Get the free Check if return is copy of original return - revenue ky

Show details

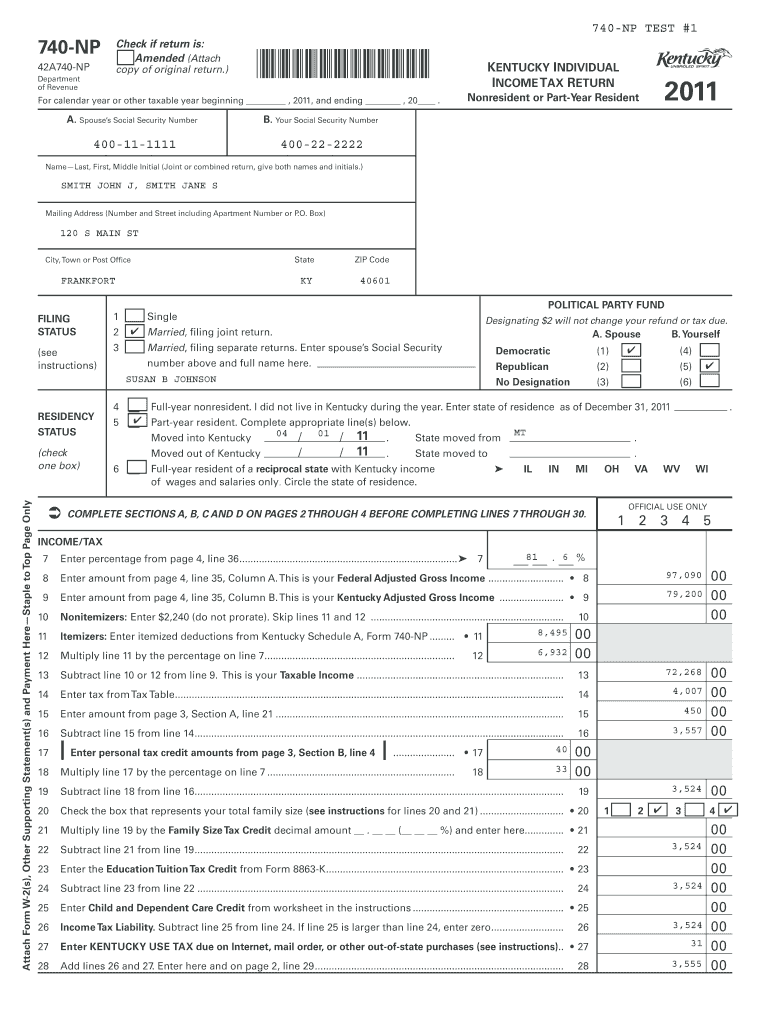

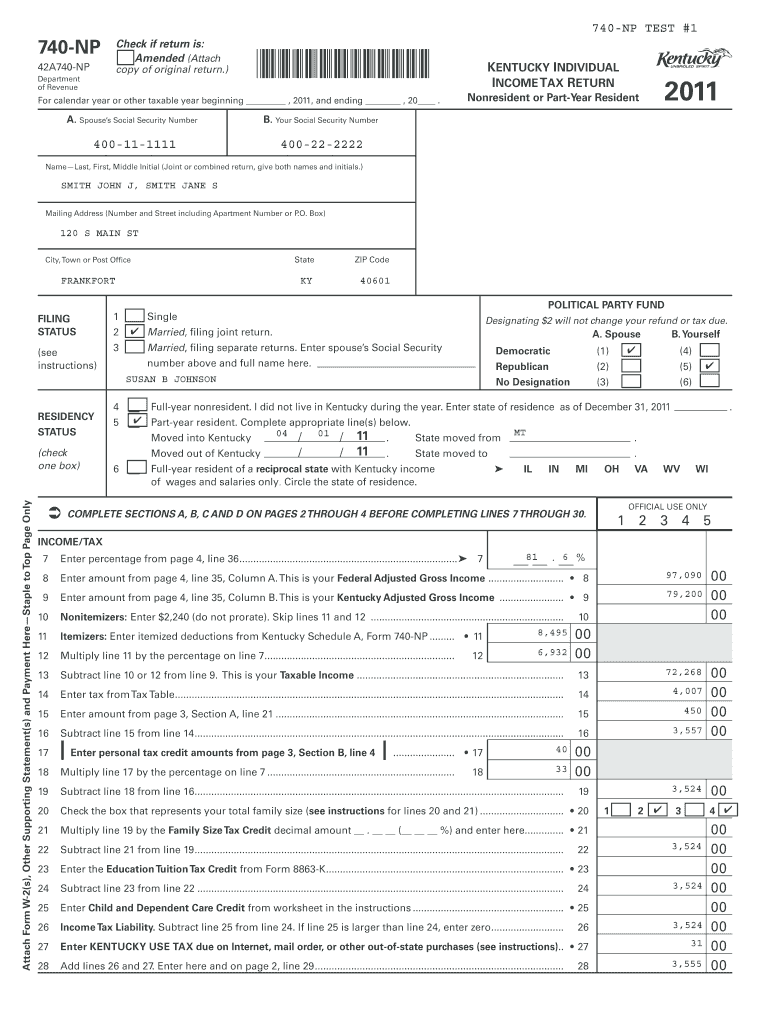

740NP TEST #1 740NP 42A740NP Check if return is: Amended (Attach copy of original return.) Department of Revenue *1100010004* For calendar year or other taxable year beginning, 2011, and ending, 20.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check if return is

Edit your check if return is form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check if return is form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit check if return is online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit check if return is. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check if return is

Point by point instructions on how to fill out a check if the return is:

01

Write the date on the top right corner of the check. Make sure to use the correct format, such as month/day/year.

02

On the "Pay to the Order of" line, write the name of the person or organization that you are issuing the check to. Make sure to write it clearly and accurately.

03

In the box next to the dollar sign symbol ($), write the numerical amount that you want to pay. Start from the far left and include any cents as a decimal. For example, if the amount is $50.75, write "50.75" in the box.

04

On the line below the "Pay to the Order of" line, write out the amount in words. Make sure to write it clearly and accurately, and include the word "and" before writing the cents portion. Using the previous example, you would write "Fifty and 75/100."

05

Sign the check on the bottom right corner. Make sure to sign it with the same name that is printed on the account.

Now, who needs to check if the return is?

01

Individuals who are making payments to someone or an organization and prefer the security and convenience of using checks instead of cash or electronic transactions.

02

Small businesses that have vendors or suppliers who prefer to be paid by check or have limited payment options available.

03

Non-profit organizations or charities that receive donations by check as a means of fundraising or support.

In summary, filling out a check if the return is involves writing the date, payee information, numerical and written amounts, and signing the check. It is a relevant skill for individuals, small businesses, and non-profit organizations who prefer or require check payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send check if return is for eSignature?

When you're ready to share your check if return is, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the check if return is electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your check if return is in seconds.

How do I complete check if return is on an Android device?

Complete check if return is and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is check if return is?

Check if return is a form used to report income paid to a non-employee.

Who is required to file check if return is?

Any business that has paid $600 or more to a non-employee during the year is required to file a check if return.

How to fill out check if return is?

You can fill out check if return using Form 1099-NEC and provide it to the non-employee and IRS.

What is the purpose of check if return is?

The purpose of check if return is to report income paid to non-employees and provide necessary information to the IRS.

What information must be reported on a check if return?

The check if return must include the non-employee's name, address, and Social Security number, along with the amount of income paid.

Fill out your check if return is online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check If Return Is is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.