Get the free savings scheme with a lockin period of 3 years) l HDFC INDEX FUND l HDFC CORE &

Show details

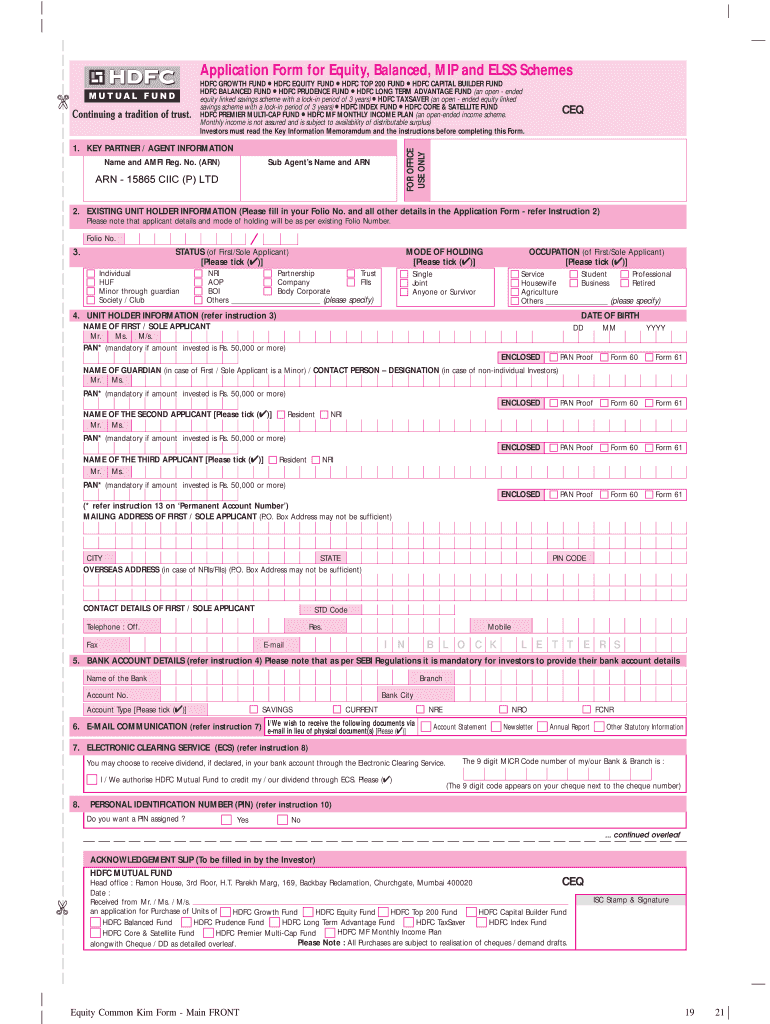

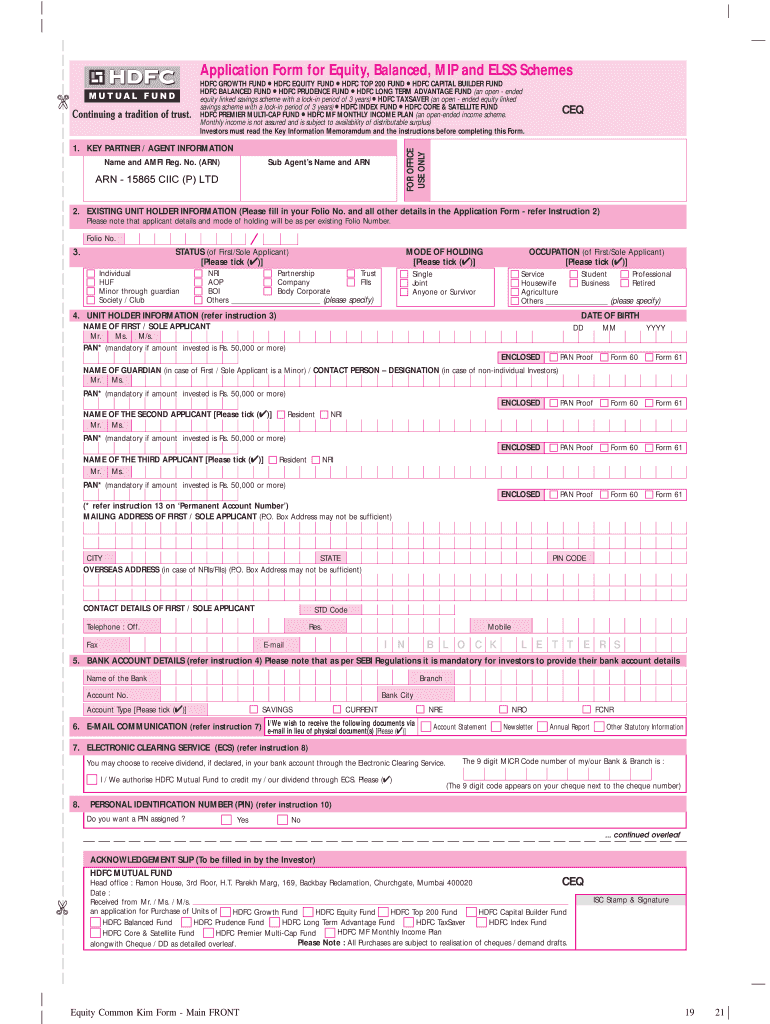

Application Form for Equity, Balanced, MIP and ELSE Schemes. HDFC ... savings scheme with a lock-in period of 3 years) l HDFC INDEX FUND l HDFC CORE ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign savings scheme with a

Edit your savings scheme with a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your savings scheme with a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing savings scheme with a online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit savings scheme with a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out savings scheme with a

How to fill out savings scheme with a:

01

Gather necessary information: Start by collecting all the required information for filling out the savings scheme with a. This may include personal details such as name, address, and contact information, as well as financial information like account numbers and income details.

02

Understand the terms and conditions: Carefully read and familiarize yourself with the terms and conditions of the savings scheme with a. Make sure you understand the rules, regulations, and any potential benefits or limitations associated with the scheme.

03

Choose the appropriate savings scheme: Determine which savings scheme with a best fits your needs and financial goals. Consider factors such as the interest rates, accessibility of funds, and any additional features or benefits provided by the scheme.

04

Fill out the application form: Use the information gathered in step 1 and fill out the application form accurately. Double-check all the details to ensure there are no mistakes or missing information. Be sure to sign and date the form as required.

05

Provide supporting documents: Attach any necessary supporting documents, such as identification proof, income statements, or any other documentation as requested in the application. Ensure that all documents are valid, up-to-date, and meet the requirements specified by the savings scheme provider.

06

Submit the application: Once the form is completed and all supporting documents are ready, submit the application as per the instructions provided by the savings scheme provider. This may be done online, through mail, or in-person at a designated office or branch.

Who needs savings scheme with a:

01

Individuals looking to save money: Anyone who wants to save money for various purposes, such as emergencies, future expenses, or planned goals, can benefit from a savings scheme with a. It provides a structured and disciplined approach to saving.

