Get the free VETERANS INCOME VERIFICATION

Show details

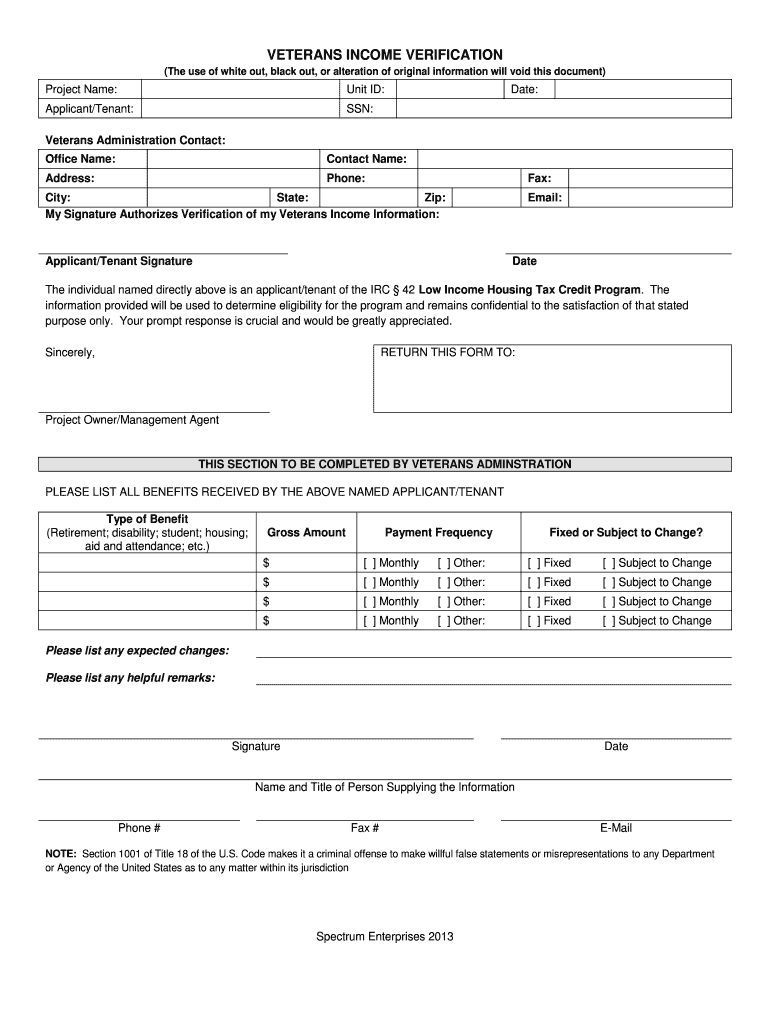

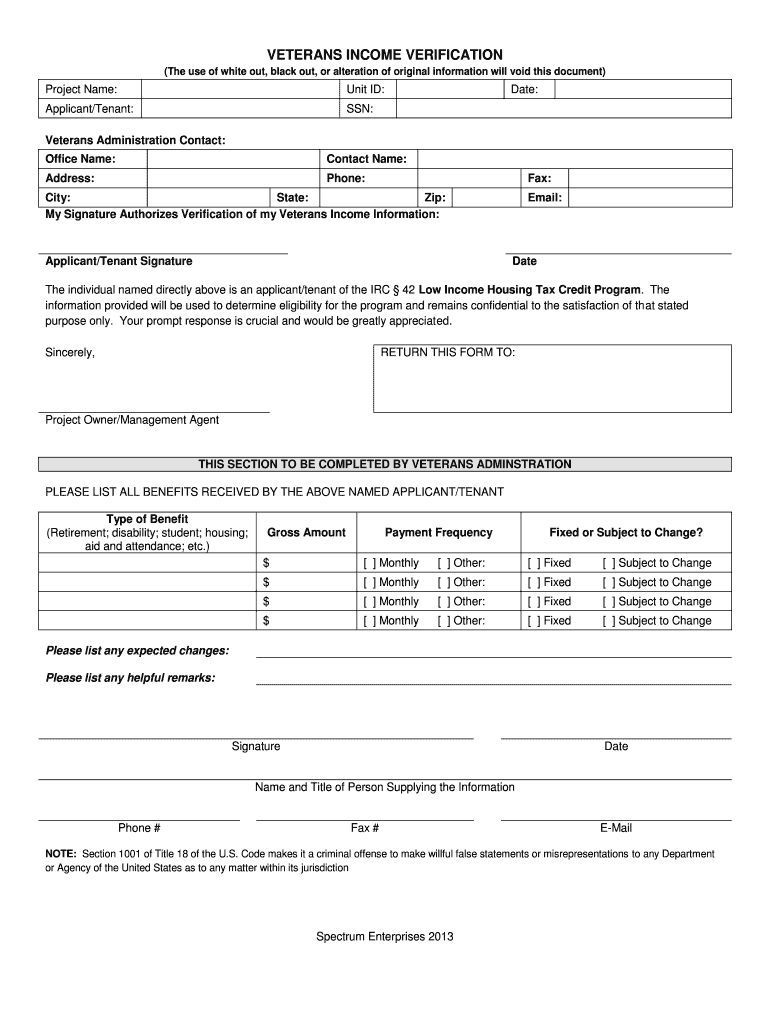

This document is used to verify the income of veterans applying for the IRC § 42 Low Income Housing Tax Credit Program.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign veterans income verification

Edit your veterans income verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your veterans income verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit veterans income verification online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit veterans income verification. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out veterans income verification

How to fill out VETERANS INCOME VERIFICATION

01

Obtain the VETERANS INCOME VERIFICATION form from the appropriate veterans administration office or download it from their website.

02

Fill in your personal information, including your name, address, and veteran identification number.

03

Provide details about your income sources, including employment, pensions, and benefits.

04

List the amounts received for each income source in the designated sections.

05

Review the form for accuracy and ensure all required fields are completed.

06

Sign and date the form to certify that the information provided is true to the best of your knowledge.

07

Submit the completed form to the designated veterans administration office either by mail or electronically, if available.

Who needs VETERANS INCOME VERIFICATION?

01

Veterans who are applying for financial assistance or benefits.

02

Veterans seeking to verify their income for housing or healthcare programs.

03

Surviving spouses of veterans who are applying for benefits based on the veteran's income.

04

Veterans who need to provide proof of income for legal or financial reasons.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum income to qualify for VA benefits?

In 2021, the VA National Income Thresholds were as follows: $34,616 or less if you have no dependents. $41,539 or less if you have one dependent. $43,921 or less if you have two dependents.

What is 40% VA disability?

