Get the free affidavit to collect compensation of deceased

Show details

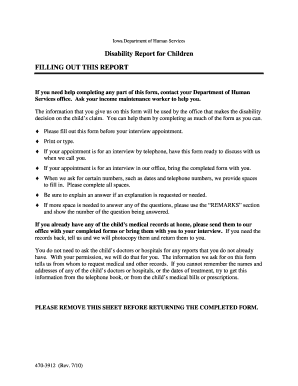

AFFIDAVIT TO COLLECT COMPENSATION OF DECEASED UP TO 5 000 NET The surviving spouse registered domestic partner guardian or conservator of the estate must complete this form. Under California Probate Code 13601 a to collect salary or other compensation of a deceased spouse or registered domestic partner Decedent the surviving spouse registered partner guardian or conservator of the estate must complete this Affidavit under penalty of perjury under the laws of California. I name do hereby...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign affidavit to collect compensation

Edit your affidavit to collect compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit to collect compensation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit to collect compensation online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit affidavit to collect compensation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out affidavit to collect compensation

How to fill out deceased employee compensation collection:

01

Obtain the necessary forms from the appropriate government agency or employer. These forms typically include a death certificate, proof of relationship to the deceased, and any other relevant documents.

02

Complete the forms accurately and provide all requested information. This may include personal details of the deceased, such as their name, social security number, and date of death.

03

Attach any supporting documentation required, such as medical records or evidence of the deceased's employment and salary history.

04

Submit the completed forms and supporting documents to the relevant government agency or employer. Ensure that you follow any specified submission procedures or deadlines.

Who needs deceased employee compensation collection:

01

The surviving family members of a deceased employee may need to file for compensation. This could include spouses, children, or other dependents who were financially dependent on the deceased.

02

Employers may also be required to handle the deceased employee's compensation collection process. They may need to complete certain forms or provide documentation to ensure that the family receives the appropriate benefits.

03

Government agencies responsible for administering compensation programs may require the completion of the deceased employee compensation collection forms in order to process the claim and distribute benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is sf1153?

Standard Form 1153.

How do you handle a W-2 for a deceased employee?

If you made the payment after the employee's death but in the same year the employee died, you must withhold Social Security and Medicare taxes on the payment and report the payment on the employee's W-2 only as Social Security and Medicare wages to ensure proper Social Security and Medicare credit is received.

How do you handle payroll for a deceased employee?

As a general rule, an uncashed paycheck issued prior to the employee's death should be canceled, and a new check should be issued in the name of the employee's estate or beneficiary. The new check should have the same amount withheld for tax purposes as the old check.

What is a payroll beneficiary?

Primary Beneficiary: Receives priority distribution upon the employee's death. Contingent Beneficiary: Receives distribution only if the primary beneficiary is deceased at the time of the employee's death.

How do you pay someone who is deceased?

Payments to a person who has died are usually made to the personal representative or executor of that person's estate.

What taxes are withheld from a deceased employee?

If payments were made in the same year the employee died, the employer must withhold Social Security and Medicare taxes on the payments and report them only as Social Security and Medicare wages on the employee's Form W-2 to ensure that proper Social Security and Medicare credit is received.

What does HR need to do when an employee dies?

How to Provide Workplace Support When an Employee Passes Away Inform People Tactfully. Put Plans in Place. Allow Time and Space to Process. Offer Grief Counseling. Send Regards to the Family. Find Ways to Remember the Employee. Sort Out Workplace Logistics.

How do I pay a deceased employee's wages in California?

In California, employers should first inquire of the deceased employee's family of the deceased's estate will be subject to probate. If the estate will be probated (either due to the size of the estate or nature of assets), then the employer can issue the final paycheck to the estate of the deceased employee.

How do I process payroll for a deceased employee?

As a general rule, an uncashed paycheck issued prior to the employee's death should be canceled, and a new check should be issued in the name of the employee's estate or beneficiary. The new check should have the same amount withheld for tax purposes as the old check.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my affidavit to collect compensation in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your affidavit to collect compensation along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get affidavit to collect compensation?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific affidavit to collect compensation and other forms. Find the template you need and change it using powerful tools.

How do I edit affidavit to collect compensation in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your affidavit to collect compensation, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is deceased employee compensation collection?

Deceased employee compensation collection refers to the process of settling and collecting any wages, benefits, or other compensation owed to an employee who has passed away.

Who is required to file deceased employee compensation collection?

Typically, the employer or the estate of the deceased employee is required to file for deceased employee compensation collection to ensure that any outstanding payments are properly disbursed.

How to fill out deceased employee compensation collection?

To fill out a deceased employee compensation collection, you must complete relevant forms provided by the employer or state agency, including details about the deceased employee, the type of compensation owed, and any necessary documentation such as a death certificate.

What is the purpose of deceased employee compensation collection?

The purpose of deceased employee compensation collection is to ensure the proper distribution of any owed compensation to the rightful beneficiaries or the estate of the deceased employee.

What information must be reported on deceased employee compensation collection?

Information that must be reported includes the deceased employee's name, Social Security number, date of death, wages or benefits owed, and the contact information of the executor or beneficiary handling the estate.

Fill out your affidavit to collect compensation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit To Collect Compensation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.