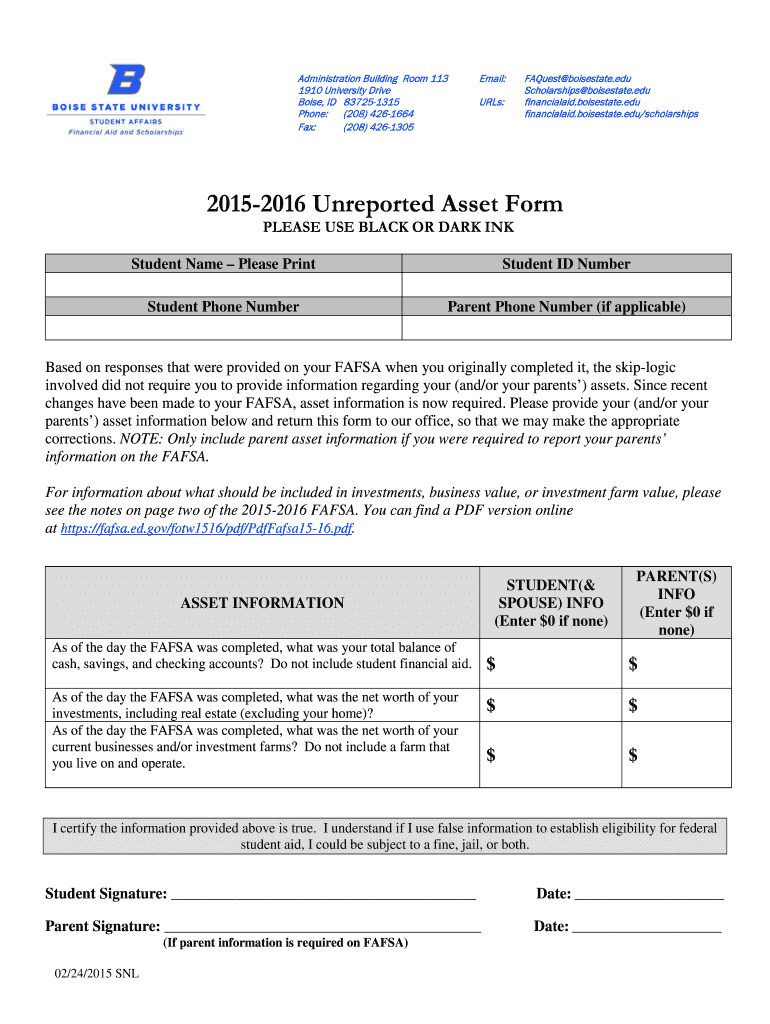

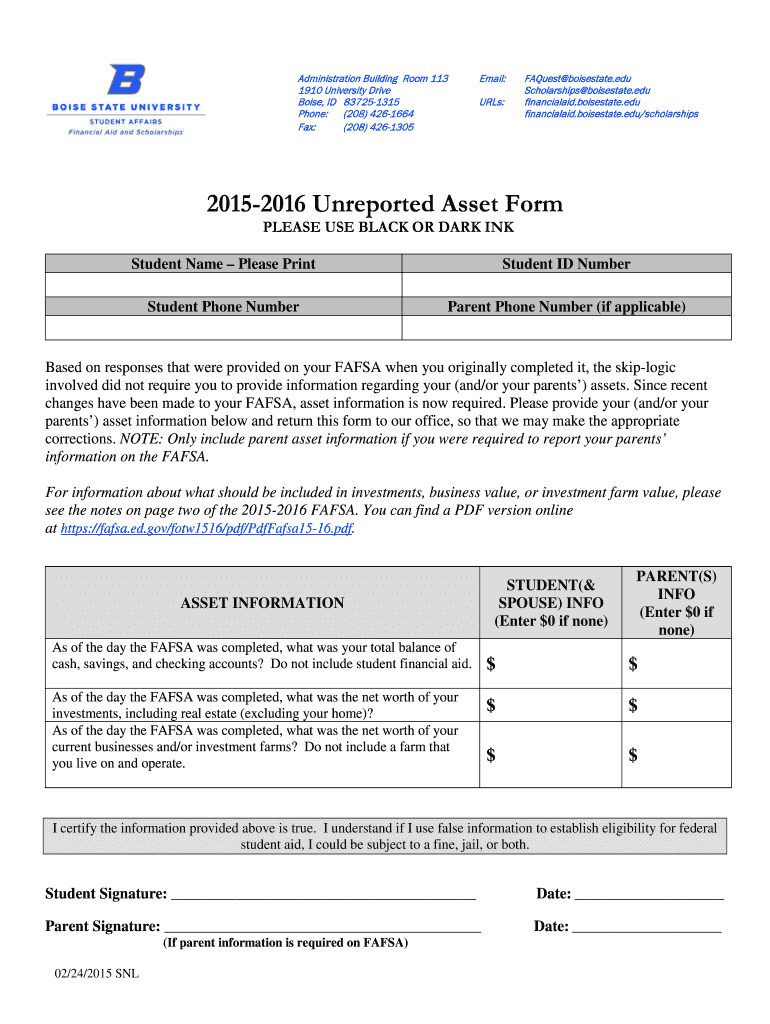

Get the free 2015-2016 Unreported Asset Form PLEASE USE BLACK OR DARK INK - financialaid boisestate

Show details

Administration Building Room 113 1910 University Drive Boise, ID 837251315 Phone: (208) 4261664 Fax: (208) 4261305 Email: URLs: Request misstate.edu Scholarships misstate.edu financial aid.misstate.edu

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2015-2016 unreported asset form

Edit your 2015-2016 unreported asset form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015-2016 unreported asset form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2015-2016 unreported asset form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2015-2016 unreported asset form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2015-2016 unreported asset form

How to fill out 2015-2016 unreported asset form:

01

Start by gathering all the necessary information and documentation regarding your assets for the specified time period, including bank statements, investment statements, real estate documentation, and any other relevant records.

02

Begin filling out the form by providing your personal information, such as your name, address, and social security number. Ensure that the information is accurate and up to date.

03

Proceed to the section that requires you to list your assets. Provide the details of each asset, including the type, value, and any other required information. Be thorough and comprehensive in your reporting to avoid any potential discrepancies.

04

If you have any unreported income related to these assets, make sure to disclose it accurately in the designated section of the form. This includes passive income, interest, dividends, rental income, and any other relevant sources.

05

Double-check all the information you have provided on the form for accuracy and completeness. Any mistakes or omissions can have serious consequences, so it is crucial to be meticulous in your review.

06

Attach any supporting documentation as required by the form. This can include bank or investment statements, receipts, or other evidence that supports the reported values and ownership of the assets.

07

After completing the form, sign and date it to confirm the accuracy of the information provided. Failure to sign the form may invalidate its submission.

08

Keep a copy of the completed form, along with all supporting documentation, for your records.

09

Submit the form to the appropriate entity or authority. This may vary depending on the specific purpose of the form, such as the Internal Revenue Service (IRS) or a financial institution.

