Get the free SALARY CAPPING

Show details

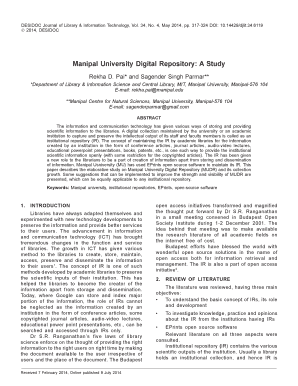

SALARY CAPPING REGULATIONS SALARY CAP YEAR 20132014 PREMIER RUGBY LIMITED 2013/14 Regulations Approved by the PRL Board on 3rd September 2013-Page 1 of 56 Index Clause No. Page No. 1 Definitions and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary capping

Edit your salary capping form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary capping form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary capping online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit salary capping. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

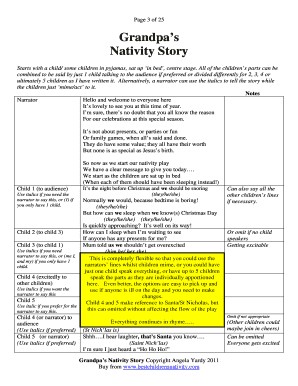

How to fill out salary capping

How to fill out salary capping:

01

Determine the objectives: The first step in filling out salary capping is to clearly define the objectives of implementing this process. Whether it is to control costs, promote fairness, or ensure financial stability, knowing the purpose will guide the decision-making process.

02

Define the salary cap limit: Next, establish the maximum limit for salaries. This can be based on various factors like industry standards, budget constraints, or market conditions. It is important to set a realistic and feasible limit that aligns with the organization's goals.

03

Identify eligible earnings and benefits: Determine which components of employees' compensation will be included in the salary cap calculation. This may include regular earnings, bonuses, commissions, allowances, or any other forms of remuneration. It is crucial to have a clear and comprehensive definition to avoid ambiguity.

04

Calculate exemptions: Consider any exceptional circumstances or special considerations that might exempt certain employees or categories from the salary cap limit. This could be based on performance, qualifications, or other relevant factors. Make sure to establish a fair and transparent exemption process to maintain employee morale and motivation.

05

Document and track: Implement a robust documentation and tracking system to monitor and record salary cap compliance. This can involve maintaining a central database, regularly updating employee records, and conducting periodic audits. By keeping thorough records, it becomes easier to identify and address any discrepancies or non-compliance issues.

06

Communicate and educate: Properly communicate the salary capping policies and procedures to all employees to ensure their understanding and cooperation. Conduct training sessions or workshops to educate staff on the importance of salary capping, its benefits, and how it aligns with the organization's objectives. Encourage open dialogue for employees to seek clarifications or raise concerns.

Who needs salary capping:

01

Organizations with budget constraints: Salary capping is often implemented by organizations that have limited financial resources. By setting a cap on salaries, they can effectively control costs and allocate resources more efficiently.

02

Sports leagues: Many professional sports leagues utilize salary capping to maintain a competitive balance among teams. It prevents wealthy teams from dominating the talent pool by imposing a maximum limit on player salaries, ensuring fair competition.

03

Government entities: Government bodies may implement salary capping to promote income equality, prevent excessive executive compensation, or ensure fiscal responsibility in public spending. This helps in creating a more equitable and transparent system.

04

Non-profit organizations: Non-profits often have limited funds and rely heavily on donations and grants. Salary capping allows them to manage their resources prudently and ensure that a significant portion of their funds go towards achieving their missions rather than excessive compensation.

05

Companies seeking fairness and transparency: Some organizations implement salary capping to foster fairness and transparency in compensation practices. By defining a maximum limit, they aim to reduce wage gaps and promote equality among employees.

In summary, filling out salary capping involves defining objectives, establishing a limit, identifying eligible earnings, calculating exemptions, documenting and tracking, and communicating with employees. While organizations with budget constraints, sports leagues, government entities, non-profit organizations, and those seeking fairness and transparency may find salary capping beneficial.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in salary capping?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your salary capping to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit salary capping on an Android device?

You can make any changes to PDF files, like salary capping, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete salary capping on an Android device?

Use the pdfFiller Android app to finish your salary capping and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is salary capping?

Salary capping is a limit set on the amount of salary that can be paid to employees within an organization.

Who is required to file salary capping?

Employers are required to file salary capping for their employees.

How to fill out salary capping?

Salary capping can be filled out by providing detailed information about the salaries of employees in a specified format.

What is the purpose of salary capping?

The purpose of salary capping is to ensure fairness and transparency in compensation practices within an organization.

What information must be reported on salary capping?

Information such as employee names, job titles, and salary amounts must be reported on salary capping.

Fill out your salary capping online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Capping is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.