Get the free Addendum for Locked-In Pension Transfers

Show details

This document outlines the terms and conditions related to the transfer of Locked-In Pension Assets to specific retirement savings plans as per the Pension Benefits Standards Act in British Columbia.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign addendum for locked-in pension

Edit your addendum for locked-in pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your addendum for locked-in pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit addendum for locked-in pension online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit addendum for locked-in pension. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

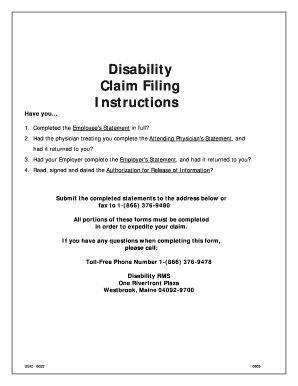

How to fill out addendum for locked-in pension

How to fill out Addendum for Locked-In Pension Transfers

01

Obtain the Addendum form for Locked-In Pension Transfers from your pension plan provider.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information including your name, address, and contact details.

04

Provide details of your locked-in pension plan such as the plan number and the name of the pension plan administrator.

05

Indicate the type of transfer you are requesting (e.g., full transfer, partial transfer).

06

Include any supporting documents required (e.g., proof of identity, previous pension statements).

07

Review the completed form for accuracy and completeness.

08

Sign and date the Addendum to validate your request.

09

Submit the Addendum to your pension plan provider along with any required attachments.

Who needs Addendum for Locked-In Pension Transfers?

01

Individuals who have locked-in pensions and wish to transfer their pensions to another plan or financial institution.

02

Employees changing jobs who want to manage their locked-in pension funds.

03

Retirees seeking to make adjustments to their pension assets.

Fill

form

: Try Risk Free

People Also Ask about

What does "locked in pension" mean?

In a LIRA, your savings will be kept “locked-in,” which means you won't be able to withdraw money until you retire. On one hand, that means you can't access it for expenses like education or housing; on the other, that makes it easier to be sure your money is there when you're ready to turn it into retirement income.

What does it mean to lock in your pension?

A locked-in retirement account (LIRA) can be used to hold money transferred out of an employer-sponsored retirement plan without losing its tax-deferred status. LIRAs are governed by provincial law and may be opened only under certain circumstances.

What does "locked-in pension" mean?

In a LIRA, your savings will be kept “locked-in,” which means you won't be able to withdraw money until you retire. On one hand, that means you can't access it for expenses like education or housing; on the other, that makes it easier to be sure your money is there when you're ready to turn it into retirement income.

What does it mean to lock your retirement account?

Understanding Locked-In Retirement Accounts (LIRAs) Cash withdrawals are not permitted while the funds are locked in, although the account may be unlocked under certain emergency circumstances.

When can you unlock your pension?

You can usually only take money out of a workplace or personal pension once you're 55 or older (rising to 57 from April 2028). You can't start claiming your State Pension before you reach State Pension age. That's 66 right now, rising to 67 and then finally to 68 by 2028.

What is the difference between Lif and LIRA?

LIRAs are used to increase amounts for retirement; it is an instrument that allows savings to grow. LIFs are used to draw a retirement income; it is a savings withdrawal instrument.

What is a reciprocal transfer agreement for pension?

The purpose of a reciprocal transfer is to combine pensionable service that you have in separate pension plans into your current plan to enable you to retire with a higher pension income.

What is the lock in period for pension funds?

As the names suggest, both are geared towards a specific investment goal or 'solution'. Retirement funds have a lock-in period of 5 years or till retirement age, whichever is earlier. Children's funds similarly have a lock-in period of 5 years or until the child reaches age of majority, whichever is earlier.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Addendum for Locked-In Pension Transfers?

The Addendum for Locked-In Pension Transfers is a supplemental document used in the process of transferring locked-in pension funds from one financial institution to another, ensuring compliance with regulatory requirements.

Who is required to file Addendum for Locked-In Pension Transfers?

The Addendum must be filed by the financial institution receiving the locked-in pension transfer and in some cases, the transferring institution may also be required to provide information.

How to fill out Addendum for Locked-In Pension Transfers?

To fill out the Addendum, the completing party must provide accurate information regarding the transferring and receiving pension plans, the amount being transferred, and relevant member details as specified in the form.

What is the purpose of Addendum for Locked-In Pension Transfers?

The purpose of the Addendum is to ensure that all legal requirements are met during the transfer of locked-in pension funds, protecting the rights of the member and ensuring proper handling of their pension assets.

What information must be reported on Addendum for Locked-In Pension Transfers?

The information required includes details such as the plan sponsor's name, member's identification, amounts being transferred, reason for transfer, and any applicable options regarding the member's pension benefits.

Fill out your addendum for locked-in pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Addendum For Locked-In Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.