Get the free GSE HARP Eligible Refinance bFormb

Show details

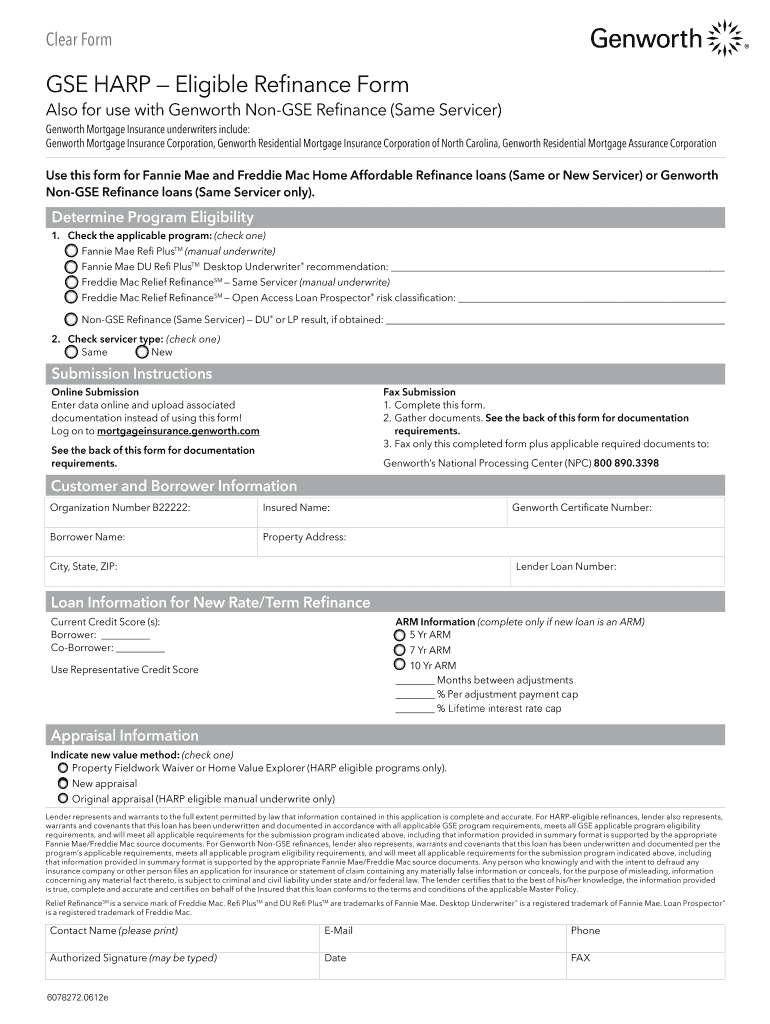

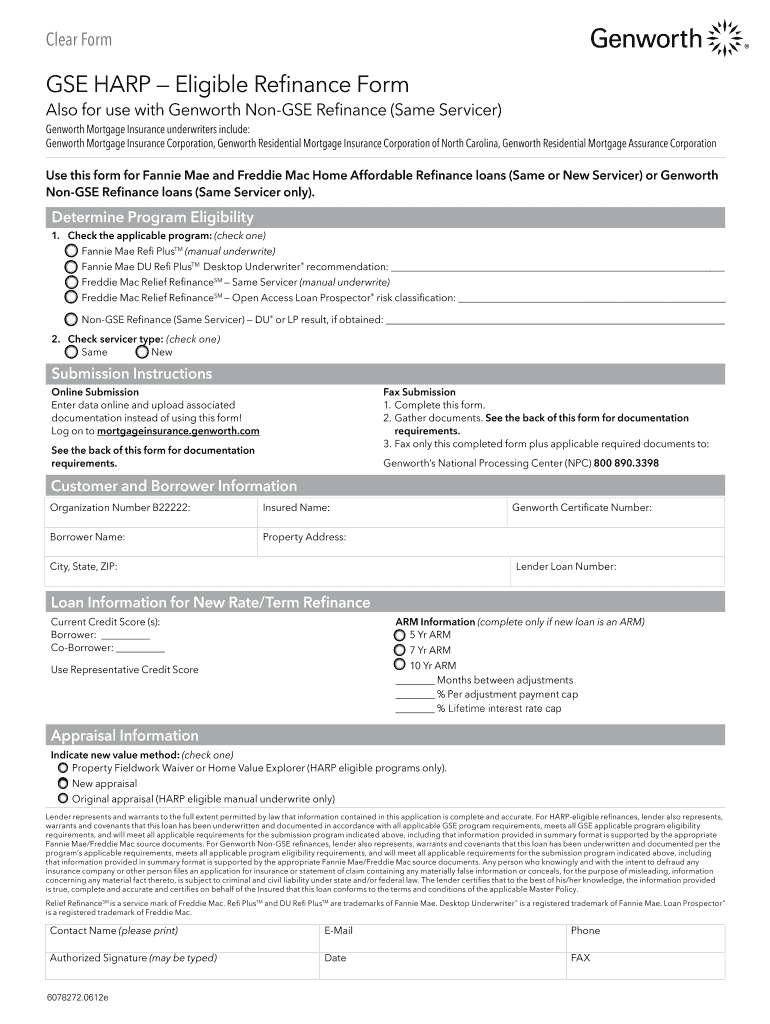

Clear Form GSE HARP Eligible Refinance Form Also for use with Gen worth Songs Refinance (Same Service) Gen worth Mortgage Insurance underwriters include: Gen worth Mortgage Insurance Corporation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gse harp eligible refinance

Edit your gse harp eligible refinance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gse harp eligible refinance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gse harp eligible refinance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gse harp eligible refinance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gse harp eligible refinance

How to fill out GSE HARP eligible refinance:

01

Gather necessary documents: Before starting the application process, collect all the required documents such as personal identification, income documentation, bank statements, and mortgage statements.

02

Check eligibility: Ensure that you meet the eligibility criteria for the GSE HARP (Home Affordable Refinance Program), which includes having a mortgage backed by Fannie Mae or Freddie Mac, being current on your mortgage payments, and having a loan-to-value ratio greater than 80%.

03

Contact your lender: Reach out to your current mortgage lender and inquire about their participation in the HARP program. If they do participate, request an application form and any additional instructions.

04

Fill out the application: Complete the application form accurately, providing all the required information about your mortgage, income, expenses, and personal details. Double-check for any errors or missing information before submitting.

05

Provide supporting documentation: Attach the necessary documents supporting your application, such as income verification, bank statements, and mortgage statements. Make sure the documents are current and valid.

06

Submit the application: Send the completed application form and supporting documents to your lender according to their submission guidelines, whether it be through mail, email, or an online portal. Keep a copy of everything for your records.

07

Await lender review: Once the lender receives your application, they will review it for completeness and accuracy. They may also request additional documentation if needed. Be prepared to promptly respond to any requests to avoid delays.

08

Follow up: If you haven't heard back from your lender within a reasonable time frame, don't hesitate to follow up to ensure your application is progressing. Stay in touch with your lender and address any concerns or questions they may have regarding your application.

Who needs GSE HARP eligible refinance:

01

