Get the free Corporate Credit Card Policy - imageserv11team-logiccom

Show details

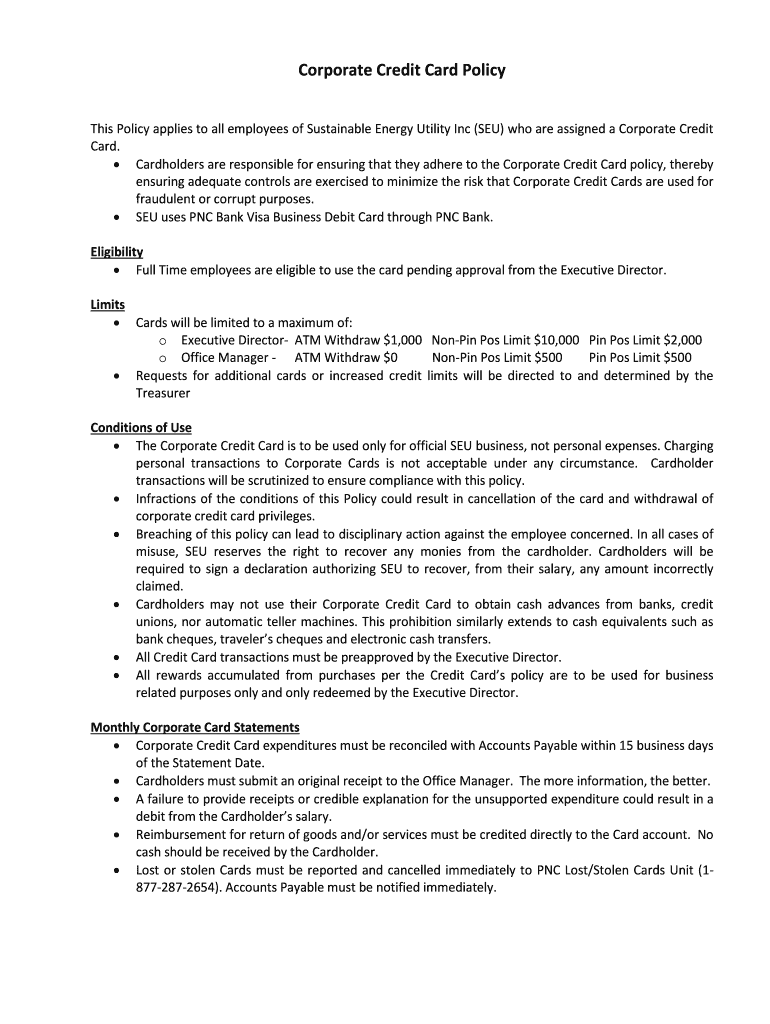

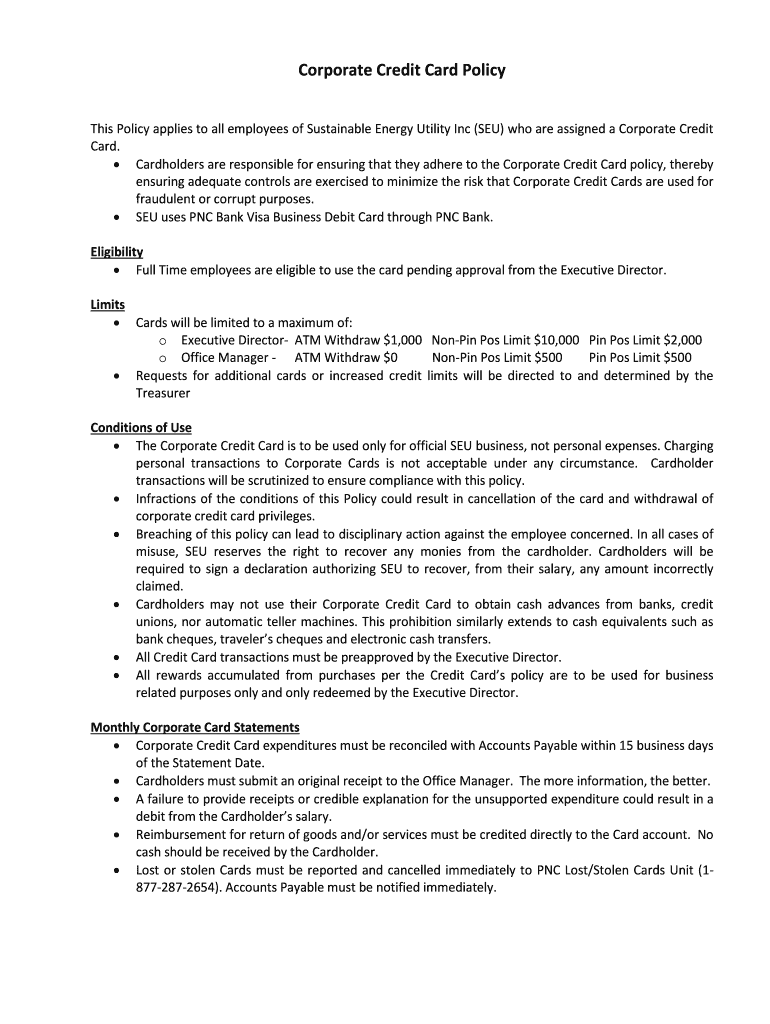

Corporate Credit Card Policy This Policy applies to all employees of Sustainable Energy Utility Inc (SEU) who are assigned a Corporate Credit Card. Cardholders are responsible for ensuring that they

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate credit card policy

Edit your corporate credit card policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate credit card policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate credit card policy online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate credit card policy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate credit card policy

How to fill out corporate credit card policy:

01

Identify the purpose: Determine the objectives and goals of having a corporate credit card policy. This could include controlling expenses, ensuring compliance with financial regulations, and promoting accountability.

02

Define cardholder eligibility: Establish criteria for employees who are eligible to receive a corporate credit card. This may include specific job roles, seniority levels, or other criteria as deemed appropriate for your organization.

03

Determine spending limits: Set clear spending limits for each cardholder based on their role and responsibilities within the organization. This helps prevent misuse and reduces the risk of excessive spending.

04

Establish approval process: Define the workflow for obtaining approval for corporate credit cards. This could involve obtaining authorization from management or a designated department within the organization.

05

Identify allowable expenses: Clearly define what expenses are considered acceptable for corporate credit card usage. This could include travel expenses, client entertainment, or other business-related costs. It is important to explicitly state any prohibited expenses as well.

06

Enforce recordkeeping: Implement a system for cardholders to maintain detailed records of their expenses, including receipts and other supporting documentation. This ensures transparency and facilitates easy tracking and reconciliation of expenses.

07

Monitor and review: Regularly review and assess the effectiveness of the corporate credit card policy. This can help identify any areas for improvement or update the policy to align with changing business needs or industry regulations.

