Get the free TAX SHELTERED ANNUNITY TSA 403b - hhbenefitscom

Show details

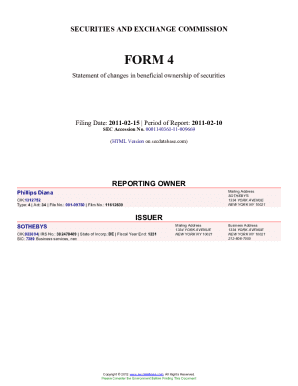

TAX SHELTERED ANNUITY (TSA) 403(b) 2012 Matchup Contribution Certification (For Use during Calendar Year 2012 Only) Employee Name (Print) Social Security Number Employee Number I certify that I have

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax sheltered annunity tsa

Edit your tax sheltered annunity tsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax sheltered annunity tsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax sheltered annunity tsa online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax sheltered annunity tsa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax sheltered annunity tsa

How to fill out tax sheltered annuity (TSA):

01

Gather relevant information: Before starting the process, you will need key documents such as your social security number, income information, and personal identification.

02

Research available options: Familiarize yourself with different providers and their offerings, as well as the rules and regulations governing tax sheltered annuities.

03

Determine contribution amount: Decide how much money you want to contribute to the annuity each month. Consider your financial goals, investment strategies, and any contribution limits imposed by the IRS.

04

Select an annuity provider: Choose a reputable and trustworthy annuity provider that aligns with your investment goals and offers competitive rates. Compare their features, fees, and customer reviews to make an informed decision.

05

Complete the application: Fill out the necessary application forms provided by the chosen annuity provider. Provide accurate and up-to-date information to avoid any delays or complications.

06

Designate beneficiaries: Decide who will receive the annuity payments in case of your untimely demise. Designate beneficiaries by providing their names, contact information, and relationship to you.

07

Review and sign: Carefully review all the terms, conditions, and disclosures associated with the tax sheltered annuity. Ensure that you understand and agree with them before signing the required documents.

08

Submit the application: Once you have filled out the application and completed all the necessary steps, submit it to the annuity provider for processing and approval.

09

Monitor your annuity: After successfully filling out the TSA, regularly review your account, track contributions, and keep informed about any changes in the annuity provider's terms or IRS regulations.

Who needs tax sheltered annuity (TSA)?

01

Individuals planning for retirement: Tax sheltered annuities offer a way to save and invest pre-tax income for retirement, providing potential tax advantages and a steady income stream.

02

Educators and non-profit employees: TSA plans are often available to employees in the education sector and certain non-profit organizations. It allows these individuals to save for retirement while enjoying tax benefits specific to their profession.

03

Individuals seeking tax advantages: Tax sheltered annuities provide an opportunity to reduce taxable income as contributions are made before tax. This can be advantageous for individuals in higher tax brackets.

04

Those looking for long-term financial security: TSA plans are designed to grow funds over time, providing a reliable income source during retirement. They offer a way to accumulate wealth and protect against financial uncertainties in the future.

05

Those desiring flexibility in retirement planning: Tax sheltered annuities allow individuals to choose how much they contribute and how they want their funds invested, giving them more control over their retirement planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax sheltered annunity tsa?

A tax-sheltered annuity (TSA) is a retirement savings plan established by an employer, usually a non-profit organization, to help employees save for retirement on a tax-deferred basis.

Who is required to file tax sheltered annunity tsa?

Employees of certain non-profit organizations may be required or eligible to participate in a tax sheltered annuity TSA plan offered by their employer.

How to fill out tax sheltered annunity tsa?

Employees can fill out a tax-sheltered annuity TSA by completing the necessary forms provided by their employer or plan administrator.

What is the purpose of tax sheltered annunity tsa?

The purpose of a tax sheltered annuity TSA is to allow employees to save for retirement in a tax-efficient manner, as contributions are made on a pre-tax basis.

What information must be reported on tax sheltered annunity tsa?

Information such as employee contributions, employer contributions, investment gains, and distributions must be reported on a tax sheltered annuity TSA.

How can I send tax sheltered annunity tsa to be eSigned by others?

Once you are ready to share your tax sheltered annunity tsa, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get tax sheltered annunity tsa?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific tax sheltered annunity tsa and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit tax sheltered annunity tsa on an Android device?

With the pdfFiller Android app, you can edit, sign, and share tax sheltered annunity tsa on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your tax sheltered annunity tsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Sheltered Annunity Tsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.