Get the free Real Estate Advanta IRA Services LLC Purchase

Show details

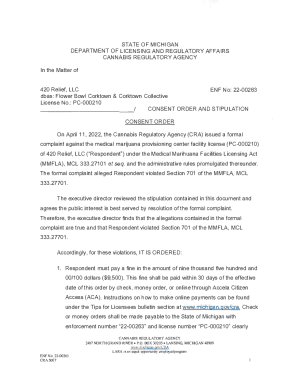

Advance IRA Services, LLC 13191 Starkey Rd., Suite 9 Largo, FL 33773 P: (800) 4250653 F: (866) 3856045 Real Estate Purchase Authorization 1 ACCOUNT INFORMATION Name (Your name as it appears in your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real estate advanta ira

Edit your real estate advanta ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real estate advanta ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit real estate advanta ira online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit real estate advanta ira. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real estate advanta ira

How to fill out real estate Advanta IRA:

01

Research and educate yourself on the rules and regulations surrounding self-directed IRAs and real estate investments. Familiarize yourself with the Advanta IRA company and their specific requirements for opening and funding a real estate Advanta IRA.

02

Contact Advanta IRA to initiate the process. Speak with their team and provide them with the necessary information and documentation. They will guide you through the steps and answer any questions you may have.

03

Complete the necessary paperwork. Advanta IRA will provide you with the required forms to fill out. Make sure to accurately and thoroughly fill in all the requested information. Double-check for any errors or omissions before submitting the paperwork.

04

Fund your real estate Advanta IRA account. Decide on the amount you want to contribute or transfer into your account. Follow Advanta IRA's instructions for depositing funds into your account. Be aware of any contribution limits or restrictions that may apply.

05

Choose the real estate investment(s) you want to make. Conduct thorough research and due diligence on potential properties or real estate projects. Ensure they meet the criteria allowed by Advanta IRA for investment within a self-directed IRA.

06

Submit the necessary documentation for your investment. Advanta IRA will require you to provide specific paperwork, such as purchase agreements, contracts, or any other relevant documents related to your chosen real estate investment. Follow their instructions and provide the requested information promptly.

07

Monitor and manage your real estate Advanta IRA. Stay informed about the performance of your investment and proactively manage your account. Regularly review statements and communicate with Advanta IRA regarding any updates or changes to your investment.

Who needs real estate Advanta IRA:

01

Real estate investors: Individuals or companies actively involved in real estate investment may benefit from using a real estate Advanta IRA. It allows them to leverage their retirement savings to invest in a wide range of real estate assets, such as residential properties, commercial buildings, or raw land.

02

Individuals seeking diversification: Those who want to diversify their retirement portfolio beyond traditional investment options like stocks, bonds, and mutual funds may find real estate Advanta IRA as an attractive alternative. It provides an opportunity to invest in tangible assets with the potential for long-term growth and income.

03

Self-employed individuals: People who are self-employed or have their own businesses can use real estate Advanta IRA to invest in properties relevant to their business. For example, a business owner may purchase their office space or a rental property that aligns with their business strategy.

04

Investors looking for tax advantages: Real estate Advanta IRA offers potential tax advantages, such as tax-deferred or tax-free growth, depending on the type of account used. Investors looking to minimize their tax liabilities and maximize their retirement savings may choose to utilize this type of self-directed IRA.

05

Individuals with real estate expertise: Those with knowledge and expertise in the real estate industry can capitalize on their skills by utilizing real estate Advanta IRA. They can leverage their understanding of the market to make informed investment decisions, potentially generating higher returns for their retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send real estate advanta ira to be eSigned by others?

When you're ready to share your real estate advanta ira, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute real estate advanta ira online?

pdfFiller has made it simple to fill out and eSign real estate advanta ira. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in real estate advanta ira without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your real estate advanta ira, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is real estate advanta ira?

Real Estate Advanta IRA is a self-directed retirement account that allows individuals to invest in real estate.

Who is required to file real estate advanta ira?

Individuals who want to invest in real estate through a self-directed IRA are required to open and file with Real Estate Advanta IRA.

How to fill out real estate advanta ira?

To fill out Real Estate Advanta IRA, individuals need to open an account with Advanta IRA, select real estate as their investment option, and follow the required documentation and procedures.

What is the purpose of real estate advanta ira?

The purpose of Real Estate Advanta IRA is to provide individuals with a tax-advantaged way to invest in real estate for their retirement savings.

What information must be reported on real estate advanta ira?

The information that must be reported on Real Estate Advanta IRA includes the details of the real estate investment, income generated, expenses incurred, and the overall performance of the investment.

Fill out your real estate advanta ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Estate Advanta Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.