Get the free Microsoft PowerPoint - IRS Southern Illinois Symposium FlyerDraft 2015 - revenue sta...

Show details

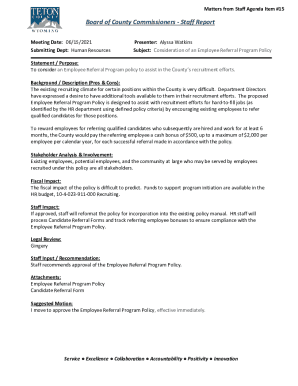

Internal Revenue Service 2015 Southern Illinois Tax Symposium ThursdaySeptember24,2015 CheckinBeginsat7:30a.m. SymposiumBeginsat8:00a.m. Allpresentationsinperson DirectorSouthernIllinoisUniversityEdwardsvilleSmallBusiness

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign microsoft powerpoint - irs

Edit your microsoft powerpoint - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your microsoft powerpoint - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing microsoft powerpoint - irs online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit microsoft powerpoint - irs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out microsoft powerpoint - irs

How to fill out Microsoft PowerPoint - IRS:

01

Open Microsoft PowerPoint: Launch the Microsoft PowerPoint application on your computer.

02

Choose a template or design: Select a template or design that matches your presentation needs. This will provide a starting point for your PowerPoint slide design.

03

Add slides: Click on the "New Slide" button or use the shortcut key (Ctrl + M) to add new slides to your presentation. Customize each slide with your desired content.

04

Insert text: To add text, click on a slide and start typing in the text boxes provided. Resize and reposition the text boxes as needed.

05

Format text: Highlight the text and use the toolbar options to format it according to your preferences. You can change the font, size, color, alignment, and other formatting options.

06

Add images or multimedia: Insert images, videos, or audio files to enhance your presentation. Click on the "Insert" tab and choose the desired media, then follow the prompts to insert and customize them on your slides.

07

Add animations and transitions: To make your presentation more dynamic, apply animations and transitions to your slides. Click on the "Transitions" tab and choose from the various effects available.

08

Review and edit: Before finalizing your presentation, review each slide for accuracy, spelling, and grammar errors. Make any necessary edits or revisions.

09

Save and share: Once you're satisfied with the presentation, click on the "File" tab and choose "Save" to save your PowerPoint file. You can also share it directly with others by selecting the "Share" option.

Who needs Microsoft PowerPoint - IRS?

01

Professionals: Business professionals, educators, trainers, and speakers often use Microsoft PowerPoint to create engaging presentations for meetings, conferences, workshops, and lectures.

02

Students: Students of all ages use PowerPoint for school projects, class presentations, and assignments. It allows them to organize and present information effectively.

03

Individuals: Anyone looking to create visually appealing slideshows, whether for personal or professional use, can benefit from using Microsoft PowerPoint. It offers a user-friendly interface and a wide range of customization options.

In conclusion, Microsoft PowerPoint is a versatile tool that allows users to create compelling presentations. By following the steps outlined above, anyone can fill out PowerPoint slides and effectively communicate their message.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the microsoft powerpoint - irs electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your microsoft powerpoint - irs and you'll be done in minutes.

How do I edit microsoft powerpoint - irs on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign microsoft powerpoint - irs right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit microsoft powerpoint - irs on an Android device?

You can make any changes to PDF files, like microsoft powerpoint - irs, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is microsoft powerpoint - irs?

Microsoft PowerPoint is a software program used to create presentations for various purposes, while IRS refers to the Internal Revenue Service of the United States.

Who is required to file microsoft powerpoint - irs?

Individuals or businesses who meet certain criteria set by the IRS are required to file tax returns using the appropriate forms, not Microsoft PowerPoint.

How to fill out microsoft powerpoint - irs?

Microsoft PowerPoint is not used to fill out IRS forms. Taxpayers can fill out IRS forms electronically or by hand according to the instructions provided by the IRS.

What is the purpose of microsoft powerpoint - irs?

The purpose of Microsoft PowerPoint is to create visually appealing presentations, while the purpose of IRS forms is to report financial information for tax purposes.

What information must be reported on microsoft powerpoint - irs?

Microsoft PowerPoint is not used to report information to the IRS. Taxpayers must report income, deductions, credits, and other financial information on the relevant IRS forms.

Fill out your microsoft powerpoint - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Microsoft Powerpoint - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.