Get the free Records Taxes and Treasury Division - Tourist Development - broward

Show details

Board of County Commissioners, Broward County, Florida Finance and Administrative Services Department Records, Taxes and Treasury Division Tourist Development Tax Section REGISTRATION FORM 1. RENTAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign records taxes and treasury

Edit your records taxes and treasury form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your records taxes and treasury form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit records taxes and treasury online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit records taxes and treasury. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out records taxes and treasury

How to fill out records taxes and treasury:

01

Gather all necessary documentation, including income statements, expenses records, and any relevant receipts or invoices.

02

Organize your records according to the appropriate categories, such as income, expenses, and deductions.

03

Use the appropriate forms or software to input your financial information accurately. This could include tax forms specific to your country or region, as well as any additional documentation required by the treasury department.

04

Ensure that all calculations are done correctly and double-check your entries for any errors or omissions.

05

Submit your completed records taxes and treasury forms by the designated deadline, making sure to include any payment required or relevant supporting documents.

06

Keep copies of all submitted forms and supporting documents for your own records.

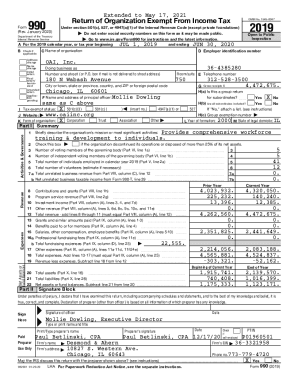

Who needs records taxes and treasury:

01

Individuals: Individuals who earn income, whether from employment, self-employment, or investments, may need to fill out records taxes and treasury forms to fulfill their tax obligations.

02

Businesses: Business owners, regardless of the size or type of business, may be required to fill out records taxes and treasury forms to accurately report their income and expenses.

03

Non-profit organizations: Non-profit organizations typically have different tax requirements, but they still need to maintain records taxes and treasury to demonstrate their financial activities and comply with any relevant regulations.

04

Government agencies: Treasury departments and tax authorities at various levels of government utilize records taxes and treasury to ensure compliance, assess tax liabilities, and monitor economic activity.

05

Financial institutions: Banks and other financial institutions may require records taxes and treasury from individuals and businesses for loan applications or to verify their financial standing.

Overall, anyone who earns income, operates a business, or deals with financial transactions may need to fill out records taxes and treasury forms to meet legal obligations, demonstrate financial activity, or support their financial position.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is records taxes and treasury?

Records taxes and treasury refer to the process of keeping track of financial records, paying taxes, and managing treasury functions within an organization.

Who is required to file records taxes and treasury?

All businesses and individuals who have financial transactions and/or assets are required to file records taxes and treasury.

How to fill out records taxes and treasury?

Records taxes and treasury can be filled out by organizing financial documents, calculating tax obligations, and following the guidelines set by the taxing authorities.

What is the purpose of records taxes and treasury?

The purpose of records taxes and treasury is to ensure compliance with tax laws, accurately report financial information, and effectively manage an organization's financial resources.

What information must be reported on records taxes and treasury?

Information such as income, expenses, assets, liabilities, and taxes owed must be reported on records taxes and treasury.

How can I send records taxes and treasury for eSignature?

Once you are ready to share your records taxes and treasury, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get records taxes and treasury?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the records taxes and treasury. Open it immediately and start altering it with sophisticated capabilities.

How do I edit records taxes and treasury in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing records taxes and treasury and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Fill out your records taxes and treasury online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Records Taxes And Treasury is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.