Get the free Guide to Acceptable Incomes

Show details

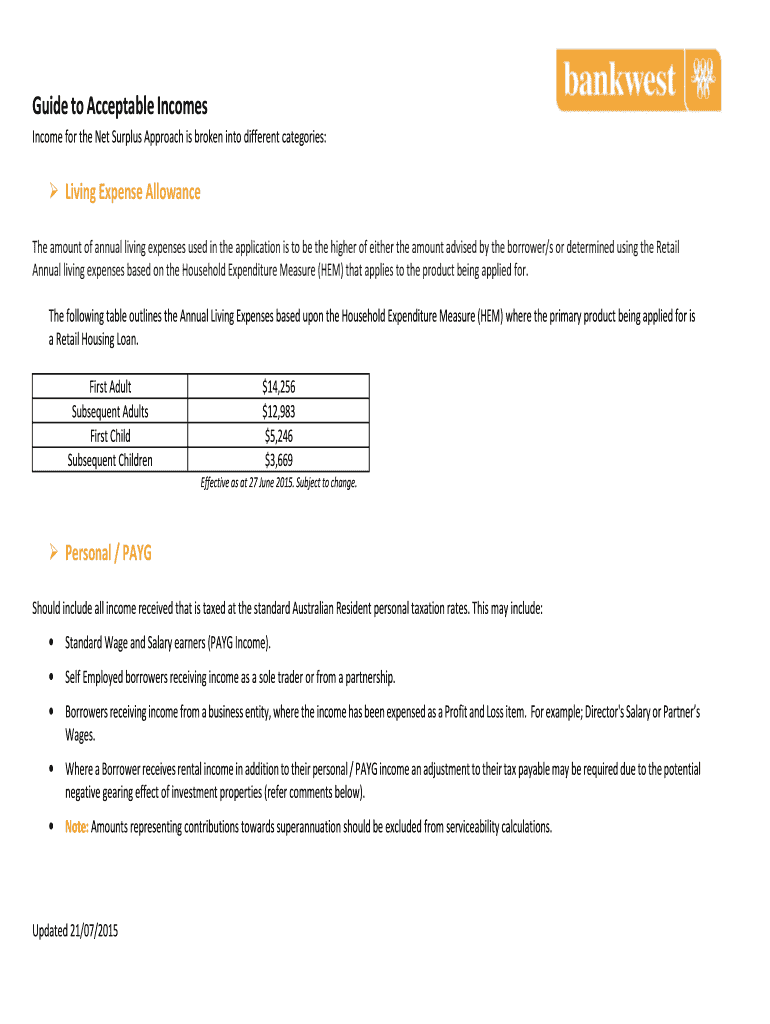

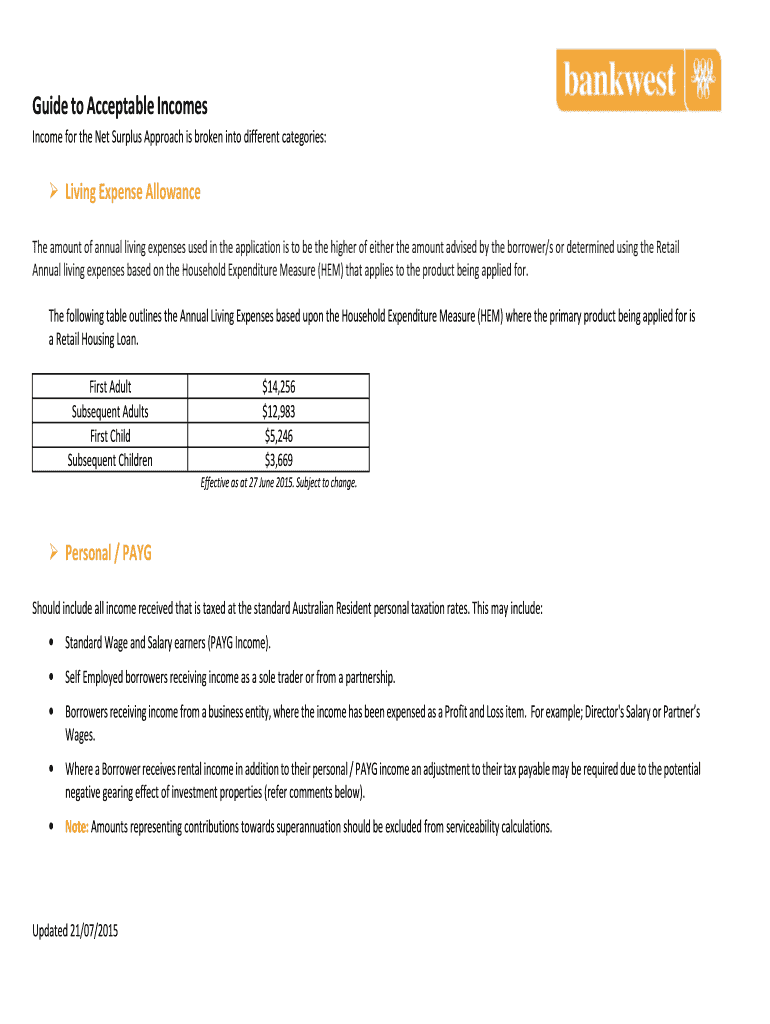

Guide to Acceptable Incomes Income for the Net Surplus Approach is broken into different categories: Living Expense Allowance The amount of annual living expenses used in the application is to be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guide to acceptable incomes

Edit your guide to acceptable incomes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guide to acceptable incomes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guide to acceptable incomes online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit guide to acceptable incomes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guide to acceptable incomes

How to fill out a guide to acceptable incomes:

01

Begin by gathering all the necessary information: This includes the requirements and criteria for acceptable incomes as outlined by your organization or institution. Make sure to have a clear understanding of what qualifies as an acceptable income.

02

Create a standardized format: Develop a template or form that allows for easy recording and presentation of income information. Consider including sections for personal details, sources of income, amounts earned, and any supporting documentation required.

03

Clearly define the sources of income: In the guide, explain what types of income should be included and which ones may be excluded. This can include wages/salary, rental income, dividends, commissions, government benefits, etc.

04

Set income thresholds and limits: Determine the minimum and maximum income levels that are considered acceptable. This threshold can vary depending on the purpose of the guide, such as loan applications, rental agreements, or grant eligibility. Provide clear instructions on how to calculate and report income accurately.

05

Include instructions for supporting documentation: Specify what type of documentation should be provided to support the reported income. This may include pay stubs, tax returns, bank statements, or any other relevant documents. Clearly state the requirements for each document and provide examples if necessary.

06

Outline any special considerations: If certain circumstances affect the determination of acceptable incomes, such as self-employment, irregular income patterns, or additional financial resources, provide guidelines on how to address these situations. Explain what additional documentation or calculations may be required.

07

Review and revise guidelines periodically: As income standards or regulations change over time, it is important to keep the guide up to date. Regularly review the guide to ensure its relevance and accuracy, and make any necessary updates based on current requirements.

Who needs a guide to acceptable incomes?

01

Financial institutions: Banks, credit unions, and lending institutions often require a guide to acceptable incomes when considering loan applications. This helps them determine a borrower's ability to repay the loan and assess their creditworthiness.

