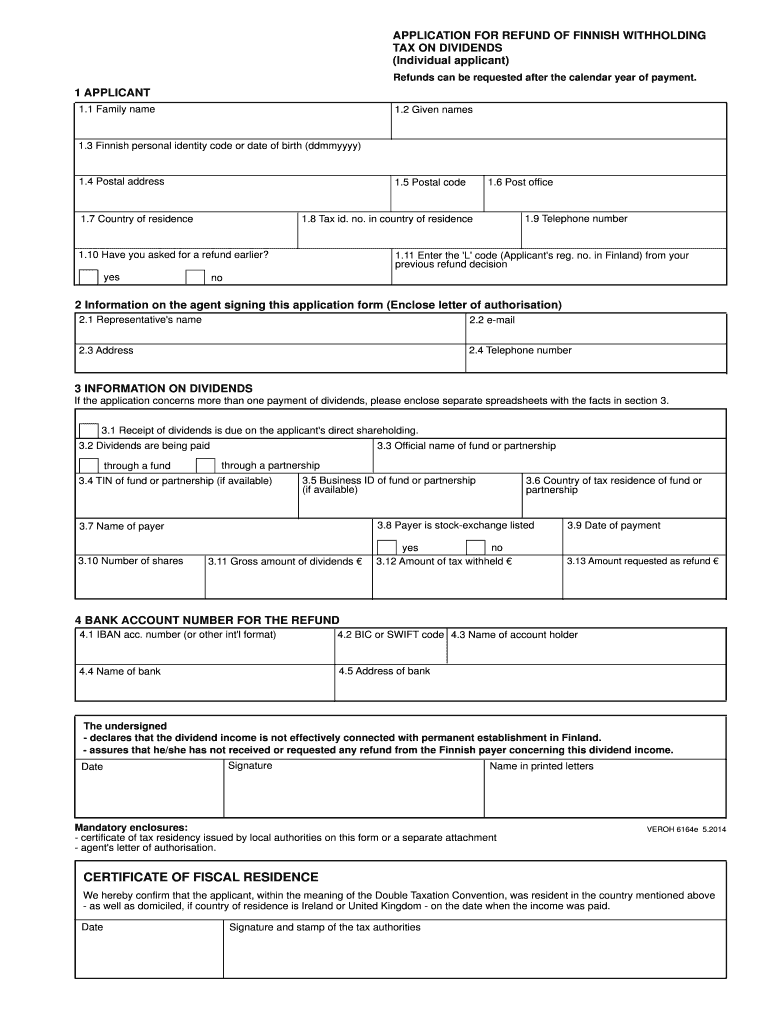

Reset form APPLICATION FOR REFUND OF FINNISH WITHHOLDING TAX ON DIVIDENDS (Individual applicant) To the instructions Refunds can be requested after the calendar year of payment. 1 APPLICANT 1.1 Family

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for refund of

Edit your application for refund of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for refund of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for refund of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for refund of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for refund of

How to fill out application for refund of:

01

Gather necessary documents: Before filling out the application, gather all relevant documents such as receipts, proof of purchase, or any other supporting documents that prove your eligibility for a refund.

02

Download or obtain the application form: Visit the official website of the organization or institution from which you are seeking a refund. Look for the application form specifically designed for refund requests. Alternatively, you can visit their office or contact their customer service to obtain a physical copy of the form.

03

Read the instructions carefully: Before proceeding with filling out the application, thoroughly read the instructions provided with the form. Make sure you understand the eligibility criteria, required information, and any additional documents or signatures that may be needed.

04

Provide your personal information: Start the application by entering your personal details such as full name, contact information, address, and any identification numbers or account references relevant to your refund request.

05

Explain the reason for the refund: Clearly state the reason why you are applying for a refund. Provide a detailed explanation, including any relevant dates, events, or circumstances that led to your need for a refund.

06

Include supporting documentation: Attach all the necessary supporting documents along with the application form. These could include receipts, warranties, invoices, or any other paperwork that validates your claim for a refund.

07

Provide accurate financial information: If the refund you're applying for involves any financial transactions, accurately provide all the financial details as asked in the application form. This may include bank account information, transaction dates, or any other financial identifiers needed to process your refund.

08

Review and sign the application form: Before submitting the application, carefully review all the information you have provided to ensure accuracy and completeness. Sign and date the form where required.

09

Submit the application: Once you have completed the application form and gathered all supporting documents, it's time to submit your request. Check the instructions provided to determine the appropriate method of submission, whether it's by mail, email, or through an online form.

10

Follow up on your application: Keep track of the progress of your refund application. If there is a specified timeline mentioned in the instructions, wait until that timeframe has passed before contacting the organization or institution for an update on your request.

Who needs application for refund of:

01

Individuals who have made a purchase but wish to return or exchange the item due to dissatisfaction, damage, or any other valid reason.

02

Customers who have overpaid for a product or service and require a refund for the excess amount.

03

Students or parents who have paid tuition fees but are eligible for a refund due to withdrawal from a course or educational institution.

04

Consumers who have canceled a subscription or membership and are entitled to a refund of any unused portion.

05

Individuals who have experienced a financial loss or paid for services that were not delivered and are seeking reimbursement.

06

People who have purchased a defective or faulty product and need a refund from the manufacturer or retailer.

07

Applicants who have paid application fees for a service (e.g., visa application) but were denied and are eligible for a refund based on the terms and conditions.

08

Customers who have been billed incorrectly or double-charged for a product or service and require a refund for the overcharged amount.

09

Individuals who have experienced a cancellation or rescheduling of an event, flight, or reservation and need a refund for the tickets or bookings.

10

Any person or organization who has paid an unnecessary fee or tax and meets the criteria for a refund as defined by the concerned authority.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for refund of to be eSigned by others?

When your application for refund of is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute application for refund of online?

Filling out and eSigning application for refund of is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out application for refund of on an Android device?

On Android, use the pdfFiller mobile app to finish your application for refund of. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is application for refund of?

Application for refund of is for requesting a return of funds that were overpaid or incorrectly paid.

Who is required to file application for refund of?

Individuals or entities who have overpaid taxes or fees are required to file an application for refund.

How to fill out application for refund of?

To fill out an application for refund, provide detailed information about the overpayment, the reason for the refund, and any supporting documentation.

What is the purpose of application for refund of?

The purpose of an application for refund is to request the return of funds that were paid in excess or in error.

What information must be reported on application for refund of?

Information such as the amount of overpayment, the tax or fee type, the payment date, and any relevant supporting documentation must be reported on the application for refund.

Fill out your application for refund of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Refund Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.