Get the free TR1 Individual Disclosure 3% Template NEW - media corporate-ir

Show details

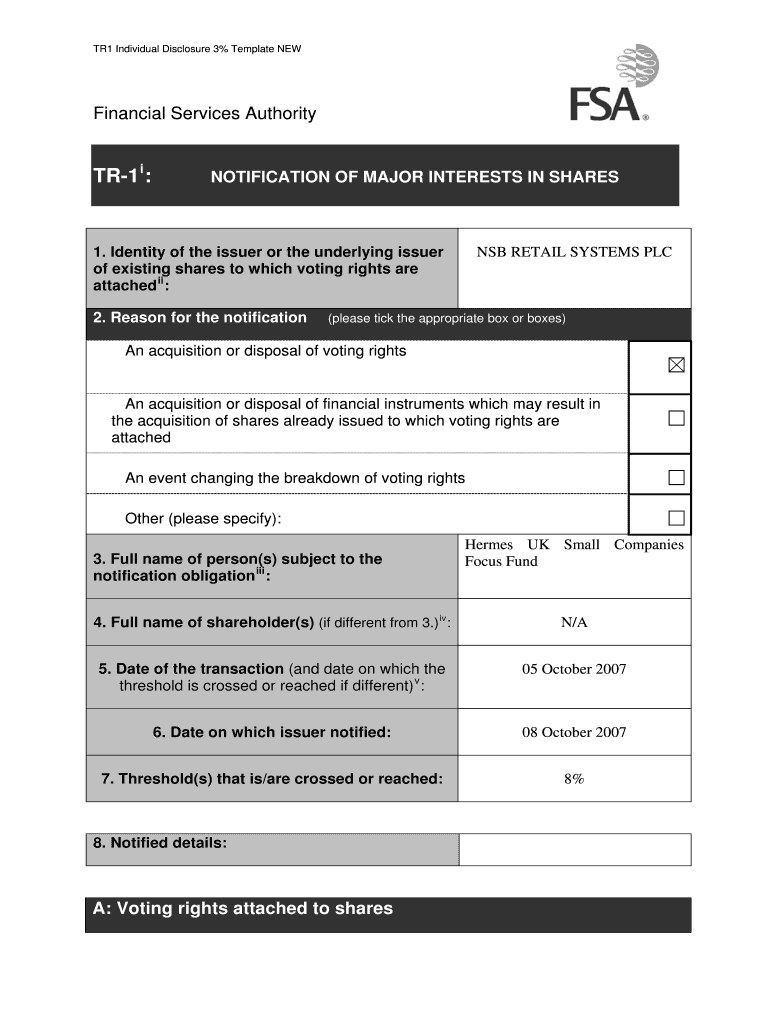

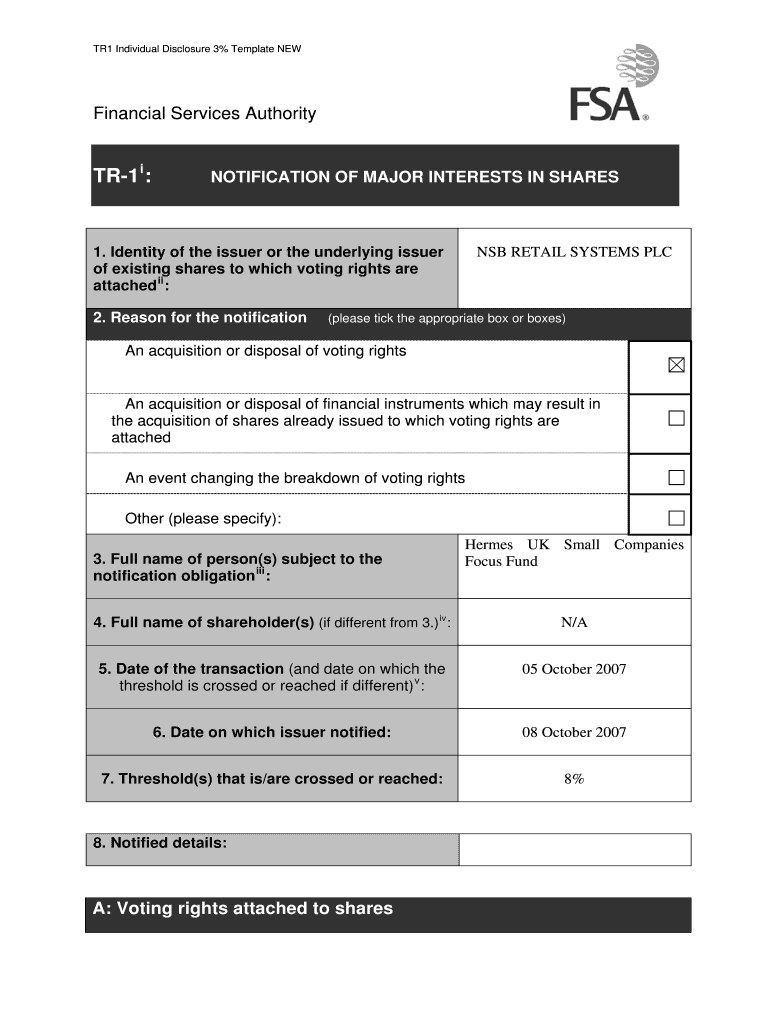

TR1 Individual Disclosure 3% Template NEW Financial Services Authority TR1 i : NOTIFICATION OF MAJOR INTERESTS IN SHARES 1. Identity of the issuer or the underlying issuer of existing shares to which

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tr1 individual disclosure 3

Edit your tr1 individual disclosure 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tr1 individual disclosure 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tr1 individual disclosure 3 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tr1 individual disclosure 3. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tr1 individual disclosure 3

How to fill out TR1 individual disclosure 3:

01

Start by obtaining the TR1 individual disclosure 3 form. This form can typically be found on the official website of the organization or institution requiring it. Make sure you have the latest version of the form.

02

Begin by carefully reviewing the instructions provided with the TR1 individual disclosure 3 form. Familiarize yourself with the purpose of the form and the information that needs to be disclosed.

03

Fill in your personal details accurately. This may include your name, address, date of birth, social security number, and other relevant identifying information. Ensure that all the information is entered correctly to avoid any issues or delays.

04

Provide the required information regarding your financial situation. This may include details about your income, assets, liabilities, and other financial resources. Be honest and precise when providing this information as it may be subject to verification.

05

Pay attention to any specific sections or questions that need to be addressed. Some forms may have additional sections for disclosing specific information, such as criminal history or previous bankruptcies. Ensure that you carefully read and understand these sections before completing them.

06

Attach any supporting documents that are required. This may include bank statements, tax returns, pay stubs, or any other relevant documents that validate the information provided on the form. Ensure that you make copies of these documents for your own records.

07

Double-check all the information you have entered before submitting the form. Make sure there are no errors or missing information that could lead to delays or complications in the processing of your application.

08

Sign and date the form as required. Some forms may require a witness or notary public to verify your signature. Follow the instructions provided to ensure the form is properly executed.

09

Keep a copy of the completed form and any attached documents for your records. It is always recommended to have a copy of all submitted documents for future reference or in case there are any queries or concerns.

10

