Get the free 403b IU Tax Deferred Account TDA Plan - indianaedu

Show details

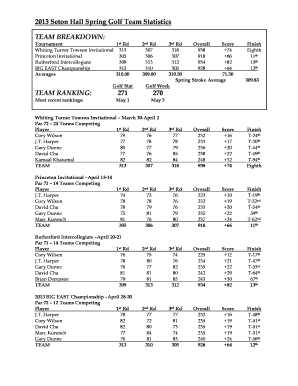

403(b) CHRS 07/10 Tax Deferred Account (TDA) Plan Salary Deferral Agreement Name: Indiana University ID #: Campus Phone #: Department: Campus: Salary Deferral Amount. I request to defer the following

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b iu tax deferred

Edit your 403b iu tax deferred form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b iu tax deferred form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 403b iu tax deferred online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 403b iu tax deferred. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b iu tax deferred

How to fill out 403b IU tax deferred:

01

Gather necessary documents: To fill out a 403b IU tax deferred, you will need to gather important documents such as your Social Security Number, employer information, and financial details.

02

Obtain the 403b IU tax deferred form: Contact your employer or plan administrator to obtain the specific form required to enroll in a 403b tax deferred account. They will provide you with the necessary paperwork or direct you to the appropriate online portal.

03

Complete personal information: Start by filling out your personal information accurately on the form, including your full name, address, phone number, and Social Security Number. Double-check the information for any errors or typos.

04

Provide employment information: Enter your current employer's name, address, and other relevant details as required on the form. If you have multiple employers contributing to your 403b account, you may need to provide information for each employer separately.

05

Choose investment options: Depending on the plan, you may be able to select from a range of investment options for your 403b tax-deferred contributions. Review the available choices and indicate your preferred investment options on the form. If you are unsure which options to choose, consult with a financial advisor for guidance.

06

Decide on contribution amount: Determine the amount you wish to contribute to your 403b IU tax-deferred account. This can be a percentage of your salary or a specific dollar amount per pay period. Bear in mind any maximum contribution limits imposed by the IRS for tax-deferred retirement accounts.

07

Review and sign the form: Carefully review all the information you have provided on the form for accuracy. Once you are confident that everything is correct, sign and date the form as required. Your signature signifies your agreement to the terms and conditions of the 403b IU tax-deferred account.

Who needs 403b IU tax deferred:

01

Employees of certain educational institutions: The 403b IU tax-deferred account is commonly offered to employees of educational institutions such as schools, colleges, and universities. If you work for an eligible educational organization, you may be eligible to participate in a 403b tax-deferred retirement plan.

02

Nonprofit organizations and religious groups: Employees of qualifying nonprofit organizations and religious groups may also have access to 403b tax-deferred accounts. These accounts provide an opportunity to save for retirement on a tax-advantaged basis.

03

Individuals seeking tax advantages for retirement savings: Anyone who wishes to save for retirement in a tax-efficient manner can consider a 403b IU tax-deferred account. Contributions made to a 403b account are typically made on a pre-tax basis, meaning they reduce your taxable income for the year. This can result in immediate tax savings.

Remember, it is always essential to consult with a financial or tax advisor to ensure that a 403b IU tax-deferred retirement account is the right choice for your specific financial situation and retirement goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 403b iu tax deferred directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 403b iu tax deferred along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find 403b iu tax deferred?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 403b iu tax deferred and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete 403b iu tax deferred on an Android device?

On Android, use the pdfFiller mobile app to finish your 403b iu tax deferred. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is 403b iu tax deferred?

403b iu tax deferred is a retirement savings plan for employees of certain non-profit organizations, schools, and government entities that allows them to contribute a portion of their salary to a tax-deferred investment account.

Who is required to file 403b iu tax deferred?

Employees of eligible organizations who wish to save for retirement and take advantage of tax benefits are required to file 403b iu tax deferred.

How to fill out 403b iu tax deferred?

To fill out 403b iu tax deferred, employees need to complete the necessary forms provided by their employer or plan administrator, indicating their desired contribution amount and investment options.

What is the purpose of 403b iu tax deferred?

The purpose of 403b iu tax deferred is to help employees save for retirement by deferring taxes on their contributions and investment gains until they withdraw the funds in retirement.

What information must be reported on 403b iu tax deferred?

Employees must report their contributions, investment gains, and any distributions they receive from their 403b iu tax deferred account on their tax returns.

Fill out your 403b iu tax deferred online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403b Iu Tax Deferred is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.