One of the primary benefits associated with a 40% VA disability rating is monthly compensation. This is a tax-free payment designed to help offset the financial burden of your disability. The exact amount of compensation will depend on your single or married status, as well as any additional dependents you may have.

Is VA disability considered income?

Tax benefits as a Veteran: Disability benefits received from VA should not be counted as part of a Veteran's gross income. Payments from compensation, pension, Veteran Readiness & Employment (VR&E), and education — including the G.I. Bill — are exempt from taxation.

What is the maximum VA benefit?

The max VA disability payment for most disabled veterans occurs with a 100 percent VA rating. In 2024, that amounts to a minimum of $3,737.85 for a veteran alone and can exceed $4,000 per month with dependents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VETERANS INCOME VERIFICATION?

Veterans Income Verification is a process used by the Department of Veterans Affairs to confirm the income and financial information of veterans and their families for benefit eligibility.

Who is required to file VETERANS INCOME VERIFICATION?

Veterans who receive certain benefits, such as pension or other needs-based benefits, may be required to file the Veterans Income Verification.

How to fill out VETERANS INCOME VERIFICATION?

To fill out the Veterans Income Verification form, individuals must provide accurate details regarding their income, including wages, pensions, and any other sources of income, along with supporting documentation.

What is the purpose of VETERANS INCOME VERIFICATION?

The purpose of Veterans Income Verification is to ensure that benefits are awarded based on accurate and updated financial information, preventing fraud and ensuring that veterans receive the correct level of assistance.

What information must be reported on VETERANS INCOME VERIFICATION?

Individuals must report all sources of income, including employment income, pensions, Social Security benefits, and any other financial resources, as well as household expenses and assets.

Fill out your veterans income verification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Veterans Income Verification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.