02

Landlords and property managers: When screening potential tenants, landlords and property managers may need a guide to acceptable incomes to verify the applicants' ability to pay rent and fulfill their lease obligations.

03

Grant organizations: Non-profit organizations or government agencies that offer grants or financial assistance programs often need a guide to acceptable incomes to establish eligibility criteria. This ensures that the grants are allocated to those with genuine financial need.

04

Human resources departments: Companies and organizations may rely on a guide to acceptable incomes for employee-related matters, such as setting income thresholds for certain benefits or allowances.

05

Government agencies: Government entities that determine eligibility for social welfare programs, subsidies, or tax benefits may require a guide to acceptable incomes to ensure fair and accurate assessments.

Overall, a guide to acceptable incomes serves as a reference tool for various individuals or entities involved in financial assessments, lending decisions, rental agreements, grant allocations, and other situations where income verification is necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my guide to acceptable incomes directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your guide to acceptable incomes and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the guide to acceptable incomes electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your guide to acceptable incomes and you'll be done in minutes.

Can I edit guide to acceptable incomes on an iOS device?

Use the pdfFiller mobile app to create, edit, and share guide to acceptable incomes from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is guide to acceptable incomes?

The guide to acceptable incomes is a document that provides information on the acceptable income levels for certain programs or initiatives.

Who is required to file guide to acceptable incomes?

Individuals or organizations who are participating in programs or initiatives that require income verification may be required to file a guide to acceptable incomes.

How to fill out guide to acceptable incomes?

To fill out a guide to acceptable incomes, you will need to provide information about your income sources, amounts, and any relevant documentation supporting your reported income.

What is the purpose of guide to acceptable incomes?

The purpose of the guide to acceptable incomes is to ensure that individuals or organizations are meeting the income requirements for specific programs or initiatives.

What information must be reported on guide to acceptable incomes?

You must report details about your income sources, income amounts, and any documentation that supports your reported income.

Fill out your guide to acceptable incomes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guide To Acceptable Incomes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.