Get the Petty Cash Reconciliation - Free Links

Show details

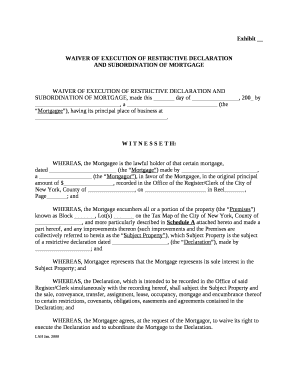

Petty Cash Reconciliation Date: / / Department: Cashier: Authorized Amount: $ Petty Cash Change Fund Total Checks: $ Count Count Count Vendor Cash on Hand Currency Denomination 100 50 20 10 5 1 Coins

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petty cash reconciliation

Edit your petty cash reconciliation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petty cash reconciliation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petty cash reconciliation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit petty cash reconciliation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petty cash reconciliation

How to fill out petty cash reconciliation:

01

Gather all petty cash receipts: Start by collecting all the receipts for expenses made from the petty cash fund. These receipts should include details such as the date, amount, and purpose of each expense.

02

Verify the receipts against the cash fund: Compare the total amount of receipts with the remaining cash in the petty cash fund. Ensure that the receipts match the cash on hand to detect any discrepancies.

03

Record the expenses: Create a petty cash reconciliation form and record each expense separately. Include the date, the amount spent, the purpose of the expense, and any relevant details. This step allows for better organization and tracking of expenses.

04

Calculate the total expenses: Add up all the expenses recorded on the petty cash reconciliation form to get the total amount spent during the specified period.

05

Replenish the petty cash fund: If the petty cash fund is low or depleted, you may need to replenish it by requesting funds from the appropriate authority. Ensure to follow your organization's procedures for replenishing petty cash.

06

Complete the reconciliation: Calculate the new total cash balance by subtracting the total expenses from the original cash fund. Record this new balance on the petty cash reconciliation form.

07

Obtain approval and signatures: Seek approval and ensure the petty cash reconciliation form is signed by the appropriate authority responsible for monitoring and controlling petty cash expenses.

Who needs petty cash reconciliation?

Petty cash reconciliation is necessary for businesses and organizations that maintain a petty cash fund. This includes:

01

Small businesses: Many small businesses often rely on a petty cash fund to cover minor expenses that do not warrant using checks or credit cards. Reconciling petty cash helps these businesses track and control their cash expenditures.

02

Non-profit organizations: Non-profits often have cash on hand for various minor expenses like office supplies, travel, or meal reimbursements. Reconciling petty cash ensures transparency and accuracy in recording these expenses.

03

Government agencies: Certain government agencies may have petty cash funds to handle small expenses quickly. Reconciliation helps maintain financial control and accountability within these agencies.

04

Retail stores and restaurants: Some retail stores and restaurants may have a petty cash fund to cover small cash purchases or provide change for customers. Reconciliation ensures that the cash handled is accurately recorded and accounted for.

Overall, any organization or business that operates a petty cash fund should perform regular reconciliation to ensure proper financial management and control.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit petty cash reconciliation from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including petty cash reconciliation, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in petty cash reconciliation?

The editing procedure is simple with pdfFiller. Open your petty cash reconciliation in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit petty cash reconciliation in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your petty cash reconciliation, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is petty cash reconciliation?

Petty cash reconciliation is the process of comparing and adjusting the amount of cash on hand with the recorded amount in the petty cash account.

Who is required to file petty cash reconciliation?

Any organization or individual that uses petty cash for business purposes is required to file petty cash reconciliation.

How to fill out petty cash reconciliation?

To fill out petty cash reconciliation, one must count the cash on hand, compare it to the recorded amount in the petty cash account, and make any necessary adjustments to reconcile the two amounts.

What is the purpose of petty cash reconciliation?

The purpose of petty cash reconciliation is to ensure that the amount of cash on hand matches the recorded amount in the petty cash account, and to identify and correct any discrepancies.

What information must be reported on petty cash reconciliation?

The information reported on petty cash reconciliation includes the starting cash balance, any cash received or disbursed, and the ending cash balance.

Fill out your petty cash reconciliation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petty Cash Reconciliation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.