Get the free Petty Cash Fund Reconciliation - mtsuedu

Show details

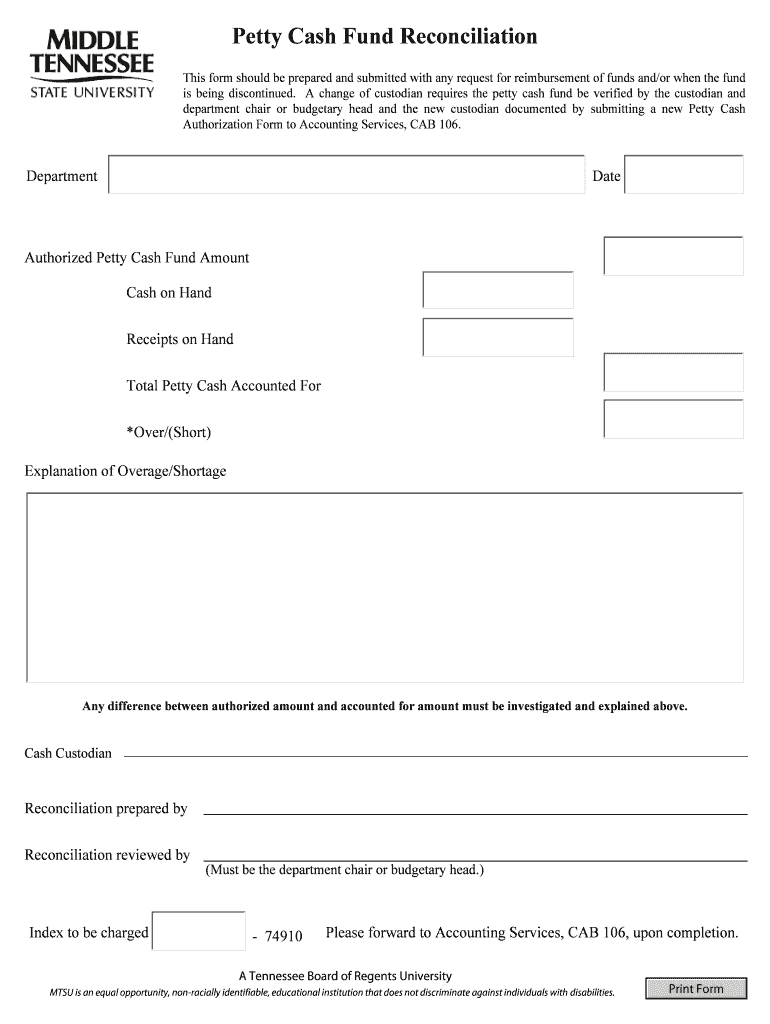

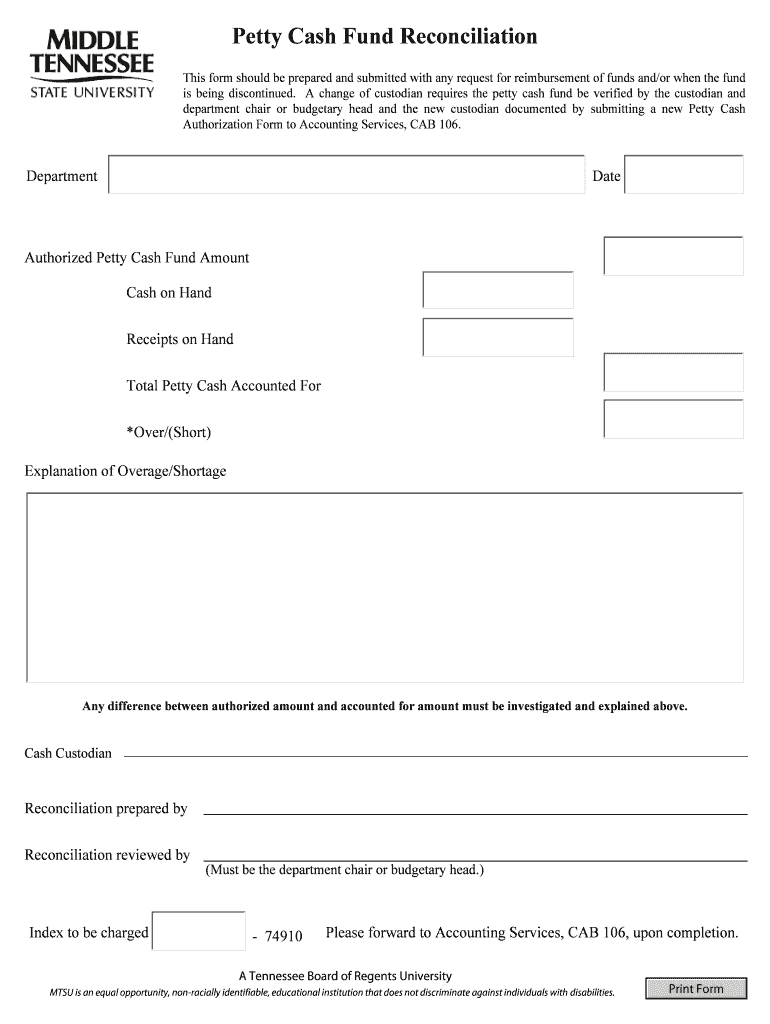

Petty Cash Fund Reconciliation This form should be prepared and submitted with any request for reimbursement of funds and/or when the fund is being discontinued. A change of custodian requires the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petty cash fund reconciliation

Edit your petty cash fund reconciliation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petty cash fund reconciliation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petty cash fund reconciliation online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit petty cash fund reconciliation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petty cash fund reconciliation

How to Fill Out Petty Cash Fund Reconciliation:

01

Gather all necessary documentation: Start by collecting all receipts, invoices, and petty cash vouchers related to the expenses made from the petty cash fund. These documents will help you accurately reconcile the fund.

02

Calculate the total expenses: Add up the total amounts from all the receipts, invoices, and petty cash vouchers. This will give you the total expenses incurred from the petty cash fund.

03

Count the remaining cash in the fund: Physically count the cash remaining in the petty cash fund. This will be the amount of cash that should be present according to the fund's replenishment amount.

04

Determine the variance: Subtract the remaining cash from the total expenses. The result will indicate whether there is a surplus or a shortage in the petty cash fund. A positive variance means there is excess cash, while a negative variance implies a cash shortage.

05

Check the supporting documentation: Ensure that the receipts, invoices, and petty cash vouchers correspond to the expenses claimed. Verify that they are properly filled out, have appropriate signatures, and include relevant details such as dates, descriptions, and amounts.

06

Prepare the reconciliation form: Use a petty cash fund reconciliation form or create a spreadsheet to record the details of the reconciliation. Include columns for date, description, amount, and indicate whether an expense was allowed or not.

07

Provide an explanation for variances: If there are any variances (positive or negative), provide an explanation for each discrepancy. Document any excess or missing cash, and detail any discrepancies found in the supporting documentation.

08

Obtain necessary approvals: Depending on the organization's procedures, the petty cash fund reconciliation may need to be reviewed and approved by the appropriate personnel, such as a supervisor or manager, before finalizing the process.

