Get the free Securities Law Advisory

Show details

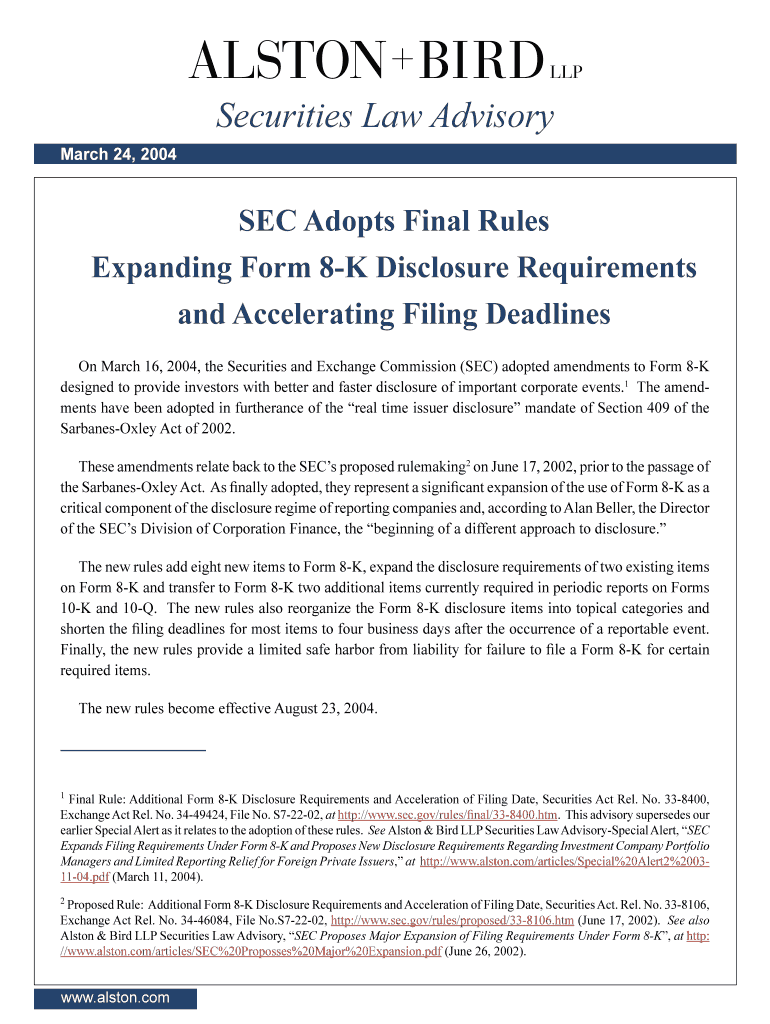

This document discusses the SEC's adoption of amendments to Form 8-K that expand disclosure requirements and accelerate filing deadlines to improve real-time issuer disclosure under the Sarbanes-Oxley

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign securities law advisory

Edit your securities law advisory form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your securities law advisory form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit securities law advisory online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit securities law advisory. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out securities law advisory

How to fill out Securities Law Advisory

01

Begin by gathering all necessary documentation related to your securities, including offering memorandums and financial statements.

02

Clearly define the purpose of the Securities Law Advisory to ensure compliance with relevant laws and regulations.

03

Identify the specific securities involved and their classifications (e.g., stocks, bonds, etc.).

04

Consult the applicable jurisdiction’s securities laws to understand the legal requirements that must be fulfilled.

05

Fill out the advisory form, specifying the details of the transactions and entities involved.

06

Include any relevant codes, policies, or guidelines that apply to the securities being advised upon.

07

Review the advisory for accuracy and completeness before submission.

08

Submit the completed Securities Law Advisory to the appropriate regulatory authority.

Who needs Securities Law Advisory?

01

Companies planning to issue new securities to the public.

02

Investors seeking guidance on the legality of their investment options.

03

Startups requiring advice on compliance with securities regulations.

04

Lawyers and legal professionals needing to advise clients on securities matters.

05

Financial institutions involved in underwriting or selling securities.

Fill

form

: Try Risk Free

People Also Ask about

What is a securities law violation?

Securities violations encompass a range of unlawful activities related to securities trading, including fraud, insider trading, market manipulation, and failure to disclose material information. These violations have serious consequences, such as financial losses for investors and damage to market integrity.

What are the laws of securities?

The securities laws broadly prohibit fraudulent activities of any kind in connection with the offer, purchase, or sale of securities. These provisions are the basis for many types of disciplinary actions, including actions against fraudulent insider trading.

What is the difference between the Securities Act and the Exchange Act?

The Trust Indenture Act of 1939 supplemented the Securities Act by adding more requirements for public offerings of debt securities. While the Securities Act governs primary offerings, the Securities Exchange Act of 1934 (Exchange Act) fosters transparency and fairness in secondary securities markets.

What do you mean by securities law?

In the United States, the securities law framework regulates the registration and public sale of securities, as well as the periodic reporting obligations of public companies. This framework is primarily established by: Securities Act 1933. Securities Exchange Act of 1934, also known as the Exchange Act.

What do you mean by securities?

The term "security" is defined broadly to include a wide array of investments, such as stocks, bonds, notes, debentures, limited partnership interests, oil and gas interests, and investment contracts.

What is the 4 A of the Securities Act?

Section 4(a)(1) of the Securities Act (formerly Section 4(1) but redesignated Section 4(a)(1) by the JOBS Act) provides an exemption from registration under the Securities Act for transactions by any person who is not an issuer, underwriter or dealer.

What is meant by securities law?

Securities Law: An Overview Securities laws and regulations aim at ensuring that investors receive accurate and necessary information regarding the type and value of the interest under consideration for purchase.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Securities Law Advisory?

Securities Law Advisory refers to the guidance and consultation provided regarding compliance with securities laws and regulations, ensuring that companies and individuals understand their obligations in the capital markets.

Who is required to file Securities Law Advisory?

Entities and individuals who are involved in the issuance, sale, or trading of securities, including public companies, private companies seeking to go public, and investment professionals, may be required to file Securities Law Advisory.

How to fill out Securities Law Advisory?

To fill out a Securities Law Advisory, you must provide detailed information about the securities being offered, including the type of security, the intended use of proceeds, and any relevant regulations that must be adhered to, in addition to filling out required forms accurately and completely.

What is the purpose of Securities Law Advisory?

The purpose of Securities Law Advisory is to ensure compliance with applicable securities laws, protect investors, and facilitate transparent and fair practices in the securities market.

What information must be reported on Securities Law Advisory?

The information that must be reported includes details about the issuer, the type of securities being offered, risks associated with the investment, financial statements, and disclosures of any legal proceedings related to the issuer.

Fill out your securities law advisory online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Securities Law Advisory is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.