02

Individuals seeking higher returns: If you want your savings to grow faster than traditional savings accounts, a savings scheme with a can often offer higher interest rates or investment options to help maximize your returns.

03

Those who value financial stability: Saving money creates a financial safety net and helps to build financial stability. A savings scheme with a can be instrumental in achieving this goal, providing a secure platform to save and accumulate funds.

04

Individuals with specific financial goals: Whether it's saving for a down payment on a house, funding a dream vacation, or planning for retirement, a savings scheme with a can be tailored to meet specific financial goals. It allows individuals to systematically save towards achieving their aspirations.

05

Those interested in tax benefits: In some cases, savings schemes with a may offer tax benefits or exemptions on the interest earned or contributions made. If you are looking to save on taxes while growing your savings, exploring such schemes can be advantageous.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify savings scheme with a without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your savings scheme with a into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find savings scheme with a?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the savings scheme with a in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out the savings scheme with a form on my smartphone?

Use the pdfFiller mobile app to complete and sign savings scheme with a on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is savings scheme with a?

A savings scheme with a is a financial plan or program that allows individuals to set aside money for future use.

Who is required to file savings scheme with a?

Individuals who participate in a savings scheme with a are required to file the necessary documentation for tax purposes.

How to fill out savings scheme with a?

To fill out a savings scheme with a, individuals need to provide information about their contributions, withdrawals, and any earnings from the scheme.

What is the purpose of savings scheme with a?

The purpose of a savings scheme with a is to help individuals save and invest for their future financial needs.

What information must be reported on savings scheme with a?

Information such as contributions, withdrawals, earnings, and any taxes paid on the savings scheme must be reported.

Fill out your savings scheme with a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Savings Scheme With A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.