Submit the completed TR1 individual disclosure 3 form as instructed. This may include mailing it to the appropriate address or submitting it online through a secure portal. Follow the specified submission method to ensure your form is received and processed efficiently.

Who needs TR1 individual disclosure 3:

01

Individuals who are required to disclose their financial information to a specific organization or institution.

02

Those who are applying for certain types of loans, grants, scholarships, or financial aid.

03

Individuals who are involved in legal proceedings where financial disclosure is necessary, such as divorce or bankruptcy cases.

04

People who are applying for government assistance programs that require detailed financial information.

05

Students or parents applying for student financial aid or scholarships from educational institutions.

06

Individuals who are part of a business partnership or have invested in a company where disclosure of financial information is necessary.

07

Any person who is required to disclose their financial information as part of a regulatory or compliance requirement.

08

Those who are applying for certain licenses or permits that require financial disclosure.

09

Individuals who are involved in specific types of agreements, contracts, or transactions where financial transparency is required.

10

Anyone who is unsure about whether they need to submit TR1 individual disclosure 3 should consult the specific guidelines and requirements provided by the organization or institution that is requesting the form. It is always best to seek clarification to ensure compliance with the necessary regulations or procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tr1 individual disclosure 3 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tr1 individual disclosure 3. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute tr1 individual disclosure 3 online?

pdfFiller has made filling out and eSigning tr1 individual disclosure 3 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete tr1 individual disclosure 3 on an Android device?

On Android, use the pdfFiller mobile app to finish your tr1 individual disclosure 3. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is tr1 individual disclosure 3?

Tr1 individual disclosure 3 is a document that discloses personal financial information of an individual.

Who is required to file tr1 individual disclosure 3?

Certain individuals holding specific positions are required to file tr1 individual disclosure 3.

How to fill out tr1 individual disclosure 3?

Tr1 individual disclosure 3 must be filled out following the guidelines provided by the relevant authority.

What is the purpose of tr1 individual disclosure 3?

The purpose of tr1 individual disclosure 3 is to promote transparency and prevent conflicts of interest.

What information must be reported on tr1 individual disclosure 3?

Tr1 individual disclosure 3 requires reporting of financial assets, liabilities, and other relevant financial information.

Fill out your tr1 individual disclosure 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

tr1 Individual Disclosure 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.