Get the free US CUSTOMS FORM 3299 - Westmount Moving

Show details

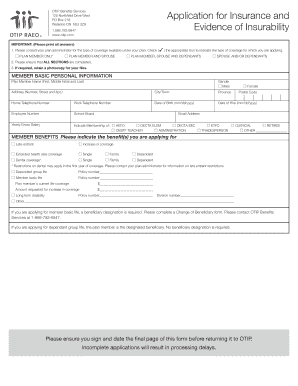

US CUSTOMS FORM 3299 DECLARATION FOR FREE ENTRY OF UNACCOMPANIED ARTICLES INSTRUCTIONS PART I 1. Property Owner's Name Last name, First Name, Middle Name 2. Property Owner's Date of Birth 3. Property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us customs form 3299

Edit your us customs form 3299 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us customs form 3299 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us customs form 3299 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit us customs form 3299. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us customs form 3299

How to fill out US Customs Form 3299?

01

Start by downloading the US Customs Form 3299 from the official website of US Customs and Border Protection (CBP).

02

Fill in the top section of the form with your personal details, such as your name, address, and contact information. Make sure to provide accurate and up-to-date information.

03

Next, provide information about the items you are bringing into the country. This includes the descriptions, quantities, and estimated values of each item. Be as specific as possible to avoid any confusion during the customs process.

04

If you are a non-U.S. resident, you must provide your passport number and the date it was issued. U.S. residents, on the other hand, need to provide their Social Security Number (SSN).

05

Indicate the country where the items were produced or manufactured. This information helps Customs officials determine the origin and value of the goods.

06

Answer the questions about your eligibility for duty-free entry or duty exemptions. This includes questions about your residency status, length of time you have been abroad, and whether the items are gifts or purchases.

07

If applicable, provide information related to any duty-free sales made onboard a vessel or aircraft. This is commonly used for purchases made on international flights or cruises.

08

Sign and date the form. By signing, you certify that the information provided is true and correct to the best of your knowledge.

Who needs US Customs Form 3299?

01

Individuals traveling to the United States with personal articles acquired abroad need to complete US Customs Form 3299. This form is required for declaring possessions being brought into the country.

02

It is important to note that US citizens, as well as non-US residents, may need to fill out Form 3299 depending on the items they are bringing into the country. Whether you are a returning resident, a visitor, or a non-resident, it is essential to comply with the customs regulations and fill out the form as required.

03

US Customs Form 3299 is particularly important when you have valuable or expensive items that may require additional documentation or payment of duties. It helps Customs officials assess any potential duties, taxes, or restrictions associated with the items you are importing.

Remember, it is crucial to familiarize yourself with the specific customs regulations and requirements of the country you are entering. Ensure you provide accurate and detailed information on US Customs Form 3299 to expedite the customs process and comply with the applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my us customs form 3299 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your us customs form 3299 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete us customs form 3299 online?

pdfFiller has made it simple to fill out and eSign us customs form 3299. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in us customs form 3299?

With pdfFiller, the editing process is straightforward. Open your us customs form 3299 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is us customs form 3299?

US Customs Form 3299 is a declaration form used for listing items being imported into the United States.

Who is required to file us customs form 3299?

Any individual or business importing items into the United States is required to file US Customs Form 3299.

How to fill out us customs form 3299?

US Customs Form 3299 can be filled out by providing detailed information about the imported items such as their description, quantity, and value.

What is the purpose of us customs form 3299?

The purpose of US Customs Form 3299 is to provide a declaration of the items being imported into the United States for customs clearance.

What information must be reported on us customs form 3299?

Information such as item description, quantity, value, country of origin, and importer details must be reported on US Customs Form 3299.

Fill out your us customs form 3299 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Customs Form 3299 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.