Get the free Loss of Profits and Earning Capacity - uscg

Show details

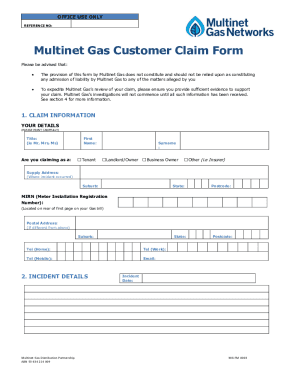

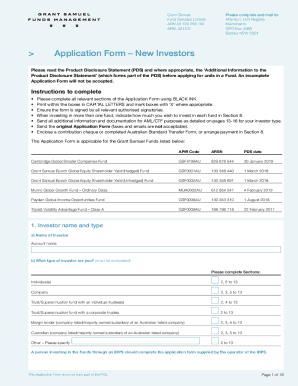

CLAIM SUMMARY / DETERMINATION FORM Claim Number Claimant Type of Claimant Type of Claim Amount Requested : : : : : N100361649 Marcus Andrews Private (US) Loss of Profits and Earning Capacity $15,000.00

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loss of profits and

Edit your loss of profits and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loss of profits and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loss of profits and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit loss of profits and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loss of profits and

How to Fill Out Loss of Profits and?

01

Gather all necessary information: To accurately fill out the loss of profits form, you need to have access to relevant financial records and documentation. This includes sales figures, operating expenses, and any other supporting data that can help calculate the loss of profits accurately.

02

Clearly state the period of loss: Specify the timeframe for which you experienced a loss of profits. This could be a specific month, quarter, or year, depending on the circumstances. Make sure to provide the exact dates to avoid any confusion.

03

Describe the cause of the loss: Clearly explain the event or circumstance that led to the loss of profits. It could be a natural disaster, fire, theft, or any other incident that directly impacted your business's ability to generate revenue. Provide any details or supporting evidence to strengthen your claim.

04

Calculate the loss of profits: Use the gathered financial information to calculate the actual loss of profits incurred during the specified period. This involves analyzing the difference between expected revenue and the actual revenue earned. Consider any additional expenses incurred due to the event or circumstance mentioned.

05

Attach supporting documentation: To validate your claim, include any relevant supporting documentation, such as financial statements, invoices, receipts, or any other records that can help substantiate the loss. This evidence will strengthen your case and improve the chances of a successful claim.

Who Needs Loss of Profits and?

01

Business owners: Loss of profits insurance is essential for business owners who want financial protection against unexpected events causing a temporary halt in operations and subsequent loss of revenue. It provides a safety net to help cover expenses and bridge the gap until the business can return to normal operations.

02

Insurance companies: Loss of profits insurance is a product offered by insurance companies to protect businesses from financial losses. Insurance companies underwrite these policies and provide coverage based on the specific terms and conditions outlined in the policy. They assess the risk and determine the premium based on various factors such as the nature of the business, revenue, and past financial performance.

03

Investors and lenders: Loss of profits insurance is an important consideration for investors and lenders when evaluating the financial stability of a business. It provides assurance that in case of unexpected events leading to a loss of profits, the business has adequate coverage to sustain itself and mitigate financial risks. This makes the business a more secure investment or lending opportunity.

In summary, filling out a loss of profits form requires gathering necessary information, clearly stating the period of loss, describing the cause of the loss, calculating the loss of profits, and attaching supporting documentation. Business owners, insurance companies, investors, and lenders are the primary individuals or entities who need loss of profits insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loss of profits and?

Loss of profits is a financial measure that reflects the amount of money lost as a result of business interruptions or other unforeseen circumstances.

Who is required to file loss of profits and?

Businesses and individuals who have experienced financial losses due to business interruptions or other unforeseen circumstances are required to file loss of profits.

How to fill out loss of profits and?

To fill out a loss of profits form, one must provide information on the financial losses incurred, the cause of the losses, and any relevant documentation to support the claim.

What is the purpose of loss of profits and?

The purpose of loss of profits is to compensate businesses and individuals for the financial losses they have incurred due to unforeseen circumstances.

What information must be reported on loss of profits and?

Information such as the amount of financial losses incurred, the cause of the losses, and any supporting documentation must be reported on loss of profits forms.

How do I edit loss of profits and online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your loss of profits and to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit loss of profits and on an iOS device?

Create, edit, and share loss of profits and from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete loss of profits and on an Android device?

Use the pdfFiller app for Android to finish your loss of profits and. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your loss of profits and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loss Of Profits And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.