IRS W-4 2013 free printable template

Show details

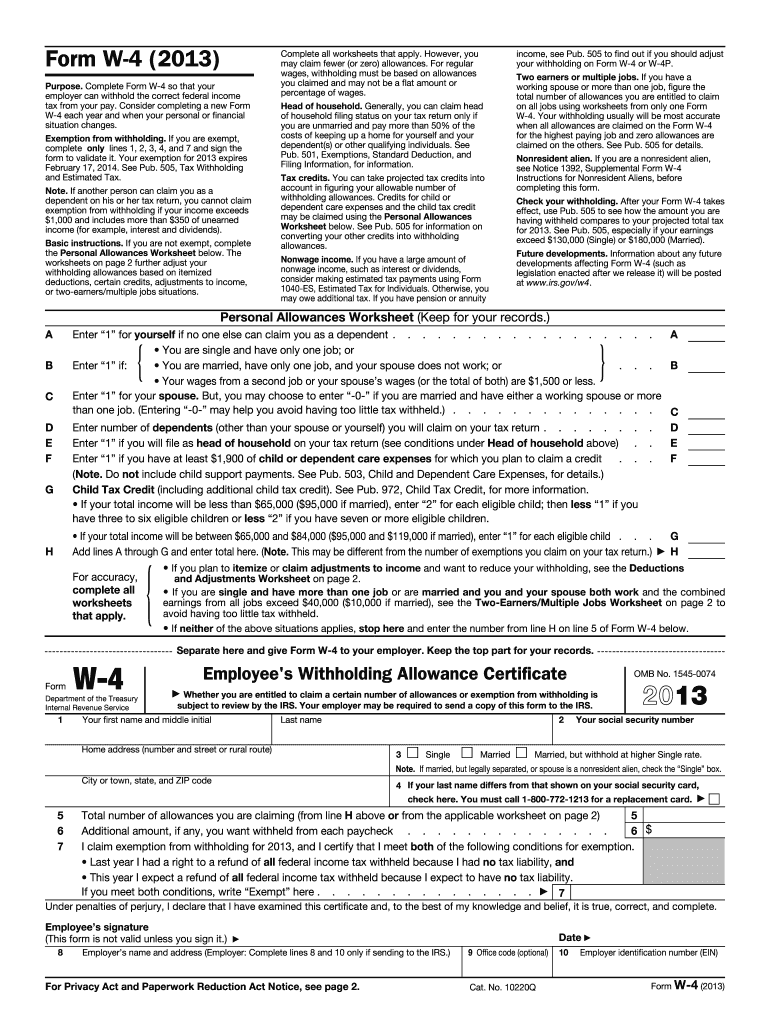

Form W-4 2013 Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. After your Form W-4 takes effect use Pub. 505 to see how the amount you are having withheld compares to your projected total tax for 2013. Consider completing a new Form W-4 each year and when your personal or financial situation changes. Exemption from withholding. If you are exempt complete only lines 1 2 3 4 and 7 and sign the form to validate it. Your exemption for 2013...expires February 17 2014. See Pub. 505 Tax Withholding and Estimated Tax. Note. Divide line 8 by the number of pay periods remaining in 2013. For example divide by 25 if you are paid every two weeks and you complete this form on a date in January when there are 25 pay periods remaining in 2013. Exemption from withholding. If you are exempt complete only lines 1 2 3 4 and 7 and sign the form to validate it. Your exemption for 2013 expires February 17 2014. See Pub. 505 Tax Withholding and...Estimated Tax. Note. If another person can claim you as a dependent on his or her tax return you cannot claim 1 000 and includes more than 350 of unearned income for example interest and dividends. I claim exemption from withholding for 2013 and I certify that I meet both of the following conditions for exemption. Last year I had a right to a refund of all federal income tax withheld because I had no tax liability and This year I expect a refund of all federal income tax withheld because I...expect to have no tax liability. If you meet both conditions write Exempt here. 7 Under penalties of perjury I declare that I have examined this certificate and to the best of my knowledge and belief it is true correct and complete. Employee s signature This form is not valid unless you sign it. Date Employer s name and address Employer Complete lines 8 and 10 only if sending to the IRS. For Privacy Act and Paperwork Reduction Act Notice see page 2. Your exemption for 2013 expires February 17...2014. See Pub. 505 Tax Withholding and Estimated Tax. Note. If another person can claim you as a dependent on his or her tax return you cannot claim 1 000 and includes more than 350 of unearned income for example interest and dividends. Basic instructions. If you are not exempt complete the Personal Allowances Worksheet below. The worksheets on page 2 further adjust your withholding allowances based on itemized deductions certain credits adjustments to income or two-earners/multiple jobs...situations. You must call 1-800-772-1213 for a replacement card. Additional amount if any you want withheld from each paycheck. I claim exemption from withholding for 2013 and I certify that I meet both of the following conditions for exemption. Last year I had a right to a refund of all federal income tax withheld because I had no tax liability and This year I expect a refund of all federal income tax withheld because I expect to have no tax liability. Consider completing a new Form W-4 each...year and when your personal or financial situation changes.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-4

