Get the free 74605 CHAPTER 11 INCENTIVES

Show details

7460.5 CHAPTER 11. INCENTIVES 111 OBJECTIVE. The objective of this Chapter is to identify the incentives and relief afforded high performing Has which perform in an exemplary manner. 112 REQUIREMENTS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 74605 chapter 11 incentives

Edit your 74605 chapter 11 incentives form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 74605 chapter 11 incentives form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 74605 chapter 11 incentives online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 74605 chapter 11 incentives. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 74605 chapter 11 incentives

How to fill out 74605 chapter 11 incentives:

01

Begin by collecting all necessary information related to the incentives offered under 74605 chapter 11. This may include details about the specific incentives, eligibility criteria, application forms, and supporting documents.

02

Familiarize yourself with the requirements and guidelines set forth in 74605 chapter 11. This will ensure that you understand the purpose and scope of the incentives, as well as any specific procedures that need to be followed during the application process.

03

Carefully review the eligibility criteria to determine if you or your organization qualifies for the 74605 chapter 11 incentives. This may involve assessing factors such as industry type, location, business size, or other relevant factors specified in the legislation.

04

Gather all the necessary supporting documents required for the application. These may include financial statements, tax returns, business plans, proof of eligibility, or any other documentation specified by the governing body responsible for administering the incentives.

05

Complete the application form accurately and ensure that all required fields are filled out. Pay close attention to any specific instructions provided in the application, such as additional attachments or signatures required.

06

Double-check the completed application to ensure its accuracy and completeness. This will help avoid potential delays or rejection of the application due to missing or incorrect information.

07

Submit the filled-out application, along with all supporting documents, to the designated authority responsible for processing the 74605 chapter 11 incentives. This may involve mailing the application, submitting it online through a portal, or delivering it in person to the designated office.

08

After submission, monitor the progress of your application. Keep track of any communication from the governing body regarding the status of your application, and promptly respond to any requests for additional information or clarification.

09

If your application is approved, make sure to comply with any post-approval requirements, such as periodic reporting, compliance audits, or other obligations specified in 74605 chapter 11. Non-compliance may lead to penalties or disqualification from receiving the incentives.

10

Finally, utilize the 74605 chapter 11 incentives as intended, whether it involves accessing financial support, tax benefits, or other advantages. Maximize the value of these incentives to foster growth, sustainability, or other desired outcomes for your business or organization.

Who needs 74605 chapter 11 incentives?

01

Small businesses looking for financial support and incentives to encourage growth and expansion.

02

Startups seeking assistance to overcome financial challenges and establish a strong foundation for success.

03

Industries or regions that have been adversely affected by economic downturns, natural disasters, or other significant events.

04

Organizations dedicated to revitalizing specific areas or sectors through targeted economic development initiatives.

05

Companies or individuals interested in taking advantage of tax benefits, grants, or subsidies offered under 74605 chapter 11.

06

Entrepreneurs or innovators aiming to leverage incentives to drive technological advancements, research and development activities, or sustainability initiatives.

07

Non-profit organizations or community-based projects that aim to address social, environmental, or economic challenges and can benefit from available incentives.

08

Employers looking to attract and retain skilled workforce by leveraging incentive programs and offering competitive compensation packages.

09

Entities seeking to contribute to economic development by investing in infrastructure, education, or other strategic areas aligned with the objectives of 74605 chapter 11.

10

Individuals or organizations looking to explore new business opportunities or expand existing operations and can benefit from the financial or other incentives available under 74605 chapter 11.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

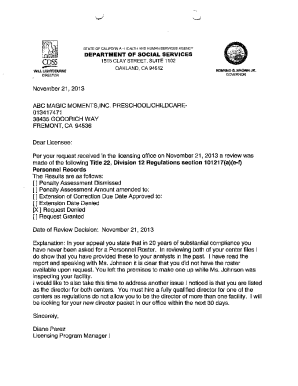

What is 74605 chapter 11 incentives?

Chapter 11 incentives under section 74605 of the tax code refer to tax credits or deductions that are available to businesses meeting certain criteria.

Who is required to file 74605 chapter 11 incentives?

Businesses eligible for chapter 11 incentives must file the necessary forms with the IRS.

How to fill out 74605 chapter 11 incentives?

To fill out chapter 11 incentives, businesses need to provide information on their qualifying activities, expenses incurred, and calculate the amount of credit or deduction they are eligible for.

What is the purpose of 74605 chapter 11 incentives?

The purpose of chapter 11 incentives is to encourage businesses to engage in specific activities that benefit the economy or society.

What information must be reported on 74605 chapter 11 incentives?

Businesses must report details of their qualifying activities, expenses, and calculations for the credit or deduction claimed.

How can I edit 74605 chapter 11 incentives on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 74605 chapter 11 incentives, you need to install and log in to the app.

How do I fill out 74605 chapter 11 incentives using my mobile device?

Use the pdfFiller mobile app to fill out and sign 74605 chapter 11 incentives. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out 74605 chapter 11 incentives on an Android device?

Use the pdfFiller mobile app to complete your 74605 chapter 11 incentives on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your 74605 chapter 11 incentives online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

74605 Chapter 11 Incentives is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.