Get the TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY D...

Show details

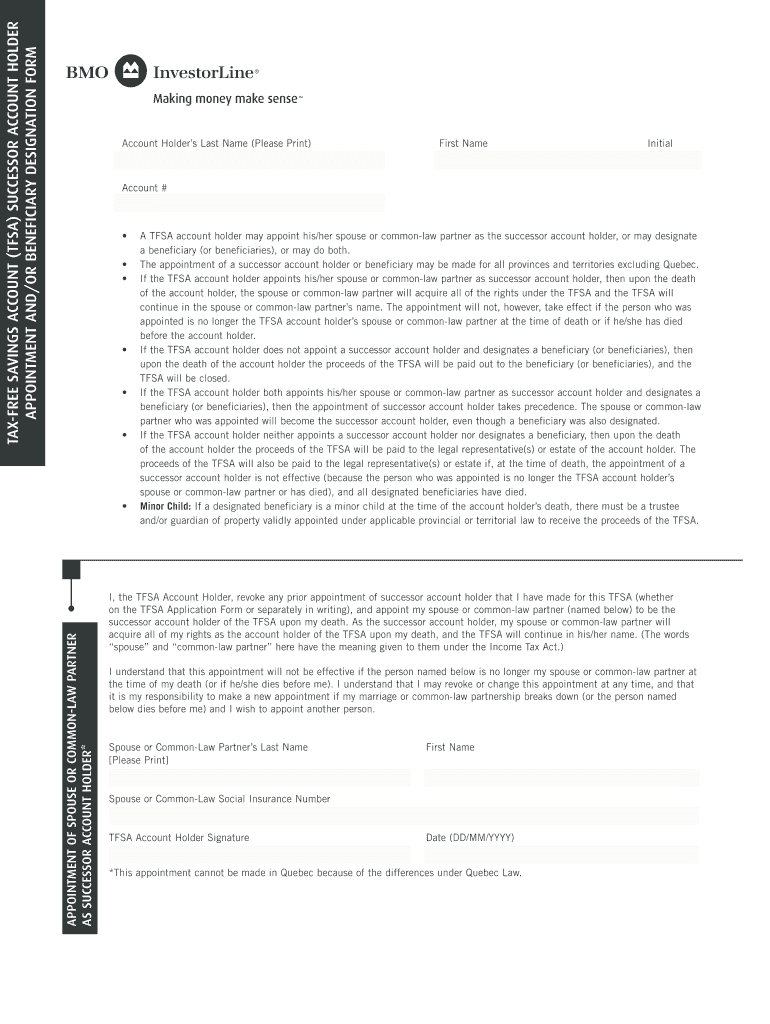

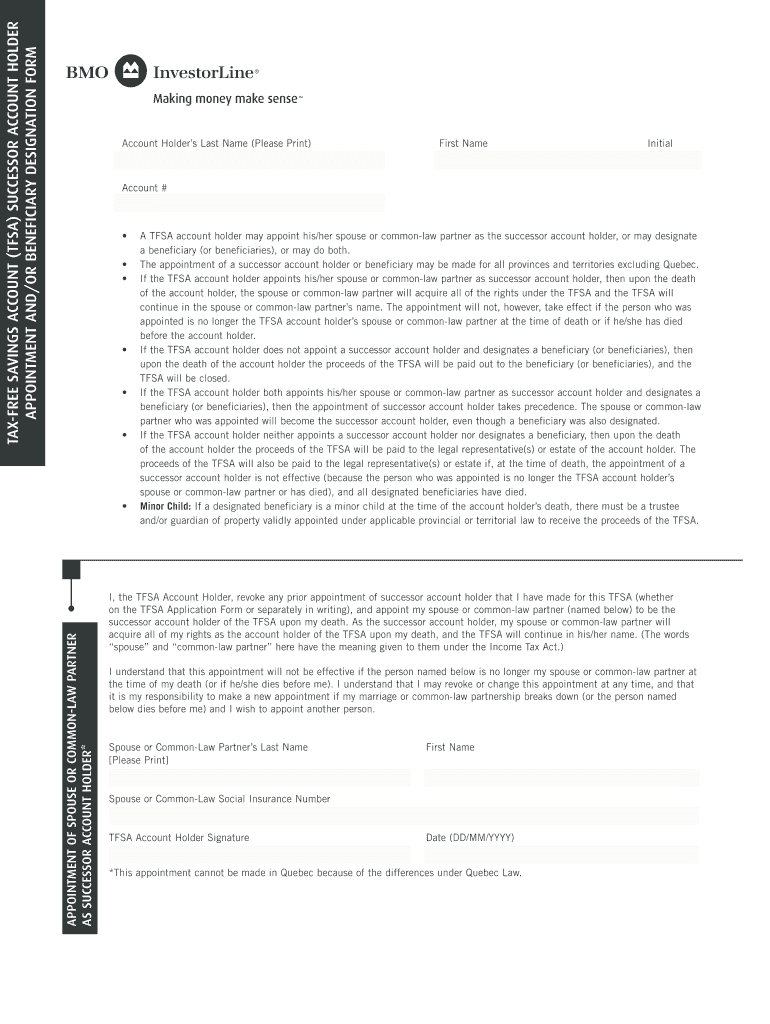

This form allows TFSA account holders to appoint a successor account holder and/or designate beneficiaries to receive the proceeds of their TFSA upon their death.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax- savings account tfsa

Edit your tax- savings account tfsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax- savings account tfsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax- savings account tfsa online

Follow the steps below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax- savings account tfsa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax- savings account tfsa

How to fill out TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM

01

Obtain the TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM from your financial institution or their website.

02

Read the form's instructions carefully to understand what information is required.

03

Fill in your personal information including your name, account number, and contact details.

04

Indicate whether you are designating a successor account holder and/or a beneficiary by checking the appropriate box.

05

Provide the personal information of the successor account holder or beneficiary, including their full name, address, and relationship to you.

06

Sign and date the form to validate your designations.

07

Submit the completed form to your financial institution as per their guidelines.

Who needs TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM?

01

Individuals who have a TFSA and wish to designate a beneficiary or successor account holder to manage their TFSA upon their death.

02

Anyone who wants to ensure their TFSA assets are passed on according to their wishes without going through probate.

03

Account holders who have specific individuals in mind that they want to inherit their TFSA funds.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of beneficiary designation?

For example, if you name your three cousins as your primary beneficiaries, you can name the children of each cousin as alternate primary beneficiaries. Then, if one cousin dies before you do, their share will be divided between their children who are named as alternate primary beneficiaries.

What is the designation of TFSA successor holder and or beneficiary?

A successor holder may only be your spouse or common-law partner. For purposes of this article, any reference to a spouse includes a common-law partner. A beneficiary of a TFSA can be your spouse who you have not named as a successor holder, your children, a third party, or a registered charity.