How to edit IRS W-4

How to fill out IRS W-4

Instructions and Help about IRS W-4

How to edit IRS W-4

To edit the IRS W-4, you can use a form editing tool like pdfFiller to ensure your data is correct and up-to-date. Simply upload the W-4 form, make the necessary adjustments to your personal information, and then save the changes. This can be particularly useful if you experience changes in your financial situation or life circumstances.

How to fill out IRS W-4

Filling out the IRS W-4 involves providing personal information and indicating your withholding allowances. Follow these steps to complete the form accurately:

01

Enter your name, Social Security number, and filing status.

02

Indicate the number of allowances you are claiming based on your situation.

03

Complete additional sections if you have multiple jobs, qualify for tax credits, or have other specific adjustments.

Make sure to review the completed form for accuracy before submission. Submitting a correct W-4 helps ensure proper withholding from your paycheck to avoid owing taxes at the end of the year.

About IRS W-4 2013 previous version

What is IRS W-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-4 2013 previous version

What is IRS W-4?

The IRS W-4 form, officially known as the Employee's Withholding Certificate, is a document used by employees to inform their employers of their tax situation. The information provided on the form dictates the amount of federal income tax withheld from an employee's paycheck. This form is crucial for ensuring that the correct amount of tax is withheld throughout the year.

What is the purpose of this form?

The purpose of the IRS W-4 is to guide employers in determining how much income tax to deduct from employees' wages. Correctly completing the W-4 ensures that employees pay the proper amount of federal income tax throughout the year, reducing the chance of a tax bill come filing season.

Who needs the form?

Any employee who wishes to have their federal income tax withheld from their paycheck must fill out the IRS W-4. This includes new hires and current employees seeking to adjust their withholding amounts due to life changes, such as marriage, divorce, or becoming a parent.

When am I exempt from filling out this form?

Employees may be exempt from filing the IRS W-4 if they had no tax liability in the previous year and expect none in the current year. If you meet these criteria, indicate your exempt status on the W-4 to avoid unnecessary withholding.

Components of the form

The IRS W-4 consists of several sections, including personal information, filing status options, and withholding allowances. Each part of the form plays a vital role in determining how much tax your employer will withhold from your paycheck. It is essential to complete all applicable sections to ensure accuracy.

What are the penalties for not issuing the form?

Failing to submit a completed IRS W-4 can result in your employer withholding taxes at the highest rate. This can lead to a significant tax bill when you file your federal tax return if you have been over-withheld throughout the year.

What information do you need when you file the form?

When filing the IRS W-4, you need to provide your name, address, Social Security number, and information regarding your filing status and any additional allowances you are claiming. Accurate information is crucial for ensuring that your tax withholding is correct.

Is the form accompanied by other forms?

The IRS W-4 is typically submitted alone to your employer. However, if you're claiming additional withholding allowances or credits, you may need to provide supplementary documentation or other forms as necessary, depending on your circumstances.

Where do I send the form?

The completed IRS W-4 should be submitted to your employer's payroll department. They will use the information provided to calculate your withholding amounts on your paycheck.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I have used other fillers and this is by far the best. Very user friendly.

yopu need to have someone you can call when there is a problem.

See what our users say