Get the free SELF DIRECTED IRA Custodial Account Application - cooperativefund

Show details

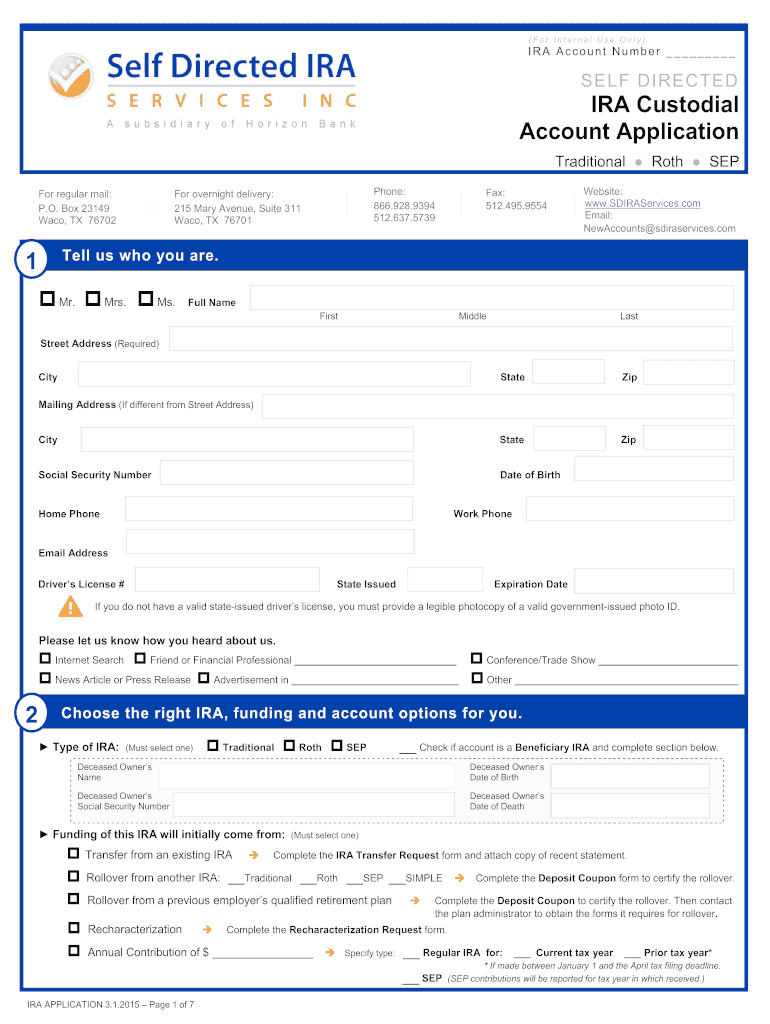

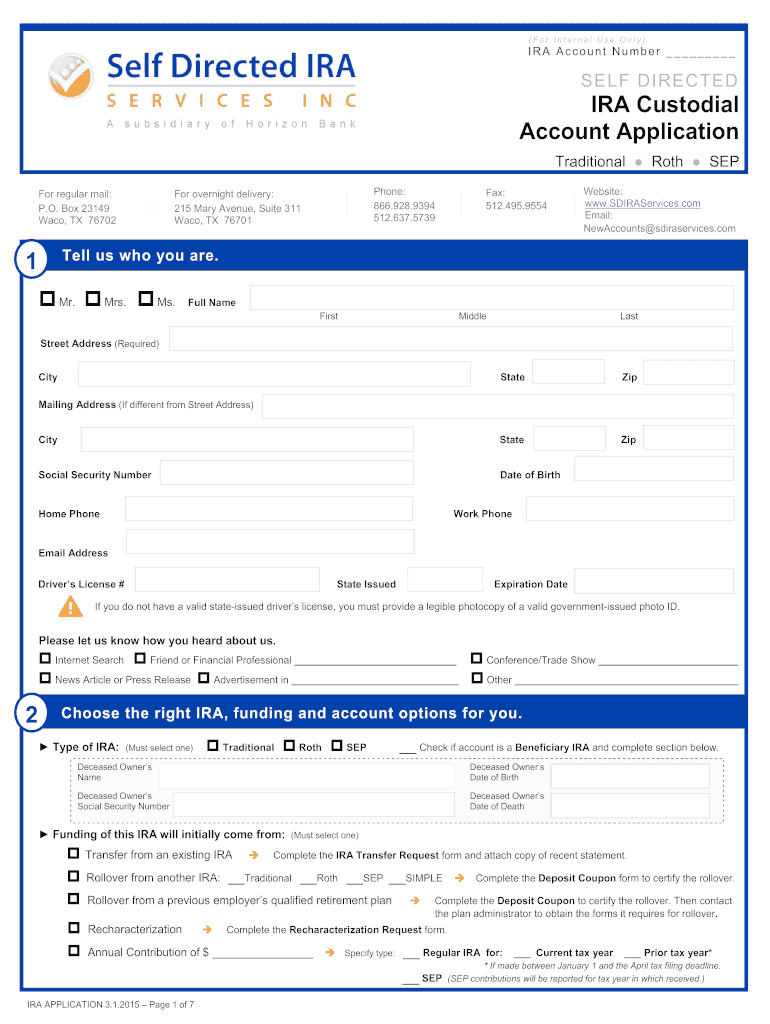

(For Internal Use Only) IRA Account Number SELF DIRECTED IRA Custodial Account Application Traditional Roth SEP For regular mail: P.O. Box 23149 Waco, TX 76702 Phone: 866.928.9394 512.637.5739 For

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self directed ira custodial

Edit your self directed ira custodial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self directed ira custodial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self directed ira custodial online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit self directed ira custodial. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self directed ira custodial

How to fill out a self-directed IRA custodial:

01

Gather necessary documentation: Start by collecting all the required documents, such as your identification, Social Security number, beneficiary information, and any additional forms provided by the custodian.

02

Identify a custodian: Research and choose a reputable self-directed IRA custodian that aligns with your investment goals and offers the services you require. Ensure they are experienced in handling self-directed IRAs.

03

Open an account: Contact the chosen custodian and follow their account opening procedures. This may involve completing an application, providing personal information, and funding the account with an initial contribution. The custodian will guide you through this process.

04

Delineate investment strategy: Determine your investment objectives and strategy for your self-directed IRA. Self-directed IRAs offer a wide range of investment options beyond traditional stocks and bonds, such as real estate, private equity, precious metals, and more. Clearly outline your preferred investments.

05

Complete investment paperwork: Depending on the investments you intend to make, you may need to complete additional paperwork. For example, if you plan to invest in real estate, you may need to provide property details, title information, and agreements. Follow the instructions provided by your custodian for each specific investment type.

06

Document all transactions: As your self-directed IRA grows and you engage in various investment transactions, keep a record of all actions and documents related to your investments. This is important for tax purposes and to ensure compliance with IRA regulations.

Who needs a self-directed IRA custodial:

01

Individuals seeking investment control: A self-directed IRA custodial account is ideal for individuals who desire greater control and flexibility over their retirement investments. It allows them to choose from a wider range of investment options beyond traditional stocks, bonds, and mutual funds.

