Get the free self employment affidavit

Show details

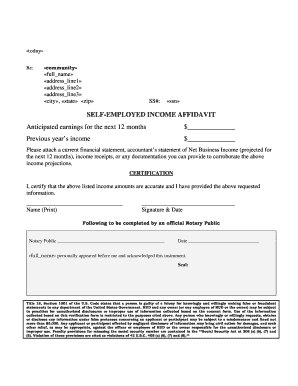

REEMPLOYMENT INCOME AFFIDAVIT The LIH TC program requires documentation regarding self-employment income. Your NET INCOME (Gross income minus expenses) must be identified. You must be able to provide

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self employment affidavit

Edit your self employment affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employment affidavit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit self employment affidavit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self employment affidavit

How to fill out self employment affidavit:

01

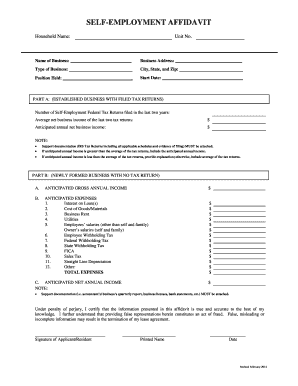

Gather all necessary information and documents related to your self-employment, such as income records, business expenses, and tax returns.

02

carefully review the self-employment affidavit form provided by the relevant authority or organization. Make sure you understand all the sections and requirements.

03

Start by filling in your personal information, including your name, contact details, and social security number or tax identification number.

04

Provide a detailed description of your self-employment activities, including the nature of your business, services offered, and any relevant licenses or certifications.

05

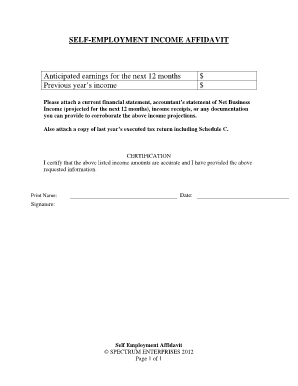

Indicate your gross income from self-employment during the specified period. Be accurate and include any additional sources of income related to your business.

06

Deduct business expenses from your gross income to determine your net income. Include all eligible expenses, such as supplies, equipment, advertising, and travel expenses.

07

If applicable, provide information about any employees you have or subcontractors you've hired. Include their names, social security numbers, and the nature of their role or services.

08

Sign and date the affidavit, affirming that the information provided is true and accurate to the best of your knowledge.

Who needs self employment affidavit:

01

Individuals who are self-employed or have income from freelance work, consulting, or other independent business activities.

02

Contractors or subcontractors who provide services to clients or companies on a non-employee basis.

03

Self-employed professionals such as doctors, lawyers, accountants, or artists who earn income directly from their services.

04

Those who receive income from rental properties or other entrepreneurial ventures outside of traditional employment.

Fill

form

: Try Risk Free

People Also Ask about

What is a self-employment statement?

A self-employment declaration letter is a document that discloses information about a person's work status as being self-employed. This letter can be used for various purposes such as obtaining a visa, child custody, applying for a job, applying for a loan, etc.

How can I prove my income without pay stubs?

You Could Show Your Tax Returns Turning in your tax returns is also a great way to prove your income when you do not have pay stubs. In fact, providing a copy of the last two years of tax returns will also show stability with your small business.

What are self-employment documents?

Any accurate, detailed record of your self-employment income and expenses. It can be a spreadsheet, a document from an accounting software program, a handwritten "ledger" book, or anything that records all self-employment income and expenses.

What is required to show my self-employed income?

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

Does a 1099 prove self-employment?

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor.

Do I need receipts for self-employment?

Self-employment expenses For self-employed individuals, it is often helpful to save receipts from every purchase you make that is related to your business and to keep track of all of your utility bills, rent, and mortgage information for consideration at tax time.

What proof do I need for self-employment?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send self employment affidavit for eSignature?

Once your self employment affidavit is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get self employment affidavit?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific self employment affidavit and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit self employment affidavit in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your self employment affidavit, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is self employment affidavit?

A self-employment affidavit is a legal document that confirms an individual's status as a self-employed worker, often used to provide proof of income or employment verification.

Who is required to file self employment affidavit?

Individuals who are self-employed and need to verify their income for various purposes, such as loan applications, rental agreements, or government assistance programs, are typically required to file a self-employment affidavit.

How to fill out self employment affidavit?

To fill out a self-employment affidavit, individuals usually need to provide their personal information, business details, income information, and a declaration of their self-employment status, then sign the document.

What is the purpose of self employment affidavit?

The purpose of a self-employment affidavit is to formally declare an individual's self-employment status and provide proof of income, which may be required for financial transactions or legal matters.

What information must be reported on self employment affidavit?

Typically, a self-employment affidavit must report the individual’s name, business name, type of business, income details, and relevant identification information along with the signer’s declaration.

Fill out your self employment affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Employment Affidavit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.