Who needs corporate credit card policy?

01

All companies and organizations that issue corporate credit cards to their employees should have a corporate credit card policy in place.

02

Small businesses and startups may benefit from having a policy since it provides guidelines for managing expenses and mitigating any potential risks associated with credit card usage.

03

Large corporations with a significant number of employees who travel or incur business-related expenses often require a comprehensive corporate credit card policy to ensure consistency and proper management of their financial resources.

04

Non-profit organizations and government agencies could also benefit from implementing a corporate credit card policy to track and manage expenses related to their operations or program activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the corporate credit card policy in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the corporate credit card policy in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your corporate credit card policy and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit corporate credit card policy on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share corporate credit card policy on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is corporate credit card policy?

A corporate credit card policy is a set of guidelines and rules that govern the use of company-issued credit cards by employees.

Who is required to file corporate credit card policy?

The finance department or procurement department is typically responsible for creating and filing the corporate credit card policy.

How to fill out corporate credit card policy?

To fill out a corporate credit card policy, the responsible department should outline the rules for card usage, reporting procedures, and consequences for policy violations.

What is the purpose of corporate credit card policy?

The purpose of a corporate credit card policy is to ensure proper use of company funds, prevent fraud, and provide guidelines for employees on how to use their company-issued credit cards.

What information must be reported on corporate credit card policy?

Corporate credit card policy should include details on card eligibility, spending limits, authorized expenses, reporting requirements, and consequences for non-compliance.

Fill out your corporate credit card policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Credit Card Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.