Get the free Lending amp Real Estate Compliance Conference - Virginia Mortgage bb

Show details

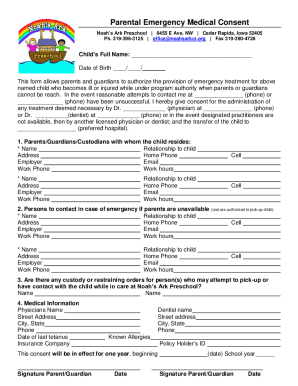

2015 Virginia Mortgage Lenders Association Lending & Real Estate Compliance Conference Wednesday, March 25, 2015 10:002:30 VEDA Virginia Housing Center, Glen Allen, VA Attention Mortgage Lenders and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lending amp real estate

Edit your lending amp real estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lending amp real estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lending amp real estate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lending amp real estate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lending amp real estate

How to fill out lending amp real estate:

01

Research and gather information about the lending process: Begin by understanding the basics of lending and real estate transactions. Educate yourself on the different types of loans available, interest rates, mortgage terms, and legal requirements.

02

Assess your financial situation: Before applying for a loan or entering into a real estate transaction, evaluate your current financial status. Determine how much you can afford to borrow, considering your income, expenses, and creditworthiness. Calculate your debt-to-income ratio and credit score to ensure you meet the necessary criteria.

03

Consult with a mortgage lender or real estate agent: Seek professional guidance from a reputable mortgage lender or real estate agent. They can provide valuable insights, assist in filling out the necessary paperwork, and help navigate the lending and real estate markets. They can also guide you through the application process and answer any questions you may have.

04

Gather required documents: To apply for a loan or participate in a real estate transaction, you will need certain documents. These typically include proof of income, employment history, bank statements, tax returns, identification documents, and any other relevant financial information. Make sure to gather these documents beforehand to streamline the application process.

05

Complete the loan application: Once you have collected the required documents and consulted with a professional, it's time to fill out the loan application. Provide accurate and detailed information, ensuring that all forms are properly completed and signed. Double-check for any errors or missing information before submitting the application.

06

Review and negotiate the terms: After submitting the application, the lender will review your information and assess your eligibility. If approved, they will provide you with loan offers and terms. Carefully review these offers, including interest rates, loan duration, and any associated fees. Negotiate with the lender if necessary to secure favorable terms that align with your financial goals.

07

Conduct a thorough property inspection: If you are seeking a real estate transaction, such as purchasing a property, conduct a comprehensive property inspection. Engage the services of a qualified inspector to assess the structural integrity, condition, and value of the property. This will help you make an informed decision and identify any potential issues before finalizing the transaction.

08

Seek legal advice: Real estate transactions involve legal contracts and obligations. Consider seeking legal advice from a qualified attorney to ensure all necessary documents and agreements are properly reviewed and understood. They can provide guidance on the legal implications of the transaction, protecting your interests throughout the process.

09

Close the transaction: Once all the necessary paperwork has been completed, and both parties have agreed to the terms, it's time to close the transaction. This involves signing the final loan documents, transferring funds, and officially becoming the owner of the property. Work closely with your real estate agent, lender, and attorney to ensure a smooth and successful closing.

Who needs lending amp real estate:

01

Individuals planning to purchase a property: Whether you're buying a residential property or investing in commercial real estate, understanding lending and real estate processes is crucial. This knowledge helps you navigate the complexities of securing a loan, negotiating terms, and making informed decisions during the transaction.

02

Real estate investors: For those looking to make investments in real estate, understanding lending practices is essential. Investors often rely on loans to acquire properties, and knowledge of different loan types, interest rates, and borrowing strategies can help optimize their investment returns.

03

Individuals looking to refinance existing loans: Refinancing a mortgage or other real estate loans can offer financial benefits such as lower interest rates, reduced monthly payments, or more favorable loan terms. Understanding the lending process allows individuals to evaluate their options and make informed decisions when refinancing their existing loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lending amp real estate?

Lending and real estate refers to the activities related to providing loans and investing in real property.

Who is required to file lending amp real estate?

Financial institutions, lenders, and companies involved in real estate transactions are required to file lending and real estate reports.

How to fill out lending amp real estate?

Lending and real estate reports can be filled out electronically through the designated platform provided by the relevant regulatory authority.

What is the purpose of lending amp real estate?

The purpose of lending and real estate reports is to ensure transparency, compliance with regulations, and oversight of lending and real estate activities.

What information must be reported on lending amp real estate?

Information such as loan amounts, interest rates, property details, borrower information, and other relevant financial data must be reported on lending and real estate reports.

How can I manage my lending amp real estate directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your lending amp real estate and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I sign the lending amp real estate electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your lending amp real estate and you'll be done in minutes.

How do I fill out lending amp real estate using my mobile device?

Use the pdfFiller mobile app to fill out and sign lending amp real estate. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your lending amp real estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lending Amp Real Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.