What form do I need to transfer TFSA to my spouse after death?

Designated beneficiaries To affect this “exempt contribution” they must file form RC240 – Designation of an Exempt Contribution – TFSA within 30 days after the contribution is made. Any income earned between the date of death and the time of transfer is taxable to the surviving spouse.

What happens if a TFSA holder dies?

The TFSA continues to exist and both its value, at the date of the original holder's death, and any income earned after that date continue to be sheltered from tax under the new successor holder.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM?

The TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM is a legal document that allows an individual to designate a successor account holder or beneficiary for their TFSA. This ensures that the assets in the TFSA can be transferred to the designated person upon the account holder's death without incurring tax liabilities.

Who is required to file TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM?

Individuals who have a TFSA and wish to ensure the smooth transfer of their account assets to a designated successor or beneficiary upon their death are required to file this form.

How to fill out TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM?

To fill out the form, individuals must provide their personal information, the information of the designated successor account holder or beneficiary, and any relevant details regarding the TFSA. It is essential to follow the instructions on the form carefully, ensuring that all sections are completed accurately.

What is the purpose of TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM?

The purpose of the form is to allow individuals to specify who will receive the assets in their TFSA upon their death, thereby facilitating the transfer process and avoiding tax implications.

What information must be reported on TAX-FREE SAVINGS ACCOUNT (TFSA) SUCCESSOR ACCOUNT HOLDER APPOINTMENT AND/OR BENEFICIARY DESIGNATION FORM?

The form must report information such as the TFSA account holder's full name, contact information, the relationship to the successor account holder or beneficiary, and any identification details required by the issuing financial institution.

Fill out your tax- savings account tfsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax- Savings Account Tfsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.