The Hartford HL-17247 2015-2025 free printable template

Show details

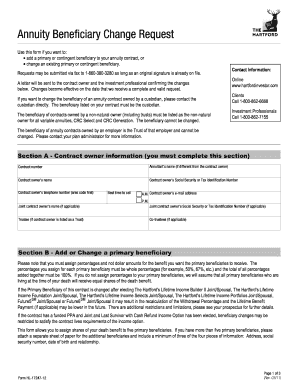

Print Form Reset Form Annuity Beneficiary Change Request Use this form if you want to change your primary or contingent beneficiary designation. remove the existing contingent beneficiary designation. Requests may be submitted via fax to 1-860-380-3280 as long as an original signature is already on file. Changes become effective on the date that we deem the request to be in good order. Your beneficiary change request will not be changed if the annuity is owned by a custodian* Please contact...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign annuity beneficiary change pdf form

Edit your 2015 hartford beneficiary request hl 17247 sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity beneficiary change form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annuity beneficiary change request form online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annuity beneficiary change request form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

The Hartford HL-17247 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hartford 17247 beneficiary form

How to fill out The Hartford HL-17247

01

Obtain the The Hartford HL-17247 form either online or from your insurance representative.

02

Read through the instructions carefully before starting to fill out the form.

03

Fill in your personal information, including your name, address, and contact details in the designated sections.

04

Provide the necessary policy information, such as policy number and type of coverage.

05

Specify the details regarding the claim, including date of occurrence and description of the incident.

06

Attach any required documentation that supports your claim, such as receipts or incident reports.

07

Review the form for accuracy and completeness before submission.

08

Sign and date the form where indicated.

09

Submit the completed form to The Hartford via the specified method (mail, fax, or online).

Who needs The Hartford HL-17247?

01

Individuals or businesses who have an insurance policy with The Hartford and need to file a claim or report an incident.

Fill

hl17247 beneficiary

: Try Risk Free

People Also Ask about annuity beneficiary change fill

Can you change the beneficiary of an annuity?

Only the annuity owner can designate a beneficiary. You can change beneficiaries at any time, as long as the annuity contract doesn't require you to name an irrevocable beneficiary. You can also choose multiple beneficiaries, designating a percentage of the annuity to each person.

How do I fill out a beneficiary change form?

General Instructions Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write “children” on one of the lines; instead write the full names of each of your children on separate lines.

Who can change the beneficiary in an individual annuity?

The owner can change beneficiaries at any time as long as the contract does not require an irrevocable beneficiary to be named. They can also choose multiple beneficiaries and a contingent beneficiary — people designated to receive payments if the primary beneficiary dies before the owner.

What is a beneficiary change form?

Your original designation remains in force whether it still reflects your wishes or not, until you submit another form to cancel prior designations or to designate a new beneficiary. A designation of beneficiary form outlines your desire to have the funds due upon your death paid out in a particular way.

Can an annuity be transferred to another person?

The new owner of the annuity can start receiving payments, change beneficiaries, and cash out the policy whenever they want. To give the annuity away, you simply contact the insurance company and state that you want to gift the ownership of the annuity policy to someone else or a trust.

What is beneficiary change?

You can change the beneficiaries of your life insurance by contacting your insurance company. You'll need to submit a change of beneficiary form online, on paper, or over the phone. The form will ask for personal information about your beneficiary, such as: Contact information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in annuity beneficiary change request print?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your hartford beneficiary change 17247 form get and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in annuity change request hl get without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit hartford beneficiary change form fill and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit hartford beneficiary change form online on an iOS device?

Use the pdfFiller mobile app to create, edit, and share annuity beneficiary change request hl form get from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is The Hartford HL-17247?

The Hartford HL-17247 is a form related to insurance or financial reporting issued by The Hartford Financial Services Group.

Who is required to file The Hartford HL-17247?

Typically, individuals or entities that are policyholders or beneficiaries of certain insurance contracts with The Hartford may be required to file The Hartford HL-17247.

How to fill out The Hartford HL-17247?

To fill out The Hartford HL-17247, individuals should provide the necessary personal and policy information as outlined in the instructions provided with the form, ensuring all required fields are completed accurately.

What is the purpose of The Hartford HL-17247?

The purpose of The Hartford HL-17247 is to collect specific information for compliance, reporting, or claims processing related to insurance policies held with The Hartford.

What information must be reported on The Hartford HL-17247?

The information required on The Hartford HL-17247 includes personal identification details, policy numbers, coverage amounts, and any other relevant data specified in the form's instructions.

Fill out your annuity beneficiary change form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hartford 17247 Form Search is not the form you're looking for?Search for another form here.

Keywords relevant to hl17247 beneficiary make

Related to hl 17247 beneficiary

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.