Get the free il444 2790

Show details

Get Read and Download E-Books Form Il444 2790 at Our Unlimited Database Form Il444 2790 PDF Download Form Il444 2790.PDF Form Il444 2790.PDF Are you looking for Form Il444 2790 Books? Now, you will

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign il444 2790 form

Edit your il444 2790 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il444 2790 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing il444 2790 form online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit il444 2790 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out il444 2790 form

How to fill out IL444-2790:

01

Start by gathering all the necessary information and documents needed to complete the form. This may include personal identification, income information, and any supporting documentation required.

02

Begin filling out the form by providing your personal information such as name, address, and contact details. Make sure to double-check the accuracy of this information before proceeding.

03

Move on to the section that requires you to provide details about your household. This may include the names and ages of all household members, as well as their relationship to you.

04

Next, you will be asked to provide information about your income and expenses. This may include details about your employment, any sources of income, monthly bills, and other financial obligations. Be sure to provide accurate and up-to-date information for this section.

05

If there are any specific circumstances or additional information that needs to be considered, you will have the opportunity to provide details in the designated section.

06

Review the completed form thoroughly to ensure all the information is accurate and complete. Make any necessary corrections before submitting the form.

07

Once the form is filled out correctly, sign and date it according to the instructions provided.

08

Finally, submit the completed form as required. This may involve mailing it to the appropriate address or submitting it online, depending on the instructions provided.

Who needs IL444-2790:

01

IL444-2790 is typically required by individuals or families who are seeking assistance or benefits from the Illinois Department of Human Services (IDHS). This form is specifically used to determine eligibility for various programs and services offered by the IDHS.

02

It may be required by individuals or families who are in need of financial assistance, healthcare services, food assistance, child care services, or other forms of support provided by the IDHS.

03

The form may also be needed for the recertification process, which is done periodically to ensure continued eligibility for the benefits or services received.

As always, it is important to refer to the specific instructions provided with the IL444-2790 form and consult with the appropriate authority or agency for any additional guidance or clarification.

Fill

form

: Try Risk Free

People Also Ask about

What document proves self-employment?

If you're self-employed, you can show proof of income in the following ways: Use a 1099 form from your client showing how much you earned from them. Create a profit and loss statement for your business. Provide bank statements that show money coming into the account.

How do I document self employment?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

How do I document self-employment income?

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

What is the self-employed income and expenses form?

IRS Schedule C, Profit or Loss from Business, is a tax form you file with your Form 1040 to report income and expenses for your business. The resulting profit or loss is typically considered self-employment income.

How do I fill out a self employment ledger?

How to use a manual self-employment ledger Open a spreadsheet or download a self-employment ledger template. Create a column for Income (money you've received) and Expenses (cost of running your business) Under Income add three columns: Date, Invoice, and Service/Product.

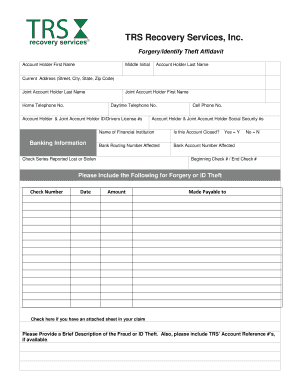

What is the IL444 2790 self employment record?

The Il 444 2790 Self Employment Record Form is used to report self-employment income and calculate the self-employment tax. This form is used to report net earnings from self-employment in ance with federal guidelines. The form must be completed regardless of whether or not taxes are owed on the income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is il444 2790?

IL444 2790 is the Illinois Department of Employment Security's Report To Determine Liability Under The Illinois Unemployment Insurance Act form.

Who is required to file il444 2790?

Employers in Illinois are required to file IL444 2790 if they have employees and are subject to the Illinois Unemployment Insurance Act.

How to fill out il444 2790?

IL444 2790 can be filled out online through the Illinois Department of Employment Security website or manually by completing the paper form and mailing it to the appropriate address.

What is the purpose of il444 2790?

The purpose of IL444 2790 is to determine an employer's liability under the Illinois Unemployment Insurance Act and to calculate the unemployment insurance taxes owed.

What information must be reported on il444 2790?

IL444 2790 requires employers to report information about their business, such as the number of employees, wages paid, and other relevant financial details.

How can I send il444 2790 form to be eSigned by others?

Once your il444 2790 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get il444 2790 form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific il444 2790 form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in il444 2790 form without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your il444 2790 form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Fill out your il444 2790 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

il444 2790 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.