Who needs the 2015-2016 unreported asset form:

01

Individuals or entities who are required by law or regulation to report their assets for the specified time period.

02

Those who have been requested by a governing authority to disclose any unreported assets or income during the 2015-2016 timeframe.

03

Individuals or entities involved in legal proceedings, such as divorce or bankruptcy, where the disclosure of assets is necessary for the resolution of the case.

04

Taxpayers who need to report unreported assets or income to the IRS or other tax authorities to avoid penalties or potential legal consequences.

It is important to consult with a qualified professional, such as a tax advisor or legal expert, to ensure that you are accurately completing the 2015-2016 unreported asset form and complying with all applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2015-2016 unreported asset form to be eSigned by others?

To distribute your 2015-2016 unreported asset form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete 2015-2016 unreported asset form online?

pdfFiller has made it easy to fill out and sign 2015-2016 unreported asset form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit 2015-2016 unreported asset form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 2015-2016 unreported asset form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is unreported asset form please?

The unreported asset form is a form used to disclose assets that were previously not reported to the appropriate government agency.

Who is required to file unreported asset form please?

Individuals or entities who have assets that were not previously disclosed must file the unreported asset form.

How to fill out unreported asset form please?

The unreported asset form can typically be filled out online or submitted in paper form, following the instructions provided by the specific government agency.

What is the purpose of unreported asset form please?

The purpose of the unreported asset form is to ensure that all assets are properly disclosed and accounted for.

What information must be reported on unreported asset form please?

The unreported asset form usually requires detailed information about the undisclosed assets, such as value, acquisition date, and source of funds.

Fill out your 2015-2016 unreported asset form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2015-2016 Unreported Asset Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.