Get the free Tax Exempt Status Please complete copy - Mountain Creek

Show details

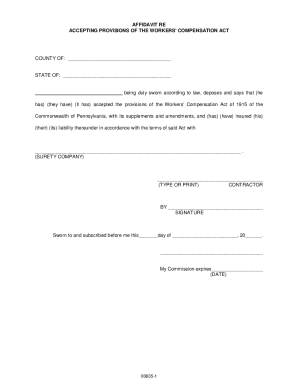

Tax Exempt Status: Please complete & copy on official letterhead Attn: Mountain Creek Date: 200 Route 94 Vernon, NJ 07462 Attention: Group Sales Name of School or Government Agency is purchasing product

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax exempt status please

Edit your tax exempt status please form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt status please form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax exempt status please online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax exempt status please. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exempt status please

How to fill out tax exempt status please?

01

Start by obtaining the necessary forms from the tax authority or department responsible for tax exemptions in your jurisdiction.

02

Carefully read the instructions provided with the form to ensure you understand the requirements and eligibility criteria for tax exemption.

03

Begin filling out the form by providing your personal information accurately, including your name, contact details, and tax identification number.

04

Specify the type of organization or entity seeking tax exempt status. This can include non-profit organizations, religious institutions, or other qualifying entities.

05

Provide detailed information about the purpose and mission of your organization, highlighting its non-profit nature and explaining how it benefits the community or society.

06

Include any relevant supporting documents, such as articles of incorporation, bylaws, financial statements, or other proof of your organization's non-profit status.

07

Clearly state the specific tax exemptions you are seeking, such as exemption from income tax, sales tax, property tax, or any other applicable taxes. Provide detailed justifications for each requested exemption.

08

Complete all additional sections or schedules that are relevant to your organization's specific tax exempt status application. This may include detailing the sources and uses of funds, the organization's governance structure, or any other required information.

09

Review your completed form thoroughly to ensure all information is accurate and complete. Make sure you have signed and dated the form where necessary.

10

Submit the filled-out form, along with any required supporting documents, to the designated tax authority, following their specified submission guidelines and deadlines.

Who needs tax exempt status please?

01

Non-profit organizations: Organizations that operate for charitable, scientific, educational, religious, literary, or other similar purposes, and meet the criteria set by the tax authority.

02

Religious institutions: Places of worship, churches, mosques, temples, or other religious organizations that qualify for tax exemptions based on their religious activities and functions.

03

Charitable foundations: Foundations that support humanitarian, educational, or other charitable causes and are eligible for tax exempt status.

04

Government entities: Certain government bodies or organizations may be eligible for tax exemptions, depending on the jurisdiction and purposes for which they operate.

05

Social welfare organizations: Organizations focused on improving social welfare, promoting community development, or supporting specific social causes might qualify for tax exempt status.

06

Educational institutions: Schools, colleges, universities, or other educational establishments that meet the specified criteria can apply for tax exempt status.

07

Healthcare organizations: Hospitals, clinics, or health-focused non-profit entities may be eligible for tax exemptions, depending on the jurisdiction and the nature of their activities.

08

Cultural or artistic organizations: Museums, art galleries, performing arts groups, or cultural institutions that align with the tax authority's guidelines may qualify for tax exempt status.

09

Trade or professional associations: Certain industry-related associations or professional organizations might be eligible for tax exemptions.

10

Other qualifying entities: Different jurisdictions may have specific provisions for other types of organizations that can apply for tax exempt status. It is essential to consult the relevant tax authority or seek professional advice in these cases.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax exempt status please?

Tax exempt status is a designation given to organizations or individuals that are not required to pay certain taxes.

Who is required to file tax exempt status please?

Non-profit organizations and certain other entities are required to file for tax exempt status.

How to fill out tax exempt status please?

To fill out tax exempt status, you typically need to submit Form 1023 or Form 1023-EZ to the IRS.

What is the purpose of tax exempt status please?

The purpose of tax exempt status is to provide relief from certain taxes for organizations that meet specific criteria.

What information must be reported on tax exempt status please?

Information such as the organization's mission, activities, finances, and governance must be reported on tax exempt status applications.

How can I modify tax exempt status please without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tax exempt status please. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find tax exempt status please?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the tax exempt status please. Open it immediately and start altering it with sophisticated capabilities.

How do I execute tax exempt status please online?

pdfFiller makes it easy to finish and sign tax exempt status please online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Fill out your tax exempt status please online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exempt Status Please is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.