Who Needs Petty Cash Fund Reconciliation:

01

Businesses: Petty cash fund reconciliation is essential for businesses of all sizes to maintain accurate financial records and track cash expenditures. It allows them to identify any discrepancies, ensure proper cash management, and prevent petty cash misuse or fraud.

02

Non-profit organizations: Non-profit organizations often handle cash transactions for various expenses such as office supplies or small purchases. Conducting regular petty cash fund reconciliations helps ensure that all funds are accounted for and used appropriately for charitable activities.

03

Educational institutions: Schools, colleges, and universities often maintain petty cash funds to cover small expenses like field trips, classroom supplies, or emergency purchases. Reconciling these funds helps ensure transparency, accountability, and accuracy in financial reporting within the educational institution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit petty cash fund reconciliation from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including petty cash fund reconciliation, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find petty cash fund reconciliation?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the petty cash fund reconciliation in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out petty cash fund reconciliation on an Android device?

Complete petty cash fund reconciliation and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is petty cash fund reconciliation?

Petty cash fund reconciliation is the process of matching the physical cash on hand with the recorded balance in the petty cash fund account to ensure accuracy.

Who is required to file petty cash fund reconciliation?

Any individual or entity that has established a petty cash fund is required to file petty cash fund reconciliation.

How to fill out petty cash fund reconciliation?

To fill out petty cash fund reconciliation, you need to compare the physical cash on hand with the recorded transactions in the petty cash fund account, adjust any discrepancies, and document the findings.

What is the purpose of petty cash fund reconciliation?

The purpose of petty cash fund reconciliation is to ensure that there are no discrepancies between the physical cash on hand and the recorded balance in the petty cash fund account.

What information must be reported on petty cash fund reconciliation?

The information reported on petty cash fund reconciliation may include the date, amount of cash counted, recorded transactions, adjustments made, and the final balance.

Fill out your petty cash fund reconciliation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petty Cash Fund Reconciliation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.