AL Form CR-10 1998 free printable template

Show details

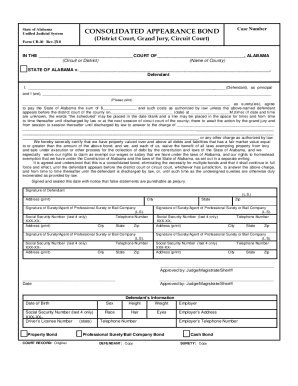

State of Alabama Unified Judicial System Form CR-10 Case Number CONSOLIDATED APPEARANCE BOND (District Court, Grand Jury, Circuit Court) Rev.8/98 IN THE COURT OF, ALABAMA (Circuit or District) (Name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL Form CR-10

Edit your AL Form CR-10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL Form CR-10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL Form CR-10 online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AL Form CR-10. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL Form CR-10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL Form CR-10

How to fill out AL Form CR-10

01

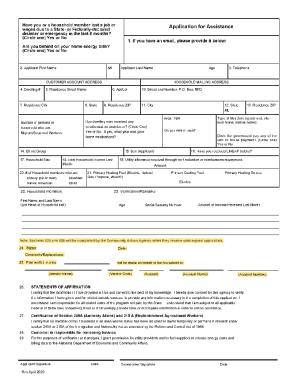

Obtain the AL Form CR-10 from the appropriate official source.

02

Fill in your personal information, such as your name, address, and contact details in the designated fields.

03

Provide details about the specific situation or reason for completing the form.

04

Review any guidelines or instructions related to the form for additional requirements.

05

Sign and date the form at the bottom as required.

06

Submit the completed form through the specified method (mail, online, or in person) to the designated authority.

Who needs AL Form CR-10?

01

Individuals who are required to report certain activities or updates to the state authorities.

02

Residents seeking to apply for certain licenses or permits.

03

Entities or organizations involved in activities that necessitate official documentation.

Fill

form

: Try Risk Free

People Also Ask about

How do they calculate child support in Idaho?

Child support obligations in Idaho are calculated using the Income Shares Model. The idea is to estimate the amount of support that the children would have received if the marriage hadn't failed. This support amount is then divided between the parents in proportion to their respective incomes.

What income is child support based on in Idaho?

Gross earnings: Gross earnings are established based on tax records and current pay stubs. Idaho law requires the use of both parents' incomes from the equivalent of one full-time job to determine a child support amount.

What is child support supposed to cover in Idaho?

In Idaho, the duty to pay child support for minor (underage) children refers to each parent's obligation to pay for necessary food, clothing, shelter, education, and health care. Child support amounts are determined ing to a set of mathematical guidelines that are based on gross income.

How often can child support be modified in Idaho?

Each child support order is carefully determined with a child's best interest in mind and is generally not eligible to be reviewed for a change for at least three years. A child support order can be reviewed for a change in support: After three years at the request of either parent.

How much is child support in Idaho per child?

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

What is a stipulation for divorce in Idaho?

To divorce by stipulation, you and your spouse must agree about the reason why your marriage ended. It's very common for spouses to cite irreconcilable differences as the cause of their divorce, because it's a non-specific way of saying that the marriage broke down and can't be saved. (Idaho Code § 32-616 (2020).)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the AL Form CR-10 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your AL Form CR-10 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit AL Form CR-10 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share AL Form CR-10 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I fill out AL Form CR-10 on an Android device?

Complete AL Form CR-10 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is AL Form CR-10?

AL Form CR-10 is a tax form used in Alabama for reporting corporate income tax.

Who is required to file AL Form CR-10?

Corporations that are subject to Alabama corporate income tax are required to file AL Form CR-10.

How to fill out AL Form CR-10?

To fill out AL Form CR-10, corporations must provide their gross income, deductions, and other relevant financial information as instructed on the form.

What is the purpose of AL Form CR-10?

The purpose of AL Form CR-10 is to report corporate income and calculate the tax liability owed to the state of Alabama.

What information must be reported on AL Form CR-10?

The information that must be reported on AL Form CR-10 includes the corporation's gross receipts, deductions, taxable income, and any applicable credits.

Fill out your AL Form CR-10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL Form CR-10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.