Get the free Retirement Savings Plan Application - nbbnca

Show details

Retirement Savings Plan Application To apply for a Manlike Bank of Canada Retirement Savings Plan (RSP), you must personally meet with your client and complete the following steps: 1. Complete this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement savings plan application

Edit your retirement savings plan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement savings plan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement savings plan application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit retirement savings plan application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement savings plan application

How to fill out a retirement savings plan application:

01

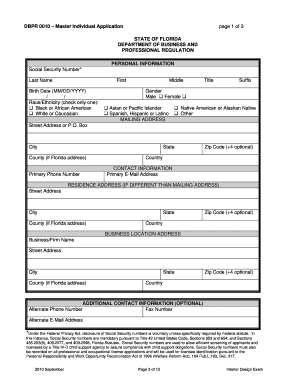

Gather important personal information: Start by collecting essential details like your full name, date of birth, social security number, and contact information. This information is crucial for the application process.

02

Research and choose a suitable retirement savings plan: Before filling out the application, it is essential to explore different retirement savings plans and select the one that aligns with your financial goals. Consider factors such as contribution limits, tax advantages, and investment options.

03

Review the application form and instructions: Carefully read through the retirement savings plan application form and accompanying instructions. This will ensure that you understand the requirements and have all the necessary documentation ready.

04

Provide employment and income details: The application may ask for information about your current employment, including the name of your employer, job title, and salary. Make sure to provide accurate and up-to-date information.

05

Determine your contribution amount: Decide on the amount you wish to contribute to your retirement savings plan. Be aware of any matching contributions your employer may offer and take full advantage of them if available.

06

Complete beneficiary designation: Many retirement savings plans require you to designate a beneficiary who will receive the funds in case of your death. Ensure you provide the required details, such as the beneficiary's name, relationship to you, and their contact information.

07

Review and proofread: Before submitting the application, carefully review all the provided information. Double-check for any errors or missing information that may cause delays or complications.

Who needs a retirement savings plan application?

01

Individuals planning for retirement: Anyone who wants to proactively save and prepare for their retirement should consider filling out a retirement savings plan application. It allows individuals to take advantage of tax benefits and build a substantial nest egg for their future.

02

Employees: Many employers offer retirement savings plans as part of their employee benefits package. If you're an employee, it's important to inquire about these plans and complete the application form to start saving for retirement.

03

Self-employed individuals: Without access to an employer-sponsored retirement plan, self-employed individuals can establish and contribute to their retirement savings plan, commonly referred to as a Solo 401(k) or a Simplified Employee Pension (SEP) IRA. They can fill out the respective application forms to initiate their retirement savings journey.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is retirement savings plan application?

Retirement savings plan application is a document that individuals can use to enroll in a retirement savings plan, such as a 401(k) or an IRA.

Who is required to file retirement savings plan application?

Any individual who wants to start saving for retirement through a retirement savings plan is required to file a retirement savings plan application.

How to fill out retirement savings plan application?

To fill out a retirement savings plan application, individuals need to provide personal information, choose investment options, and designate beneficiaries.

What is the purpose of retirement savings plan application?

The purpose of a retirement savings plan application is to help individuals save money for retirement and take advantage of tax benefits.

What information must be reported on retirement savings plan application?

Information such as name, address, social security number, beneficiary information, investment options, and contribution amounts must be reported on a retirement savings plan application.

How can I send retirement savings plan application for eSignature?

retirement savings plan application is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the retirement savings plan application in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your retirement savings plan application and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out retirement savings plan application using my mobile device?

Use the pdfFiller mobile app to fill out and sign retirement savings plan application. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your retirement savings plan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Savings Plan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.