02

Experienced investors: Those with knowledge and experience in alternative investments may find self-directed IRAs appealing. It provides an opportunity to leverage their expertise and invest in assets they understand well, leading to potential higher returns.

03

Individuals with specific investment preferences: If you have a strong inclination or passion for a specific type of investment, such as real estate, startups, or precious metals, a self-directed IRA custodial account can cater to those preferences. It enables investors to focus on their preferred asset classes.

04

Those seeking potential diversification: A self-directed IRA allows individuals to diversify their retirement portfolios beyond traditional investments. By spreading investments across different asset classes, there is a potential to minimize risk and increase the chances of higher returns.

It is important to consult with a financial advisor or tax professional before making any investment decisions or opening a self-directed IRA custodial account to ensure it aligns with your specific financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my self directed ira custodial directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your self directed ira custodial and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in self directed ira custodial?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your self directed ira custodial to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out self directed ira custodial using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign self directed ira custodial. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is self directed ira custodial?

A self-directed IRA custodian is a financial institution that acts as the trustee or administrator of a self-directed IRA account.

Who is required to file self directed ira custodial?

Individuals who have a self-directed IRA account are required to file self-directed IRA custodial forms.

How to fill out self directed ira custodial?

To fill out self-directed IRA custodial forms, you will need to provide information about your account, investments, and transactions.

What is the purpose of self directed ira custodial?

The purpose of self-directed IRA custodial is to ensure compliance with IRS regulations regarding self-directed IRA investments.

What information must be reported on self directed ira custodial?

Information such as account details, investment types, and transaction history must be reported on self-directed IRA custodial forms.

Fill out your self directed ira custodial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Directed Ira Custodial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.