Get the free TAX Invoice Receipt FORM

Show details

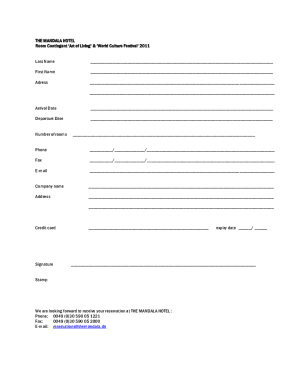

TAX INVOICE/RECEIPT FORM AUSTRALIAN INSTITUTE OF OFFICE PROFESSIONALS Suite 8, 336 Churchill Avenue, SUBRACE 6008 (telephone 6222 8516) ABN 68 004 992 527/006 WA Division, ATOP Email: Can't live with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax invoice receipt form

Edit your tax invoice receipt form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax invoice receipt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax invoice receipt form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax invoice receipt form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax invoice receipt form

How to fill out tax invoice receipt form:

01

Start by filling out your personal information: Provide your full name, contact information, and any tax identification numbers required by your country or state.

02

Include the recipient's information: Write the name, address, and contact details of the person or organization receiving the invoice.

03

Enter the invoice details: Include a unique invoice number, the date of the invoice, and the payment due date. Also, mention details about the goods or services provided, such as a description, quantity, unit price, and any applicable taxes.

04

Calculate the total amount: Add up the costs from all line items, including any applicable taxes or discounts. Clearly state the total amount due on the invoice.

05

Provide payment instructions: Specify the payment methods accepted (such as cash, check, bank transfer, or online payment) and include any necessary information or account details.

06

Include any additional terms or notes: If there are any specific terms or conditions regarding payment, delivery, or other matters related to the invoice, make sure to include them clearly.

07

Review and proofread: Double-check all the information entered on the tax invoice receipt form to ensure accuracy and avoid any potential errors or confusion.

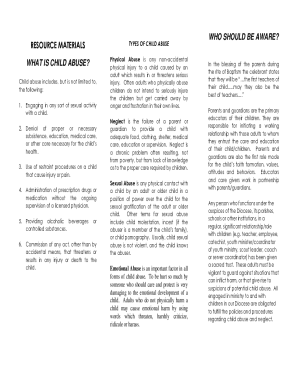

Who needs tax invoice receipt form:

01

Individuals who are self-employed or freelancers: If you provide goods or services as an independent contractor, you may need to issue tax invoice receipts for your clients or customers.

02

Small businesses: Companies that sell products or services to customers, either locally or internationally, often use tax invoice receipts for proper record-keeping and tax purposes.

03

Non-profit organizations: Even non-profit entities may need to issue tax invoice receipts when they receive donations or payments for services rendered.

04

Companies that rely on reimbursement: Businesses that need to be reimbursed for expenses incurred by employees or clients often use tax invoice receipts to document and justify the expenses.

Remember to always consult with a tax professional or local authorities to ensure compliance with specific tax regulations and requirements in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax invoice receipt form?

The tax invoice receipt form is a document used to record sales transactions and provide evidence of the taxes paid on those transactions.

Who is required to file tax invoice receipt form?

Businesses and individuals who make taxable sales are required to file tax invoice receipt form.

How to fill out tax invoice receipt form?

Tax invoice receipt form can be filled out by providing details of the sales transaction including date, amount, taxes paid, and customer information.

What is the purpose of tax invoice receipt form?

The purpose of tax invoice receipt form is to track sales transactions and ensure that the appropriate taxes are paid.

What information must be reported on tax invoice receipt form?

Information such as date of sale, amount sold, taxes paid, customer name, and address must be reported on tax invoice receipt form.

How can I send tax invoice receipt form to be eSigned by others?

To distribute your tax invoice receipt form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the tax invoice receipt form electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out tax invoice receipt form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your tax invoice receipt form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your tax invoice receipt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Invoice Receipt Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.