Homeowners with Fannie Mae or Freddie Mac backed mortgages: The GSE HARP eligible refinance is specifically designed for individuals whose mortgages are backed by Fannie Mae or Freddie Mac. If you have a mortgage from one of these government-sponsored enterprises, you may be eligible.

02

Homeowners with high loan-to-value ratio: The GSE HARP program particularly targets homeowners who have a loan-to-value ratio greater than 80%. This means that the amount of their outstanding mortgage balance exceeds 80% of the current value of their home.

03

Homeowners seeking more affordable mortgage terms: If you want to refinance your existing mortgage to obtain better loan terms, such as a lower interest rate, reduced monthly payments, or a shorter loan term, the GSE HARP eligible refinance can be beneficial. It is aimed at helping homeowners make their mortgage payments more affordable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gse harp eligible refinance?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the gse harp eligible refinance. Open it immediately and start altering it with sophisticated capabilities.

How do I edit gse harp eligible refinance online?

The editing procedure is simple with pdfFiller. Open your gse harp eligible refinance in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the gse harp eligible refinance electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your gse harp eligible refinance in seconds.

What is gse harp eligible refinance?

GSE HARP eligible refinance refers to refinancing options available under the Home Affordable Refinance Program (HARP) that are backed by Government-Sponsored Enterprises (GSEs) like Fannie Mae or Freddie Mac.

Who is required to file gse harp eligible refinance?

Homeowners who are looking to refinance their mortgages and meet the eligibility requirements set forth by GSEs like Fannie Mae or Freddie Mac are required to file for GSE HARP eligible refinance.

How to fill out gse harp eligible refinance?

To fill out GSE HARP eligible refinance, homeowners should contact their lenders or mortgage servicers that participate in the HARP program. They will guide the homeowners through the application and documentation process.

What is the purpose of gse harp eligible refinance?

The purpose of GSE HARP eligible refinance is to help homeowners who are underwater on their mortgages or have little equity in their homes to refinance at lower interest rates and more favorable terms.

What information must be reported on gse harp eligible refinance?

Information such as income, employment status, credit score, current mortgage details, and property value must be reported on GSE HARP eligible refinance applications.

Fill out your gse harp eligible refinance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gse Harp Eligible Refinance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.